Avago Rallies After Fourth-Quarter Earnings Top Estimates

ss20_20

Publish date: Thu, 03 Dec 2015, 01:49 PM

Avago Technologies Ltd., which is leading the chip industry’s consolidation wave, surged after reporting fourth-quarter profit that topped estimates on demand for mobile-phone components.

Profit, excluding certain items, was $2.51 a share in the three months ended Nov. 1, up from $1.99 a share a year earlier, company said in a statement Wednesday. That compared with an average analyst estimate of $2.38 a share, according to data compiled by Bloomberg. Revenue rose 16 percent to $1.84 billion.

Avago, which is acquiring rival Broadcom Corp. for $37 billion in the biggest chip merger, is picking up semiconductor companies in a record year for industry deals, as chipmakers seeking to build scale and cut costs. Avago, which counts Apple Inc. as one of its largest customers, cited strong growth in its wireless-chip division.

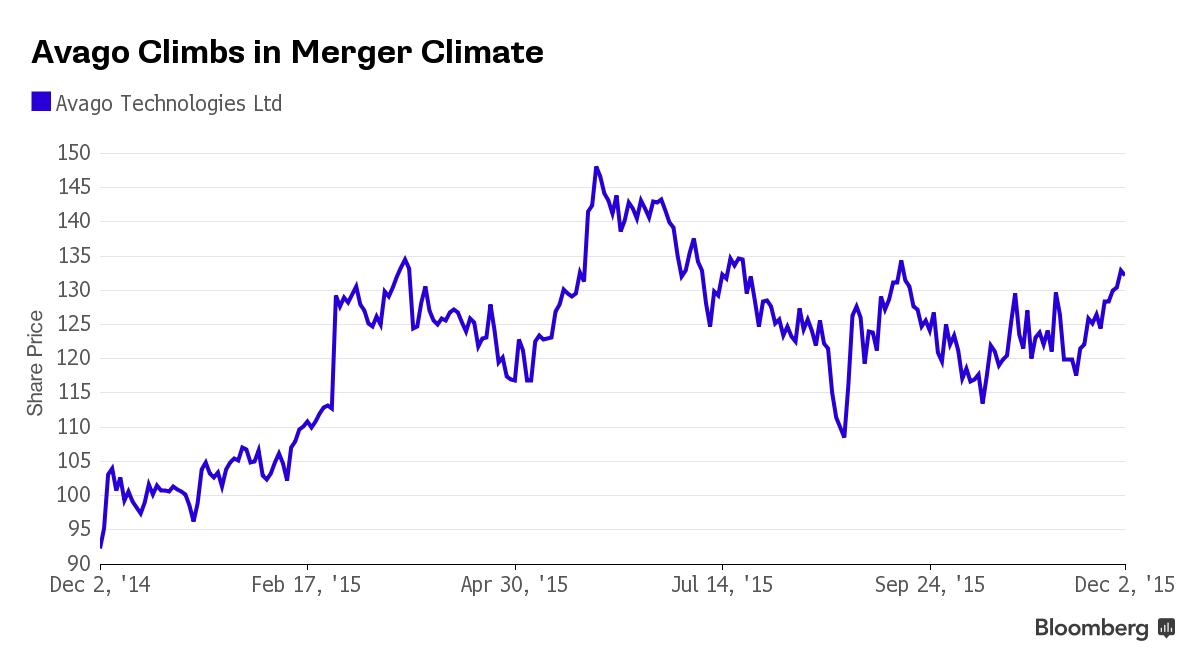

The shares of Avago rose as much as 9.7 percent to $144.97 in extended trading following the announcement. The stock had earlier declined less than 1 percent to $132.21 at the close in New York, leaving them up 31 percent this year.

Avago acquired LSI Corp in 2014 and Emulex Corp. earlier this year.

Bloomberg.com | December 3, 2015