Super KLSE Stocktalk

Record revenue for Sern Kou Resources Bhd

garyztandslr

Publish date: Mon, 28 Nov 2022, 12:36 PM

In Q1FY23, this is the first ever quarter for Sern Kou Resources Bhd (SERNKOU) to record over RM100.0 million in revenue. The results had also increased significantly over preceding year’s corresponding period, as well as against the immediate preciding quarter.

Despite a challenging outlook was seen for the furniture industry, investors must be reminded where SERNKOU is not just another furniture maker. Instead, the company is mainly involved in the wood processing business, which had significant impact on the current quarter’s performance.

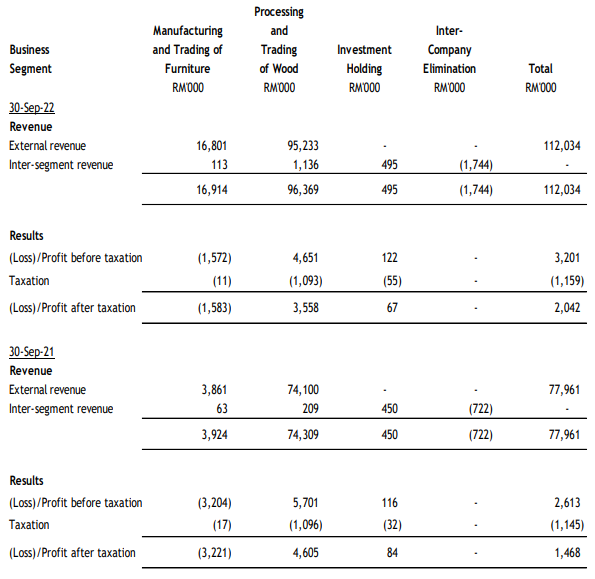

Out of the RM112.03 million revenue generated by the company, majority of it was contributed by processing and trading of wood, which was amounted to RM95.23 million, and only RM16.80 million was contributed by the manufacturing and trading of furniture.

USA and Europe are both seeing slowdown in demand for wood-based furniture, hence, it is good for SERNKOU to be strongly supported by their midstream business.

The management had explained that the spike in revenue of 44.0% was largely due to the increase in demand for tropical wood in the processing and trading and wood segment. Obviously, the furniture segment was not allowed to operate in full in the preceding year’s corresponding quarter, hence the losses incurred, and lower profit for the company.

However in this quarter, the company had a net 47.0% increase year-on-year over preceding year’s financial performance.

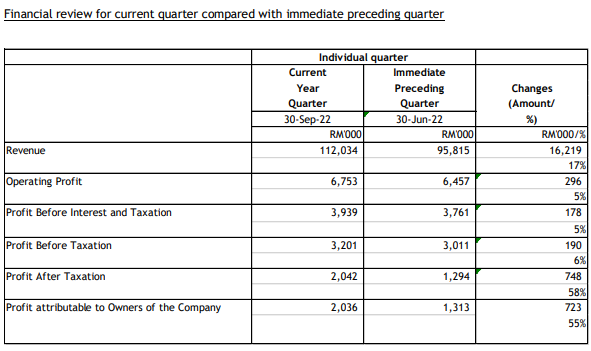

When compared to the immediate preceding quarter, we are seeing much better improvement in revenue that is growing on quarterly basis, by a quantum of 17.0%.

The increase was largely due to the demand for tropical wood in processing and trading of wood segment had increased, too.

Nevertheless, the company had shared that the margins of the company was impacted despite an increased sales volume, the absolute figure in net profit had still increased by 55.0% on a quarter-to-quarter basis.

Going forward, the company is positive where the financial performance and prospects for 2023 financial year would be bright, and the group is actively exploring new opportunities and is building new capabilities to strengthen the group’s business.

With stronger sets of results in place, investors can expect the share price to breakthrough the key RM0.725 resistance level on Tuesday.

We remain very optimistic for the future growth of SERNKOU.

- KC -

More articles on Super KLSE Stocktalk

Sern Kou Resources' net profit increase 47pc to RM2.04mil in Q1

Created by garyztandslr | Nov 28, 2022

What is BREWING Behind Massive Change of Hand for Sern Kou Resources Warrants?

Created by garyztandslr | Oct 25, 2022

Discussions

Be the first to like this. Showing 0 of 0 comments