WTI Crude: the Bulls Are Attempting a Rebound

rhboskres

Publish date: Mon, 13 Dec 2021, 08:43 AM

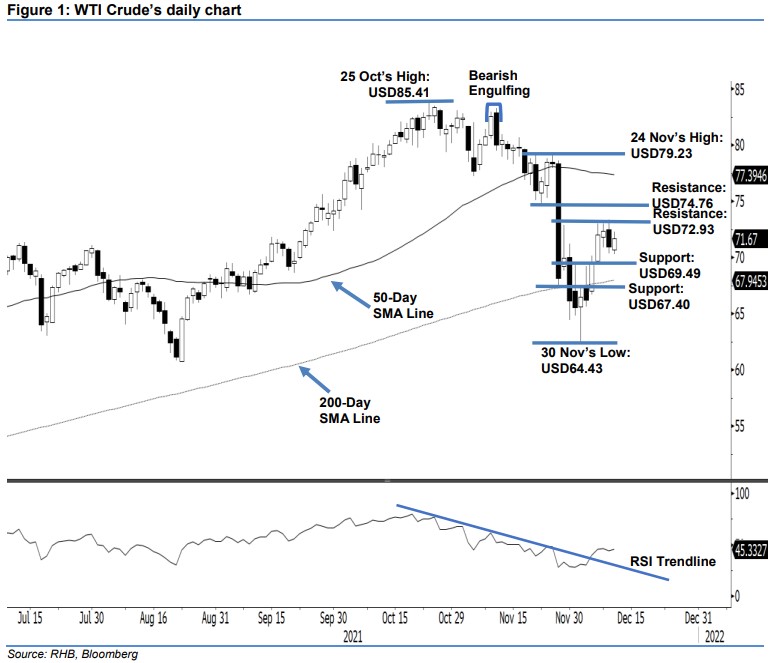

Maintain long positions. The WTI Crude bounced off positively last Friday from its recent pullback as it rose USD0.73 to settle at USD71.67. Despite starting lower at USD70.68 to merely touch the intraday bottom at USD70.32, buying pressure kicked in to propel the commodity gradually higher towards the end of the session – the black gold hit the day’s high of USD72.33 during the US trading session before profit-taking activities occurred. The WTI Crude has rebounded mildly from the pullback towards the close at USD71.67. With the latest bullish momentum above the immediate support, the bulls are expected to be back in the driver’s seat following the recent pullback, as the commodity heads towards the USD72.93 immediate resistance. The medium-term uptrend remains intact as long as the WTI Crude continues to trade above the 200-day SMA line. With that, we keep to our positive trading bias.

We advise traders to stay in the long positions initiated at USD72.05, ie the closing level of 7 Dec. To manage the downside risks, the initial stop-loss mark is set at USD67.40, or below the 200-day average line.

The immediate support is placed at USD69.49 – 1 Dec’s high – and is followed by USD67.40, ie the low of 26 Nov. The nearest resistance is eyed at USD72.93 – 29 Nov’s high – and followed by USD74.76, or 22 Nov’s low.

Source: RHB Securities Research - 13 Dec 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024