US China Trade War Got Casualties and Beneficiaries. This is the 1st Beneficiaries!!! Target Is Going In with Full Confidence

targetinvest

Publish date: Tue, 21 May 2019, 12:22 AM

Hi all reader and investor again.

This month of May is a real challenge for those who are trading for a living. The volatility is max with trade war brewing at a full scale with US imposing tariffs on China and China countered with their tariffs as well.

Market is bad, companies stocks are shaken. But I believe that every big shaking is also a big opportunity here. While trade war hurts the global economy somehow, but I think some of the Malaysian industry will stand to benefit from such event.

I believe the trade war will benefit Malaysian export market, especially the furniture market.

The key reason are

1. Malaysian furniture exporter benefit from a stronger USD

2. Demand shifting to Malaysia due to no tariff

3. US economy is still strong

While there are many key companies involved in the furniture market, namely Liihen, Latitude, Pohuat, and Jaycorp to name a few, today I will focus on the Jaycorp due to it's good prospect looking forward.

Investing in Jaycorp Berhad

1. Why is Jaycorp interesting?

One of the most important factor in investing will be the fundamental of the company. The company must be having good earning, and pay dividend.

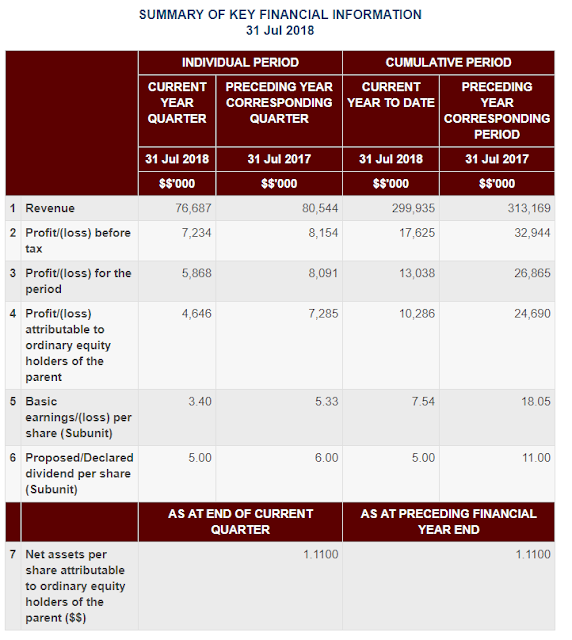

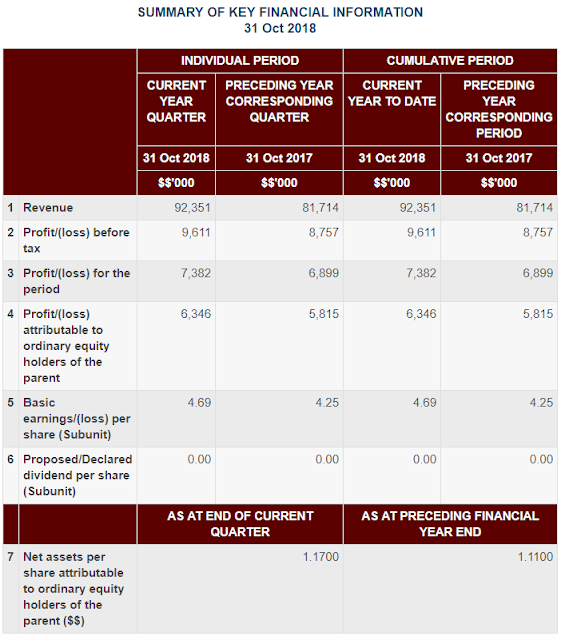

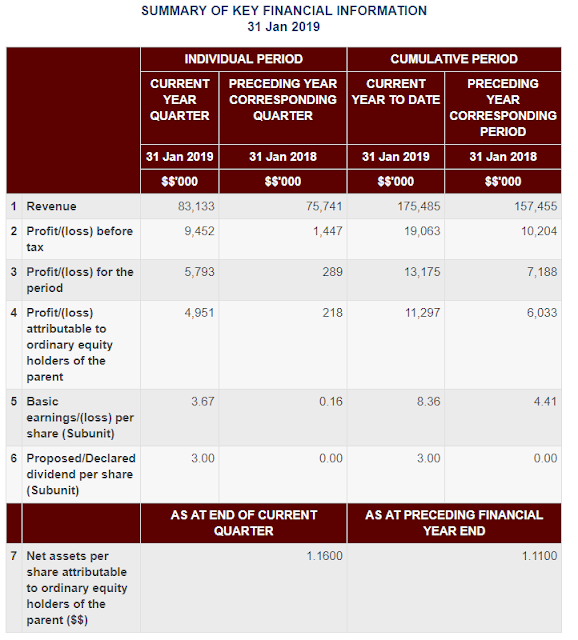

This is the past 3 quarterly result of Jaycorp.

Sep 2018

December 2018

March 2019

So for the past 3 quarter of Jaycorp, the company already made

3.4 cent + 4.69 cent + 3.67 cent = 11.76 cent

Dividend paid in the 9 month time frame = 8 cents ( 5 + 3)

So you can see this is a company that is doing well, have decent earning and is paying dividend to it's shareholder.

2. Jaycorp is heading for a new uptrend

The share already fallen from a height of RM 1.60 and consolidating at 90 cent range. Now it is the time for the company to make a new come back after breaking away from long term downtrend resistant line that is back with good result for 3 consecutive financial reports. (9 months)

3. Jaycorp to benefit from a weaker MYR

The latest measure of BNM to cut 0.25% in OPR will also see MYR floating lower against USD.

According to technical chart, the USD/MYR already broke resistant and looking to trend higher, potentially visiting the range of 4.2x to 4.3x

Conclusion

Since there are a lot of indicator pointing towards the positive outlook for furniture industry, Jaycorp will be very interesting for the next coming few months.

Assuming the coming quarter report to produce 4 cents in earning, that will bring a total 4 consecutive quarter earning to 15.76 cents

Simple valuation of PE X10, Jaycorp can see valuation at RM 1.50 to RM1.60

At the current price of RM 0.95, this will be more than 50% capital appreciation for the investor now. So now is good chance to invest when the share price is low while the potential is high.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Target Invest - We Target, We Invest

Created by targetinvest | May 20, 2024

Created by targetinvest | May 17, 2024

Created by targetinvest | Apr 05, 2024

targetinvest

good chart want to break out soon..then attract more volume to come in, heading towards RM 1.10

2019-05-21 10:59