DKSH: Why a company with 1% net margin deserves to trade at 20x PE?

sumato88

Publish date: Fri, 30 Sep 2016, 05:35 PM

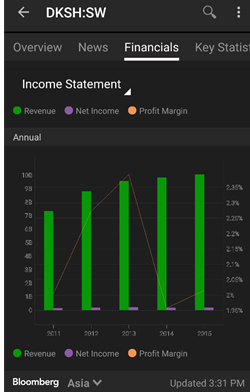

After reading some of the notes and comments on DKSH in i3, I think I may offer my 2 cents’ worth on the company. Many investors think that DKSH is a boring distribution company which make pathetic profit margin (about 1% net margin over the past 5 years), but I think this is a GREAT company that deserves to trade at 20x PE!

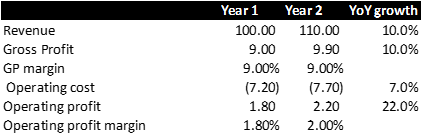

In a nutshell, the brand owners rely on their distribution partner, DKSH to grow their business in Malaysia, instead of setting up their own marketing team which probably would cost more due to the high fixed operating cost. This is the structural trend in the global supply chain as brand owners tend to focus their resources in brand building and product development. This implies that DKSH’s business model is highly scalable as the incremental cost to distribute another FMCG/ healthcare product to a same retail network will definitely be less than an additional dollar of gross profit.

Assuming the operating cost only increase by 7% for every 10% incremental sales, DKSH’s operating profit (core operating profit margin @ 1.8% in 1H16) will at least have a 20% boost (this is what we called operating leverage). Hence, thin margin is not necessary a bad thing! In fact, we have started to see this operating leverage effect kicks in since 2Q16, with operating profit margin expanded from 1.3% in 1Q16 to 2.5% (historical operating profit margin btw FY11 and FY14 was about 1.7-1.8%). To note, FY15 (OP margin @ 1.0%) was an exceptional year, as the company’s operating cost was hit by many one-off items such as double rental, start-up cost, moving cost, abnormally high inventory write down as the company invested in 2 new distribution centres (Shah Alam and Kota Kinabalu) which has much larger capacity to cater for future growth.

Now, let me explain why DKSH’s profit margin is so “pathetic”? For a distribution business, the key risks are mainly (1) market risk, i.e. economic cycle which is relatively low for DKSH given its distributed products (FMCG/healthcare products/prepaid cards) are highly inelastic to economic cycle, and (2) inventory risk which is also manageable for DKSH as it only has inventory risk exposure to FMCG while healthcare products are mainly on consignment basis and the value of telco prepaid cards is always intact, and (3) receivable risk which is also very low based on DKSH’s past 5 years average allowance for doubtful debts & bad debts written off of RM0.2m. With such low risk business model, the razor-thin profit margin is acceptable, in my humble opinion.

In fact, to determine if a business model is profitable, I would prefer to look at return on capital employed (ROCE) which takes into account the company's profitability and the efficiency with which its capital (both working capital and investment capital) is employed. For DKSH, the company used to generate a consistent ROCE of 14% between FY11 and FY14, but fallen almost half in FY15 due to the one-off issue I mentioned above. Based on my calculation, ROCE will recover to 14-15% in FY16 and continue to improve towards 20% over the next 3 years, if management willing to pay more dividends to return the excess capital to shareholders. I think the probability of more dividend is high as the holding company, DKSH Swiss also intends to raise dividend payout in future. So how much can the company afford to pay?

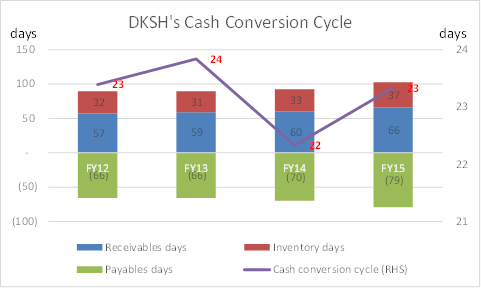

Annualizing its 2Q16 core EBITDA of RM36m, DKSH can generate about RM144m cash flow from its business. If the company generates an additional 10% revenue, i.e. about RM500m, it needs additional working capital of RM32m (RM500m x 23 days/365 days). Setting this off, the net cash flow from operation will probably be around RM110m. A check on the 2015 annual report revealed that capital commitment is only RM1.7m in FY15 vs RM22.7m in FY14. This gives a good indication that capex cycle (average capex p.a. was RM14m from FY13 and FY15 vs RM6m in FY11-FY12) for the company has already ended.

Assuming the company’s capex normalises to RM5m p.a., the company will generate free cash flow of more than RM100m p.a.. This offers a huge room for the board to raise the dividend payout substantially! To note, the company has net cash of about RM33m as at Jun 16. If you ask me, I think the company can afford to pay up to 100% of its profit (annualise 2Q16 core profit of RM24m will gives you RM96m) going forward. This translates to a mouth-watering dividend yield of 11%! Even if we assume 50% payout (slightly higher than 40% payout in FY15), we are still looking at 5.5% dividend yield. This will definitely serve as a strong re-rating catalyst for the stock! So let’s watch this space closely!

One of the key competitive edges and economic moats that DKSH poses against its competitors is its long operating history in Malaysia (more than 90 years) which helps the company to build a strong local market knowledge and data points to provide market research and analysis services to its clients. To further illustrate its capability in market research & analysis, DKSH helps its clients (suppliers/ brand owners) to identify new market opportunities, understand the feasibility of selling their products in those markets, identify any regulatory hurdles (particularly for the healthcare products) and apply for product licensing, provide advice on product development to help clients tailor their products to suit the local market, and provide market feedback on the products that it distributed based on the industry sales data tabulated by its SAP sales system. This is the key differentiating factor between DKSH and its competitors who usually only provide warehousing and logistic services as a distributor.

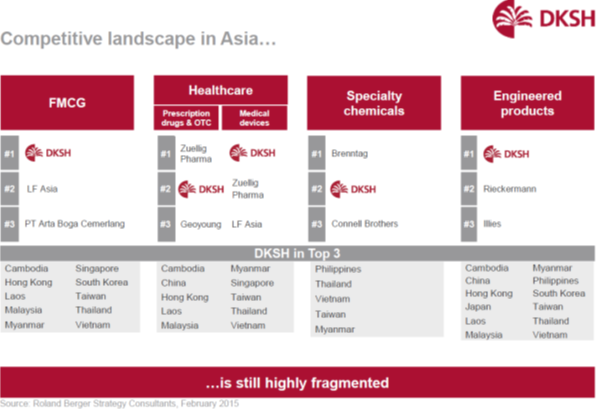

Last but not least, I like DKSH’s leading position in the FMCG/Healthcare distribution sector, an industry with high barrier of entry. Just imagine that if you want to start a distribution business tomorrow. How long does it take for you to establish a competitive network, market knowledge, and economies of scales? And most importantly, FMCG/Healthcare brand owners are typically MNCs who prefer to deal with the market leader, even though at a higher cost.

In conclusion, DKSH is now at the beginning of a multi-year re-rating cycle as I view its valuation extremely compelling, trading at less than 10x PE (annualised 2Q16 core profit of RM24m). For less than 10x PE and a potential dividend yield of 5-11%, you buy:-

-

A market leader in market expansion services, an industry which see tremendous growth potential;

-

A highly resilient business model as it distributes inelastic FMCG, healthcare products and telco prepaid cards;

-

A scalable business model with significant operating leverage which is managed by professional managers;

-

A business which has upper hand in bargaining with suppliers & customers;

-

A business which is hard to replicate and have high barrier of entry;

-

A business that can generate consistent ROCE of 15-20%,

-

A turnaround story which will see its profit jump from RM37m in FY15 to RM75-85m in FY16 and RM85-RM95m in FY17!

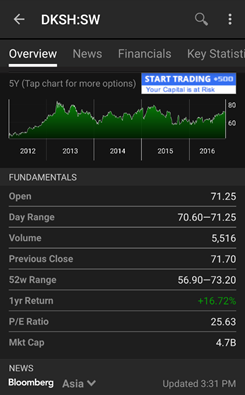

In my opinion, the stock deserves to trade at high teens to 20x PE, given all the merits mentioned above. This is the valuation that DKSH Switzerland is trading at, a stock that is well covered by analysts. (http://www.dksh.com/cs/dksh_c

Even if you value the stock at 15x PE, it will still give you a target price of RM9.10 (RM96m x 15x PE / 157.7m shares), translating to a whopping upside of 65%! Best still, this stock is unlike many small cap which usually see the earnings unsustainable after a sharp jump. You can hold on the stock for 10-20% earnings growth p.a. (depending on revenue growth of 5-10% p.a.) with attractive dividend yield of 5-10%!

For more research materials, I strongly advise you to go to DKSH Switzerland website to search for the information. http://www.dksh.com/cs/dksh_co

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Buying Biz or Buying Stock?

Created by sumato88 | May 25, 2017

Discussions

Mind to share your view?

Would like to hear from your analysis on DKSH. Thank you.

2016-11-23 22:03

I am so surprised that the sell down in DKSH is so steep. I think the irrational sell down is overdone. My 2 cents on DKSH's 3Q16 result

1) record high impairment of receivable (RM14.5m) in 9m16 shouldn't be viewed as a broad base bad debt, management has mentioned this is one-off in the quarter results so I think it is an isolated case/client. Why would I so confident on this non-recurring impairment? Well, if you look at their past 5 yrs impairment on receivables, the avg impairment p.a was only RM0.2m (Don't just take my word for it, you can verify the numbers by checking its past annual reports). So I am not too concern on this impairment charges.

2) Profit is not that bad after you exclude the one-off impairment, which comes to about rm12m, as compared to RM4.5m in 3Q15. In terms of qoq, the profit is indeed a lot lower (2Q16 pat ex impairment = rm23.9m). This is mainly due to the 7% qoq revenue contraction. In absolute amount, revenue declined by rm98m qoq. Assuming 9% gross profit margin, the lost of profit is rm8.8m. So this adds up to rm20-21m quarterly profit if the revenue sustain at rm1.35bn, which is a consistent revenue base since 4Q15, before coming off in 3Q16.

3) Cash flow seems to deteriorated rapidly with many investor pondering where the cash has gone? Obviously, the cash lock up in working capital (receivables & inventory) after the sales disappointed. It would probably normalize in next quarter. If you noticed, the co's net cash position is always very volatile from quarter to quarter but the fact is, it has been in net cash since full year 2013.

In conclusion, DKSH's 3Q16 results was not very good, but definitely not in a crisis. If you exclude the rm14.5m impairment in 9M16, the co reported rm47m pat. If it makes another rm13m in 4q16 (+30% yoy), the co will probably match its record core profit of about rm60m in 2013 and 2014. Bear in mind, DKSH share price traded above rm8.50 in March 2014. Price has came off subsequently but avg traded price throughout 2014 was still above RM7.00.

Hence, it really doesn't make sense to see the price continue to trend down from current level. If revenue recover to 1.35bn per quarter, I think the profit will be closer to rm20m level.

Feel free to comment but appreciate constructive feedback. Thanks.

2016-11-28 17:50

Hi sumato, whats the calculation behind the working capital required to support additional RM 500m in business?

2016-11-28 17:59

You need to estimate the total receivables (estimate receivable turnover days/365 x sales), inventory and payables for the forecast revenue (fy15 sales + rm500m). Then get the net working capital required for this sales (receivable + inventory - payables), minus net working capital in previous year. For illustrative purposes, if I assume turnover days remain the same, the net additional working capital for RM500m new sales is rm39m.

2016-11-28 20:27

.png)

zexon

Because you are using their products that they carry in your daily life.

2016-11-23 22:02