Hang Seng Index Futures: Consolidating Near 24,000 Pts

rhboskres

Publish date: Thu, 07 Oct 2021, 08:29 AM

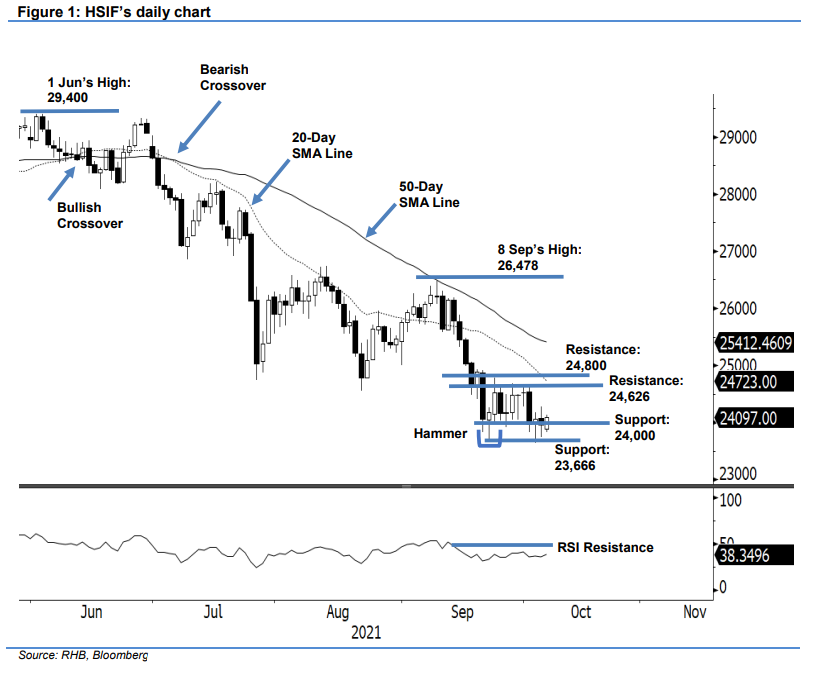

Maintain short positions. The HSIF saw selling pressure extend yesterday, declining 101 pts to settle the day session at 23,957 pts. The index initially started at 24,180 pts. However, the bulls shied away during the day session, where the HSIF fell to 23,743 pts before climbing back towards the 24,000-pt level. It closed at 23,957 pts. In the evening session, the index managed to add 140 pts and last traded at 24,097 pts – retaining the 24,000-pt support level. As mentioned in our previous report, since the RSI is still trending below the 50% threshold, it is very likely we will see the HSIF moving sideways and consolidating. Breaching the immediate support will see the index falling lower to retest September’s low at 23,666 pts. As of now, it has yet to form a fresh “higher-high” bullish pattern. Since the momentum remains sluggish, we stick to our bearish trading bias.

Traders should stick to the short positions initiated at 25,646 pts, ie the close of 9 Sep’s day session. To manage the trading risks, the trailing-stop threshold is set at 24,800 pts.

The immediate support is fixed at the 24,000-pt round figure, followed by 23,666 pts, ie 21 Sep’s low. The nearest resistance remains unchanged at 24,626 pts – 4 Oct’s high – and followed by the 24,800-pt whole number.

Source: RHB Securities Research - 7 Oct 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024