FKLI: Bullish Momentum Continues

rhboskres

Publish date: Thu, 14 Oct 2021, 08:29 AM

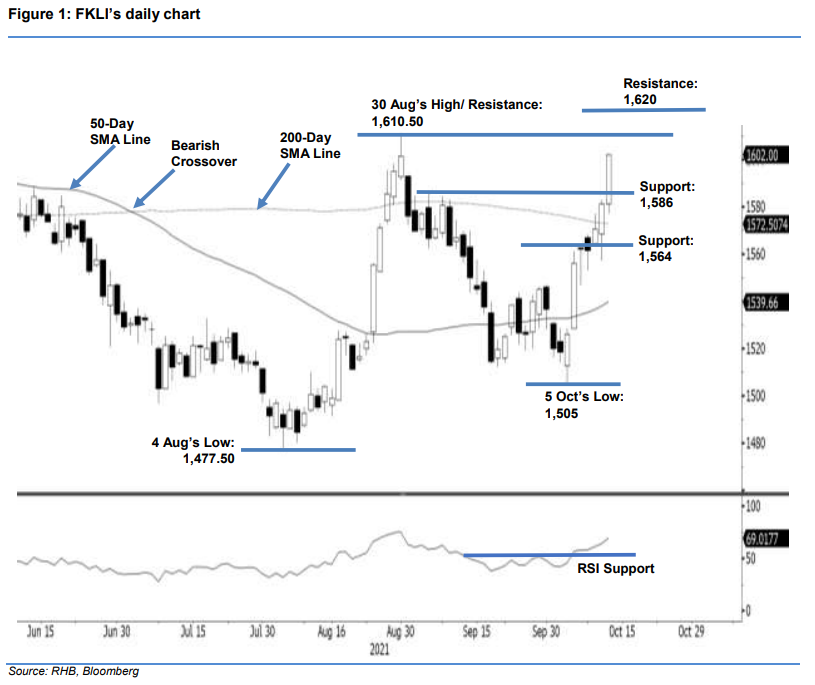

Maintain long positions. The FKLI extended the uptrend for a third consecutive session yesterday, rising 21 pts to settle at 1,602 pts – thereby reclaiming the 1,600-pt level and marking a 1-month high. Yesterday, it opened at 1,581 pts. After it formed the intraday low of 1,577 pts, strong buying interest lifted it towards the day’s high of 1,602 pts, where it closed. The latest session showed that the bulls have overpowered the bears. With the risk-on sentiment still in play, the FKLI may likely see a follow-through price action to retest August’s high of 1,610.50 pts. Breaching the immediate resistance will signify that the index is standing firmly above the 1,600-pt level. Meanwhile, the 200-day SMA line will act as a strong support for the index. For now, we maintain a positive trading bias.

Traders should stay in long positions, initiated at 1,556 pts or the closing level of 6 Oct. To manage trading risks, the trailing-stop is set at 1,564 pts.

The nearest support has been revised to 1,586 pts or the high of 6 Sep, then 1,564 pts or the low of 11 Oct. Meanhwhile, the immediate resistance is set at 1,610.50 pts, the high of 30 Aug, and followed by 1,620 pts.

Source: RHB Securities Research - 14 Oct 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024