COMEX Gold: Upside Risks Remain

rhboskres

Publish date: Fri, 11 Feb 2022, 05:50 PM

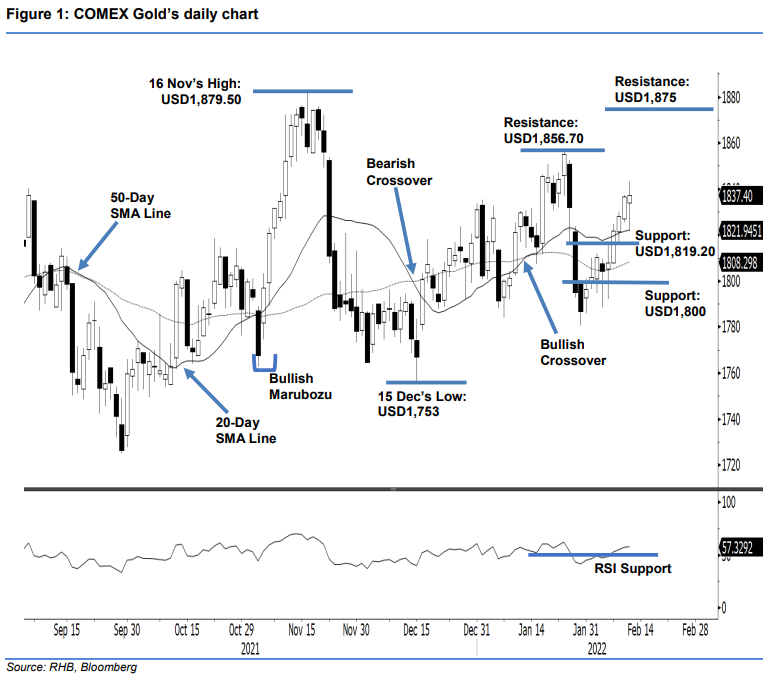

Maintain long positions. The COMEX Gold remained on an upward trajectory, adding USD0.80 to settle at USD1,837.40 yesterday. After opening at USD1,834, it moved sideways for most of the session. At one point during the US trading session, it fell to the day’s low of USD1,821.80 and rebounded rapidly towards the day’s high of USD1,843.30. It then retraced from the intraday high and closed at USD1,837.40. The long lower shadow indicates that the bulls managed to contain the selling pressure. As such, the commodity continues to trade above the 20-day SMA line. If negative momentum picks up again, we believe the 20-day SMA line will cushion the selling pressure. As long as the COMEX Gold continues to print “higher highs with higher lows”, the bullish structure will remain intact. We retain our positive trading bias until the stop-loss is triggered.

We recommend traders hold on to the long positions initiated at USD1,818.50, or the closing level of 11 Jan. To manage trading risks, the stop-loss is fixed at USD1,785.

The nearest support is marked at USD1,819.20 – 8 Feb’s low – followed by the USD1,800 psychological level. Meanwhile, the immediate resistance stays at USD1,856.70 – 25 Jan’s high – followed by the USD1,875 whole number.

Source: RHB Securities Research - 11 Feb 2022

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024