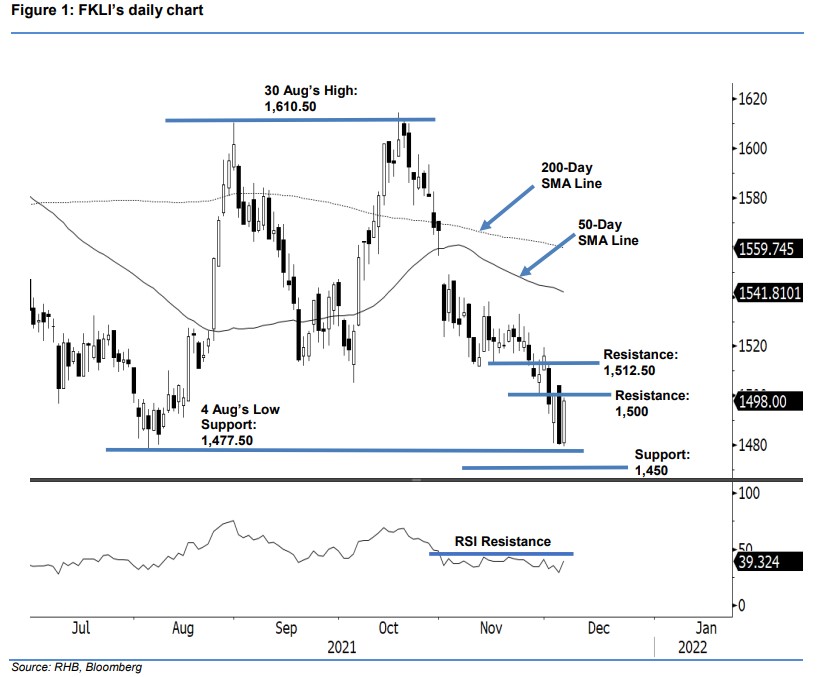

FKLI: Looking To Reclaim The 1,500-Pt Threshold

rhboskres

Publish date: Wed, 08 Dec 2021, 05:56 PM

Maintain short positions. The FKLI staged a strong rebound yesterday, jumping 17.5 pts to settle at 1,498 pts. The benchmark index opened at 1,481 pts. The bears shied away from the market, so the index kept climbing upwards to record the day’s high of 1,499 pts just before the close. Although it recouped losses from previous sessions, bullish momentum has yet to surpass the 1,500-pt psychological barrier. For immediate session, the index may consolidate below the immediate resistance. In the event that the momentum accelerates and breaches the threshold, the FKLI may test the higher hurdle of 1,512,50 pts. We expect strong selling pressure to emerge above 1,500 pts. For now, we are maintaining a negative trading bias until the stop-loss is triggered.

Traders should remain in short positions, which were initiated at 1,496.50 pts or the close of 1 Dec. To mitigate trading risks, the stop-loss is set at 1,517 pts.

The immediate support remains at 1,477.50 pts (4 Aug’s low), followed by 1,450 pts. In the meantime, the immediate resistance has been set at 1,500 pts, then 1,512.50 pts.

Source: RHB Securities Research - 8 Dec 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024