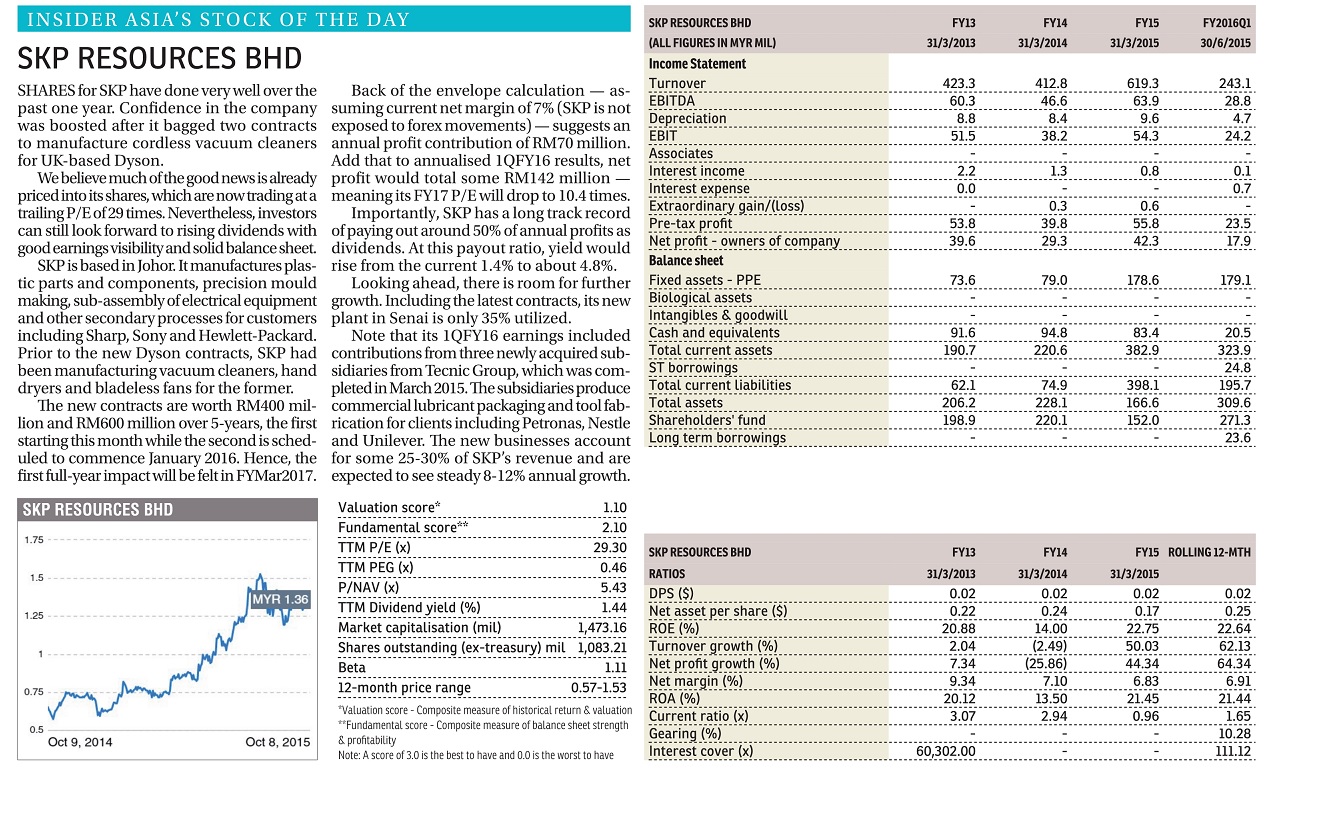

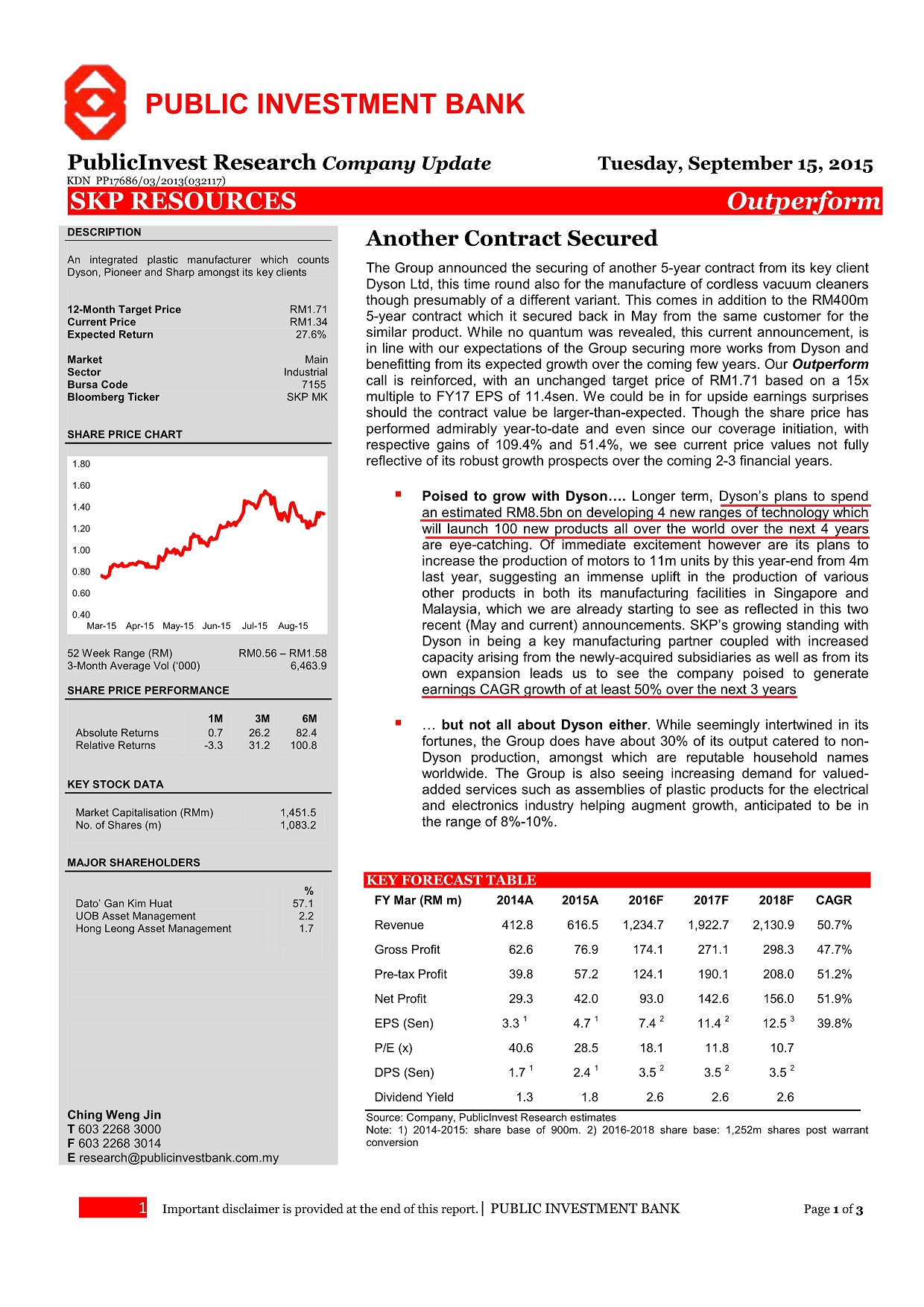

· A re-look in view of emerging major catalysts. Recall that we had previously advocated a Trading Buy call on SKPRES at the price of RM0.49 on 26th June 2014 (report title: Bouncing Back) and managed to lock in a capital reward of 22.4% (at RM0.60) a month later. Since then, the share price has continued to rally to RM1.42 (as of the closing price yesterday) which we believe was mainly driven by: (i) positive market perception on the acquisition of Tecnic, (ii) expectations of earnings boost from various contracts secured, (iii) decent financial results, and (iv) the emerging of institutional funds as major shareholders. Even with the robust YTD gain of 122%, we still see more potential, with a series of major catalysts emerging.

· Long-term contracts to anchor robust 2-year revenue CAGR of 82%. We came away from a recent company visit to both its old and new plants in Johor feeling POSITIVE, having learnt that its expansionary plan is on track. Recall that the group had acquired a 2ha land in Senai Johor (for RM6.8m back then on March 2014) and allocated a total capex of RM34.0m for an additional capacity expansion of 90% in FY17 (which implies an evenly distributed 30% additional new capacity over the next three years). Since then, the group has secured two major contracts from its major customer Dyson, with the first one being announced on May 2015 (contract value of RM400m/year over the next five years for the first model of cordless vacuum cleaners) and another 5-year contract worth RM3.0b (or RM600m/year over the next five years for the second model of cordless vacuum cleaners) which was announced recently. Note that the official production for the contract announced on May 2015 has commenced and will start contributing in 3Q16. Meanwhile, the production for the second contract will only commence from Jan 2016 onwards (or 4Q16). Collectively, the production from these two contracts will take up the first 30% of the additional capacity expansion mentioned above. We are sanguine with these new contracts being secured as this signalled Dyson’s confidence in SKPRES’s capability, which should also warrant higher chances of it securing other contracts in the near to medium term.

· Positive spillover from Dyson’s aggressive expansion plans. Dyson had on end of 2014 promised a massive GBP1.5b (c.RM9.8b) investment for the development of four new ranges of technology which will eventually launch 100 new products around the world in the next four years. Positively, this Malmesbury (UK)-based company has now become the top player in the home of appliances technology, Japan. Back home, we see SKPRES, being the key manufacturer partner to Dyson in these recent years, is poised well in winning other contracts at least for the next three years given its growing presence with Dyson. Recall that SKPRES has already started its manufacturing commitment for Dyson (RM34m invested) by getting its capacity ready, to align with Dyson’s vision. Currently, Dyson contributes 55% to SKPRES’s total sales and the percentage is expected to be more given the robust orders secured.

· Full consolidation of Tecnic in FY16. Note that Tecnic’s financials have already been consolidated into the group earnings from 1Q16. We understand from the management that the FY14 revenue of Tecnic (FYE December) stood at c.RM300m. In terms of Tecnic’s prospect, management is confident of achieving at least 8% revenue growth YoY, to be driven by resilient demand in automotive industry, electrical and electronics industry, industrial packaging and consumer packaging. Meanwhile touching base on the synergistic benefits brought by Tecnic, the group has started leveraging on Tecnic’s leading precision, mould design and fabrication technologies to increase its ranges of value-added services to its customers.

· Sheltered from currency fluctuations. We understand from the management that the group is not benefitting nor adversely impacted from the current strong USD trend as it is operating on a cost pass-through business model with its customers. We see this as a blessing in disguise as this business model means stable group’s margins in spite of the currency/raw material prices fluctuations.

· Trading Buy with FV of RM1.68. All in, we are projecting the group to register NP of RM84.9m in FY16E, followed by a robust NP of RM150.1m in FY17E, with key earnings assumptions being 2-year revenue CAGR of 82% on the back of: (i) the recent two major contracts secured, (ii) Tecnic’s full revenue contribution from FY16, and (iii) 5% YoY organic growth assumptions for its existing businesses, as well as NP margins assumption of 7.2%-7.4% in FY16E-FY17E (which is in the mid-range NP margins of 6.8%-9.4% for the past three financial years). We value SKPRES at RM1.68/share based on a 12.0x FY17E PER, a valuation which is in line with the EMS industry players’ average PER. Coupled with the net dividend yield of 5% in FY17E (DPR assumption of 50%), our TP of RM1.68 suggest a total upside of 23% from here.

Source: Kenanga Research - 20 Oct 2015