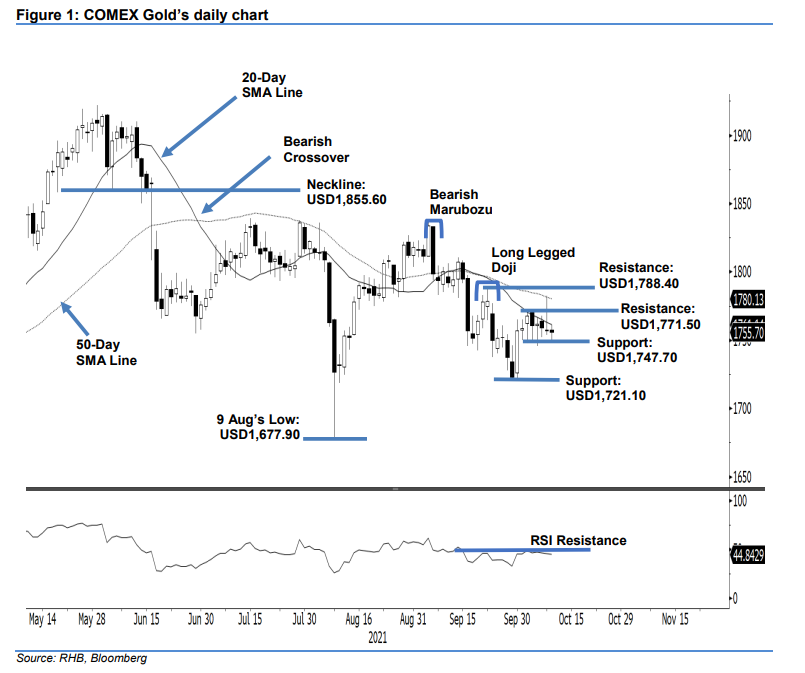

COMEX Gold: Blocked by the 20-Day SMA Line

rhboskres

Publish date: Tue, 12 Oct 2021, 08:31 AM

Maintain long positions. The COMEX Gold saw a muted session on Monday, correcting USD1.70 to settle at USD1,755.70. After opening at USD1,757.40, the commodity vacillated within a tight range of USD1,761.10 and USD1,749.90 before closing at USD1,755.70. Although it managed to stay above its USD1,747.70 immediate support, the upward movement was capped by the 20-day SMA line. Coupled with the RSI staying below the 50% threshold, and starting to point downwards, negative momentum may build up in coming sessions. If the COMEX Gold falls below the USD1,750 psychological level, or breaches below the immediate support, market sentiment will turn negative again. On the other hand, crossing above the moving average line would see the revival of upside movement. At this juncture, we stick to our positive trading bias until the stop-loss is triggered.

We advise traders to hold on to the long positions initiated at USD1,767.60, or the closing level of 4 Oct. To manage trading risks, the stop-loss is revised to the immediate support level of USD1,747.70.

The immediate support is marked at USD1,747.70 – 4 Oct’s low – followed by USD1,721.10, or 29 Sep’s low. The first resistance is maintained at USD1,771.50 – 4 Oct’s high – followed by USD1,788.40, or 22 Sep’s high.

Source: RHB Securities Research - 12 Oct 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024