*Santa* Tune Protect Group - The Next Super Stock?

Santa

Publish date: Thu, 30 Jun 2016, 08:58 AM

Introduction

In February 2013, Tune Protect Group decided to go public with an IPO price of RM 1.35. After more than 3 years in Bursa, the stock closed RM 1.49 today, a 10.37% return (excluding dividends).

The stock peaked at RM 2.57 in June 2014, and has since been down trending until January 2016, where it bottomed-out at RM 1.10. Since then, Tune Protect has rebounded, hitting a YTD high of RM 1.58 recently.

Has the downtrend finally come to an end? Is there still more upside for this counter?

Let’s find out!

Financials

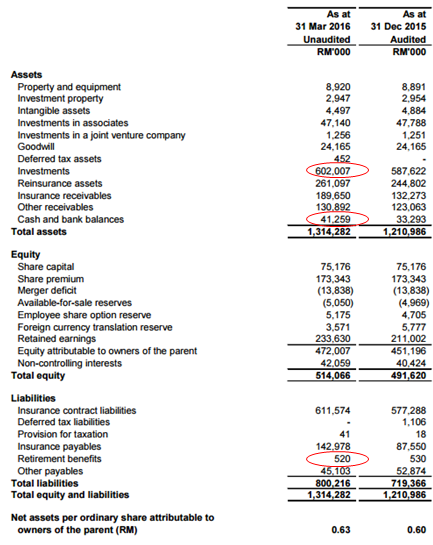

The latest QR balance sheet reveals solid fundamentals of Tune Protect. If we consider the items circled in red to be cash and cash equivalents, then we have: 602,007+41,259-520 = 642,746 thousand. This means Tune Protect is holding RM 642.7 million in net cash!

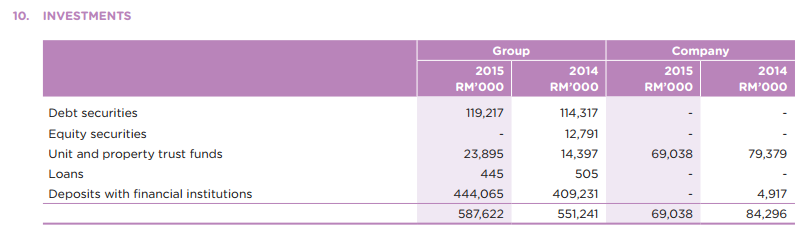

Wait, is it okay to add “investments” as cash and cash equivalents? What comprises of these “investments”?

While no data is given in the QR about these “investments”, if we refer to the most recent annual report (Note 10), we have the breakdown of these “investments”. These “investments” are very liquid and are reported at market value in financial statements, which makes sense to include as cash and cash equivalents.

Moving on to income statement and cash flow…

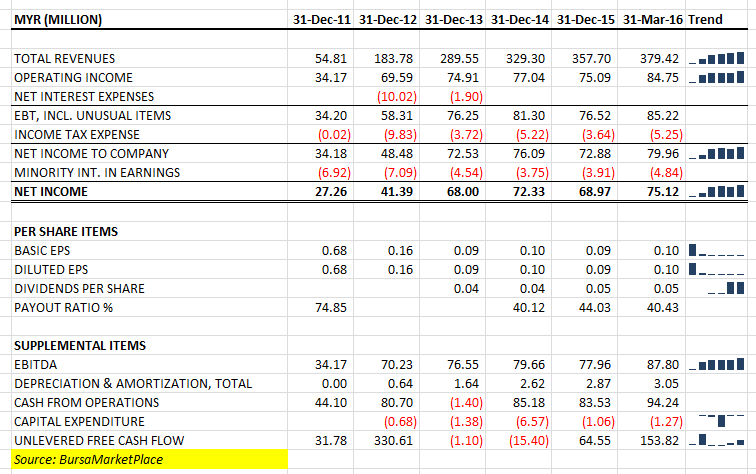

Over the past 5 years, Tune Protect did pretty well in terms of its revenue and earnings. Revenue achieved an outstanding 59.83% CAGR while net income grew in tandem at 26.12% CAGR! Tune Protect managed to maintain good operational cash flow and free cash flow throughout the past 5 years.

One of the plus point for Tune Protect is their low depreciations and low capital expenditures. This reduces the possibility of unexpected capex which could disrupt the entire cash flow of the company.

Management has also maintained a consistent 40% payout ratio in the past 3 years.

Valuation

We already have RM 642.7 million in net cash. Performing a constant growth DCF, I will assume FCF equal to net earnings around RM 70 million at required return of 12% and growth of 5% (required return and growth plucked out of thin air). This gives

Present value = FCF/(r – g) = 70/(12% – 5%) = RM 1,000 million

With 751.8 million shares outstanding, fair value is (642.7 + 1,000)/751.8 = RM 2.19, an upside of 46.98%!

Again, let’s assume an EV/EBITDA = 10. Then, (Market cap – Net cash – Minority interest)/EBITDA = 10. Refer to balance sheet for minority interest and EBITDA approximately RM 80 million,

(Market cap – 642.7 – 42.1)/80 = 10, solve for market cap we get RM 1,484.8 million.

This implies a fair value of RM 1.97, upside of 32.21%!

Conclusion

At this current price, Tune Protect is a BUY.

Hope you enjoy this article. Huat ah! :D

Note: Please buy and sell at your own risk.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

Discussions

Hello junichiro! Ouch..but on the bright side you still managed to make a profit. :D

Back then, I agree..Tune is highly dependent on AA for business and growth. But now, Tune has establish much more partnerships such as Air Arabia, Cebu Air etc. When did you buy Tune?

2016-06-30 09:29

There is good and bad about dependency on AirAsia now, it is good for them to leverage off AirAsia now and they build their size of their insurance portfolio, diversifying into other revenue streams from tying up with other airlines, outline platforms and etc. I think they are doing the right things.

Commenting about the cash equivalent, i think it is natural that is increasing due to increasing insurance liabilities (see balance sheet), while it is good to hold relative liquid investment now in volatile market, where they can take on opportunity to invest for good return when opportunities arise.

I think Tunepro is slow and steady, and relative safer in this kind of market now, further it is still cheap compare to when it first IPO... result getting better and price stay stagnant, opportunity to accumulate. It seems KWSP has been mopping up the shares also recently.

2016-06-30 12:10

Well said kchim26. Most importantly, I believe the pros outweigh the cons in the dependency on AirAsia. Revenues have much room to grow, and not affected by crude oil fluctuations.. :D

2016-06-30 16:06

this is a good write up on tune but this counter has disappointed many due to its lack lustre dis[play. solid fundamentals but need something to kick start the price. maybe mergers or tie up to make it into a big brand name.

2016-07-05 09:52

Junichiro

I owned this stock in the past when analyst give it glowing TP which never came. I do not believe them n I did not keep the stock for long n sold it for a small profit. Its weakness is it depended very much on AirASIA for business. It has an EPS abt 10 cts.

2016-06-30 09:23