TECFAST Small Cap that Benefit from Weak RM

Gary Poh

Publish date: Mon, 21 Dec 2015, 08:58 PM

After US federal government increased interest rate on last week, what stocks should we buy now? Of course stock those that benefited from weak Ringgit.

This company named Tecfast attract my attention today after saw it gain momentum. Tecfast is one of a small cap that listed in Aceboard located at Bayan Lepas area. Cape Technology Sdn Bhd which is one of the subsidiary of Techfast. This company provide mould cleaning rubber sheets and LED epoxy encapsulant materials.

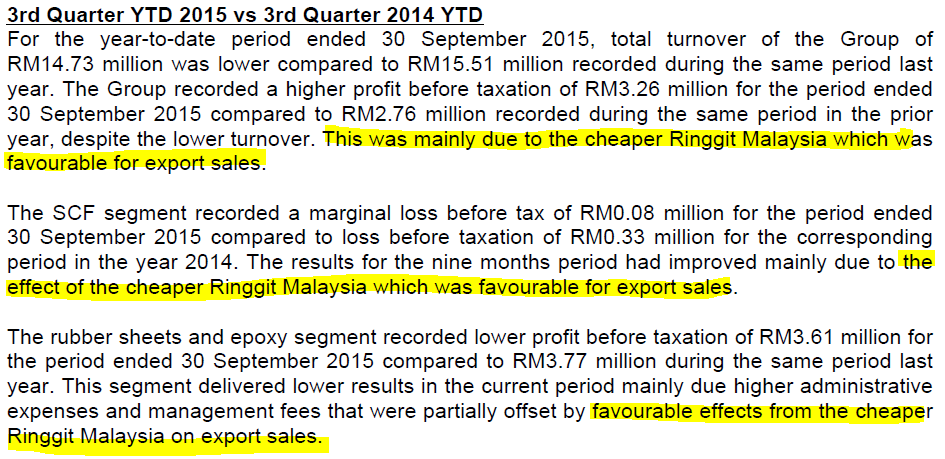

Will Tecfast perform well next quarter? Management provided the answer as below:

Well this company making higher profits due to weak RM. Evidence as below:

4 simple reasons why this company can invest:

- Company has zero debts currently.

- Overall business improved to appreciation of USD dollar.

- It was turnaround company.

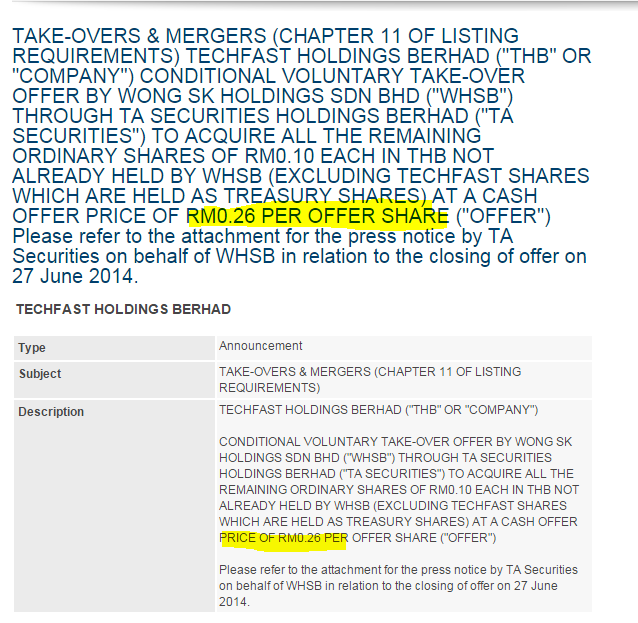

- Wong SK take over at 26cents before but no successful.

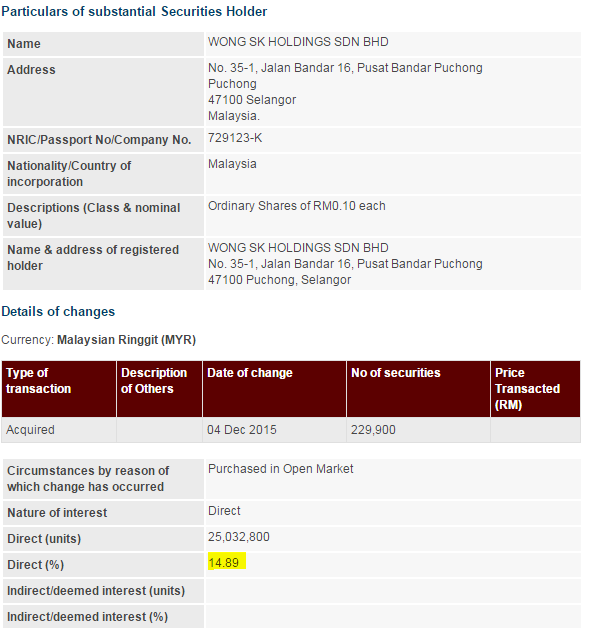

Now Wong SK increased stake to 14.89% currently? It will attempt another take over again?

Let’s say we forecast Tecfast next quarter result eps also at 0.8 remain constant. Make it ceteris paribus, annualized profit will be 2cents. This mean that Tecfast should worth 0.29 by having PE of 14.5 only. What if the coming next quarter result more than 0.8 eps. Should Tecfast deserve a higher price? You decide.

Conservative TP 0.29(Invest on your own risk)

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on TECFAST

Discussions

Thanks for sharing...

hopefully can turnaround. Already improved from 9.594m.

2015-12-22 00:16

I noticed the same thing last month or so when it was 0.185 (the pp price, the previous attempt at 0.26 etc). Hopefully this will be like another SCGM- didnt move for quite some time and then suddenly kaboom...and kaboom.

2015-12-22 08:32

Keinhin hit ur tp but techfast still hibernate.. really hope ur analysis on Tecfast is choon..

2016-01-05 22:53

a $20 million turnover company should not be listed but the play ground of venture capitalists and private equities.....

now, the public can pretend they are venture capitalists and professionals.

ACE market.

2016-01-19 21:41

PlsGiveBonus

Ca you explain what is accumulated loss at 7.668m

2015-12-21 21:24