Rgtech - Superb Growth Tech stock incoming!!!!

share4u_2020

Publish date: Wed, 26 Feb 2020, 12:35 AM

Radiant Globaltech Bhd (with MSC malaysia status company since 2014)is engaged in providing retail technology solutions including retail hardware, retail software, as well as maintenance and technical support services. It also offers full range of retail technology solutions to its customers.

WHAT is MSC Malaysia status?

MSC Malaysia status is a recognition by the Government of Malaysia through the Multimedia Development Corporation (MDeC), for ICT and ICT-facilitated businesses that develop or use multimedia technologies to produce and enhance their products and services.

RECENT NEWS:

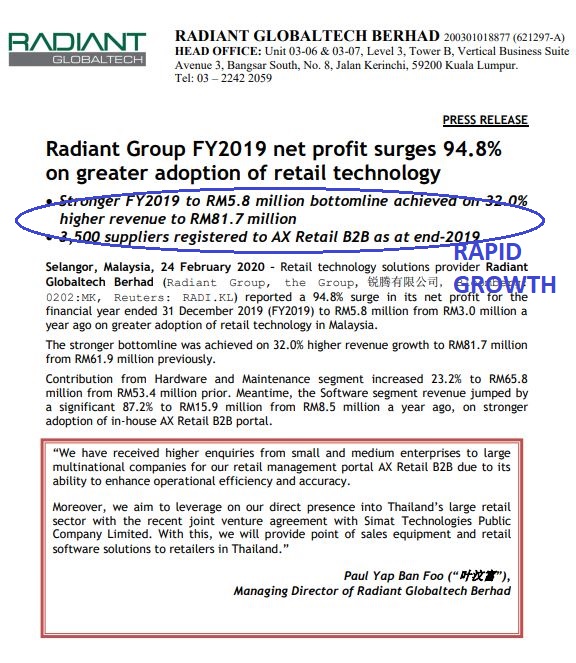

Radiant Globaltech aims to leverage direct presence into Thailand’s retail sector

KUALA LUMPUR (Feb 25): Retail technology solutions provider Radiant Globaltech Bhd aims to leverage its direct presence into Thailand’s large retail sector with the recent joint venture agreement with Simat Technologies Public Co Ltd.

In a statement Feb 24, Radiant Globaltech’s managing director Paul Yap Ban Foo said with this, the firm will provide point of sales equipment and retail software solutions to retailers in Thailand.

“We have received higher enquiries from small and medium enterprises to large multinational companies for our retail management portal AX Retail B2B due to its ability to enhance operational efficiency and accuracy,” he said.

RGTECH Has similar service products (as shown above) with REVENUE

(0020)!!! the difference is they service in different broad regions. RGTECH

focus in SEA market where Revenue focus in local market!!!

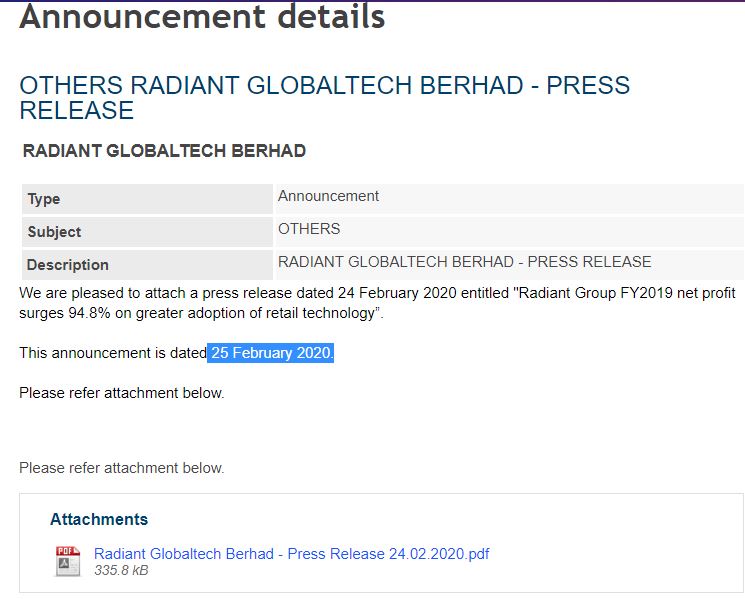

Recent Announcement :

Date 25FEB 2020

2019 Highlight:

Results:

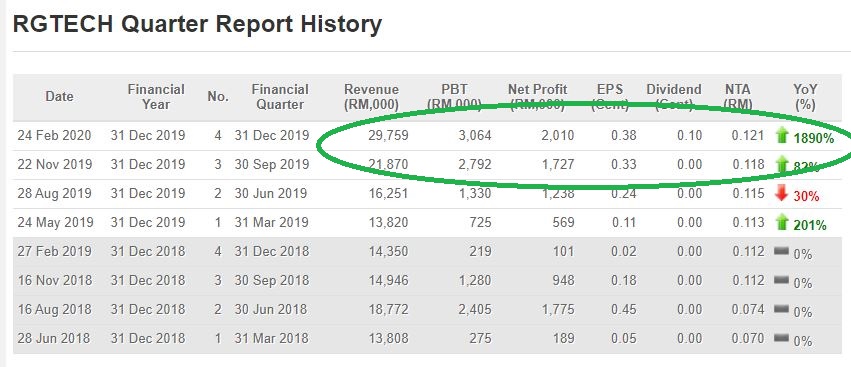

As you can see on the QR above, BOTH Revenue and Profit growing strong

Technical analysis

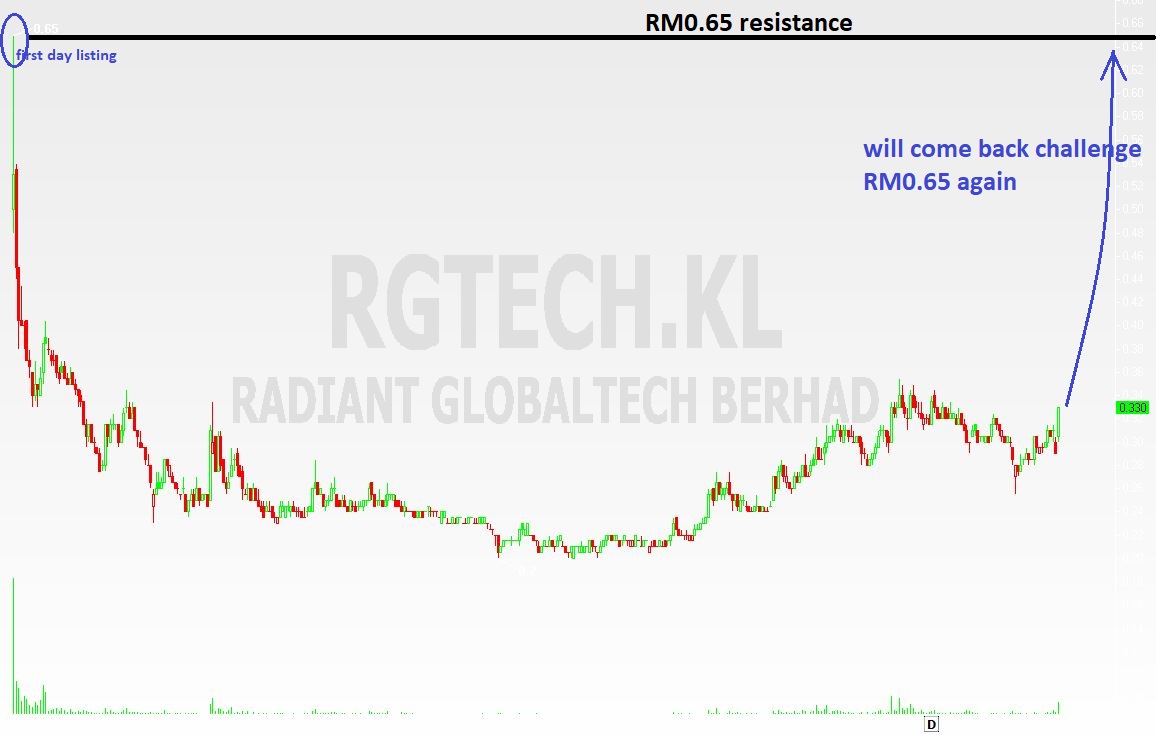

Rgtech is about to breakout RM0.35 sens, we believe short term target is RM0.65 however we do not want for short term gain as we believe the rapid growth and improvement in fundamentals of rgtech will value at much higher price. Hence, our mid to long term target for RGTECH is not available yet

WHY RGTECH

- Revenue (0200) Rival, their figures and service products are very similar

- 3,500 suppliers registered to AX Retail B2B as at end-2019

- All 7-eleven Malaysia stores total 2,323 outlets are adopting usage of AX Retail B2B portal

- MSC Malaysia Status

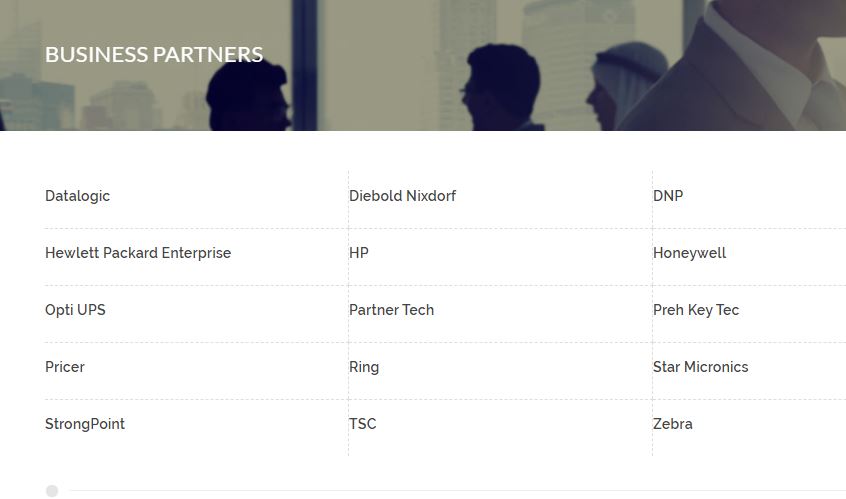

-International Business Partners: Honeywell, Pricer, HP, Datalogic and etc.

TP1 : RM 0.65

TP2 :N/A, Not going to sell as long as QR continue to improve

Our analysed target price is based on several factors : company growth, business partner, technology valuation,service product and rival valuation Revenue(0200)

Join our telegram at :

https://telegram.me/invest2gether

DISCLAIMER : Investments involve risks, including possible loss of principle and other losses. This article and charts are provided for information only and should not be construed as a solicitation to buy or sell

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

share4u2019

Rgtech is 2018ipo stock. True gem forgotten by public

2020-02-26 00:53