Investors look beyond the pandemic to acquire prime hotels in Malaysia

savemalaysia

Publish date: Tue, 02 Feb 2021, 07:11 PM

The Covid-19 pandemic is unsettling for people around the world, including business owners but for investors, this is an opportune time to grab assets such as hotels that may sell below market.

Knight Frank Malaysia executive director of capital markets James Buckley said well capitalised, shrewd investors are looking beyond the pandemic and see this as an opportunity to acquire prime hotel assets at reasonable pricing.

Buckley believes hotels in Malaysia that trade will reflect a 10 per cent to 30 per cent discount from their pre-Covid values.

"We are now seeing the most massive global vaccination effort in a century. There is hope that international travel can resume soon, but exactly when is the million dollar question. For shrewd hotel investors with strong balance sheets, we believe there is an excellent window of opportunity over the next 12 to 24 months to acquire prime hotel assets in Malaysia."

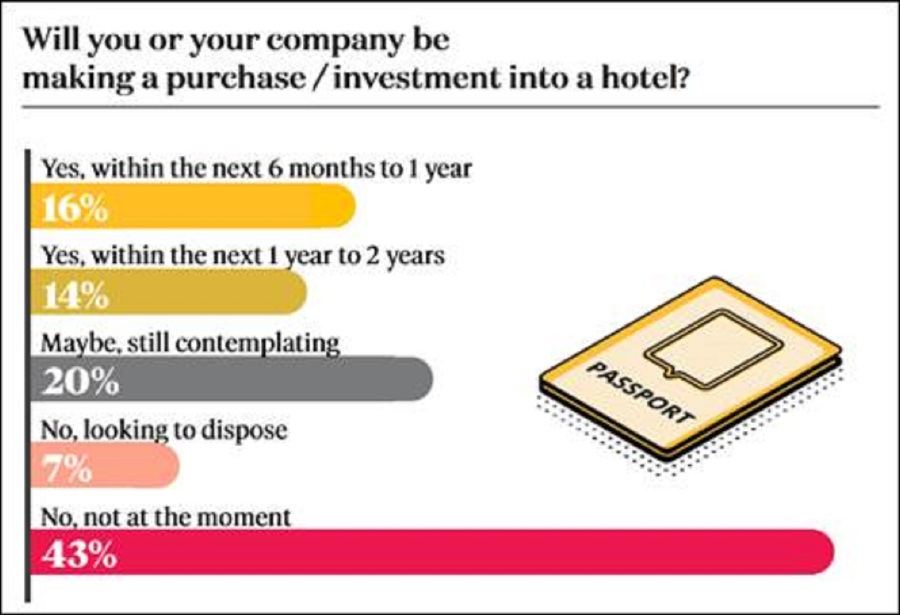

Knight Frank Malaysia recently launched the Malaysian Hospitality Investment Intentions Survey and 14 per cent of the respondents anticipate buying hotel assets within the next two years, with 16 per cent indicating that they will look at an acquisition within the next six months despite the on-going pandemic.

The survey, concluded in November 2020, provides the investment perspectives of hotel owners, operators, and owner-operators, with insight on investment demand, investor preferences and pricing, as well as the impact of Covid-19 on the sector.

Some 68 per cent of the respondents were from Malaysia, eight per cent from China, 14 per cent from other Southeast Asian countries and the remainder from Japan, South Korea, UK, continental Europe, Australia and New Zealand.

About 44 per cent of the respondents were owner operators, 43 per cent hotel owners, and 13 per cent hotel operators.

Over 72 per cent had already invested in the hotel sector in Malaysia.

Some 89 per cent of the respondents indicated that tourist arrivals and flight accessibility are crucial in their investment decision-making process, followed by friendly government initiatives that play an important role in motivating hotel operations, and investments.

"Tourism is an important sector as it is the third-largest contributor to the economy and employs about 3.6 million people. Before the pandemic hit, it contributed a total of RM86 billion in tourist receipts from about 26 million international visitors in 2019," he said.

Malaysia ranked third in Southeast Asia as the most attractive country for hotel investment, after Thailand and Singapore.

Buckley said upgrading/expanding and improving direct international flights, especially to Penang and Langkawi would provide a real boost to tourism.

"Langkawi is a fantastic tourist destination with great potential to grow its international tourist arrivals and receipts and compete on the same footing as Phuket, Bali, and the Maldives. To achieve this, it needs to improve its regional flight accessibility. Before the pandemic hit, there were only direct international flights from Guangzhou, Singapore, Phuket, and Doha," he pointed out.

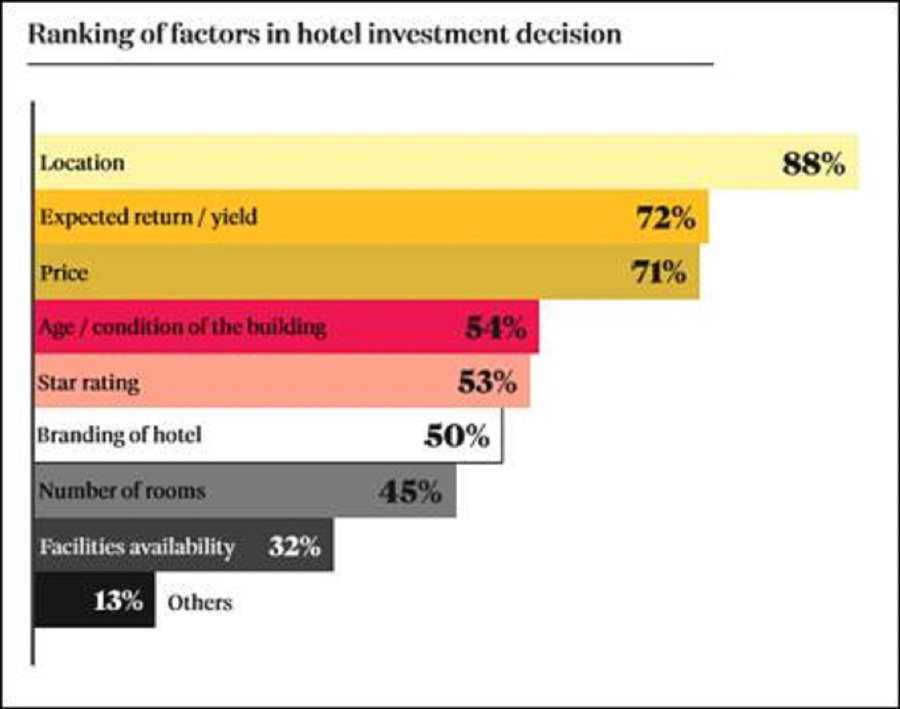

Buckley noted that hotel performance is highly driven by guests who value hotel locations, hence location is considered the most important factor by respondents when investing in a hotel.

The next factor considered by 72 per cent of respondents was the expected return/yield, followed by the availability of bank financing for hotel transactions, he said.

"Many investors are now seeking higher returns to offset the risk of investing in the sector during the pandemic with 36 per cent of respondents targeting a net yield of above seven per cent," he said.

Yield accretive assets

Knight Frank Malaysia executive director of valuation & advisory Justin Chee said during the current challenging times, investors are eyeing yield accretive assets.

According to the survey, 36 per cent of respondents expect a net return of above seven per cent from the hotel asset class.

"It is important to note that based on the past few hotel transactions (past five years) hotels in Malaysia were generally transacted at net yields of about four per cent to six per cent and there is definitely a mismatch between the expected return and the selling prices of hotels. What we may possibly see during this pandemic and the fallout of the Covid-19 impact on the hospitality sector is the bridging of the gap between the two as vendors are getting more realistic with their hotel values and asking prices," Chee said.

According to the survey results, business and conference hotels/city hotels remained the most popular hotel type investment. It is the first choice of 57 per cent of respondents as these type of hotels are known to be highly profitable where the main client segment is business travellers.

As Malaysia is well known for its beautiful beaches and lush highlands, 23 per cent prefer resorts over the rest of the hotel types. About 14 per cent of respondents expressed preference for boutique hotels, followed by four per cent for budget hotels. Spa & Wellness was the least preferred type of hotels with only two per cent interest.

Malaysian hospitality sector outlook

Uncertainty continues to loom over the hospitality sector but some hotel owners remain positive and expect better times ahead.

Almost half of the respondents remain positive about the outlook in the next 12 months with 45 per cent feeling that the sector is on its way to recovery, albeit contingent on the progressive roll-out of the vaccine and opening up of international travel restrictions.

Knight Frank Malaysia executive director of research & consultancy Judy Ong said hotels that are still in operations are aggressively promoting staycations and attractive 'work from hotel' packages as well as food delivery service to stay afloat and support employment.

But, with the country now under MCO 2.0 with exception of Sarawak following the resurgence of Covid-19 cases, the road to recovery will be long and hard, she said.

"Government measures and incentives to support the industry may be too little and too late as we continue to hear of more hotels shutting down either temporarily or permanently.

"Moving forward, once interstate travel is allowed, we believe that domestic tourism will lead the way to recovery supported by the recently launched National Tourism Policy 2020 – 2030."

https://www.nst.com.my/property/2021/02/662406/investors-look-beyond-pandemic-acquire-prime-hotels-malaysia

More articles on save malaysia!

Created by savemalaysia | Jul 23, 2024

Created by savemalaysia | Jul 23, 2024

Created by savemalaysia | Jul 23, 2024

Created by savemalaysia | Jul 23, 2024

Created by savemalaysia | Jul 23, 2024

Created by savemalaysia | Jul 23, 2024

Created by savemalaysia | Jul 23, 2024

Created by savemalaysia | Jul 23, 2024

MuttsInvestor

As an Investor in Tourism sector..... Thailand would be a MUCH better destiantion for investment over Malaysia. Govn policies, Workers availiability, Tourism perception , etc. Malaysia is near low Tier for Tourist.

2021-02-06 12:48