WTI Crude: Still Above the Immediate Support

rhboskres

Publish date: Thu, 14 Oct 2021, 08:34 AM

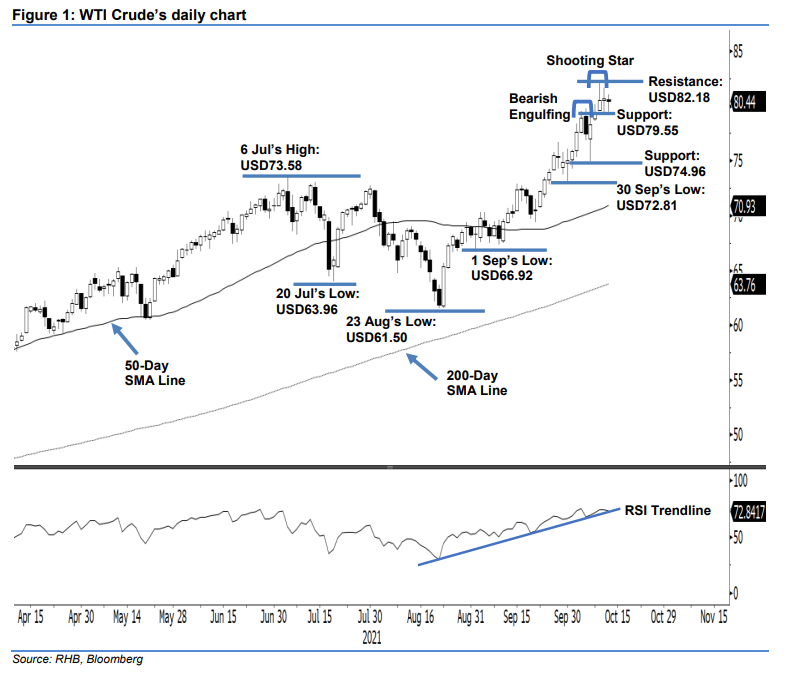

Maintain long positions. The WTI Crude continued to move sideways as it closed USD0.20 lower at USD80.44. The commodity started neutral at USD80.58 then moved south, hitting the day’s low at USD79.42 following the US trading session. It then swiftly changed directions and headed north to touch the day’s high of USD81.04 before retracing lower to close. The “doji” neutral candlestick for two consecutive sessions still suggests that the crude oil may move sideways between the USD82.18 resistance and USD79.55 support in the immediate term before firming up its direction. Meanwhile, since the latest RSI strength is decelerating above the 70% overbought territory, the odds for profit taking to occur in the coming session remain valid. We stick to our bullish trading bias until the trailing-stop level is breached.

We suggest traders keep to their long positions initiated at USD67.54, or the closing level of 24 Aug. For trading-risk management, the trailing-stop threshold is set at USD79.55, ie the immediate support.

The support levels are set at USD79.55 – 11 Oct’s low – and USD74.96, or 7 Oct’s low. The resistance level is set at USD82.18, or 11 Oct’s high. Subsequently, a higher resistance is drawn at the USD90.00 level.

Source: RHB Securities Research - 14 Oct 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024