Techfast Holdings Bhd (0084) What Else You Need to Know???

Gary Poh

Publish date: Tue, 19 Jan 2016, 07:49 PM

Going through a vulnerable market in 2016, it creates a lot of opportunities of bargain hunting. What do we expect in the year of 2016? Volatility remains. To invest in current trend, you need to be able to hold the stocks for a period of time in order to have a better return. Indeed, I agreed with the article posted by Icon8888 regarding “Looking Forward To A Turbulent 2016, The More Messy The Better”.

I am not giving up in collecting Techfast Holdings Bhd (“Tecfast”) when I saw Wong SK started to dispose his Tecfast’s stakes on 22 December 2015. In fact, this is an opportunity.

Liquidity

Currently, Wong SK holding 13.68% after disposal, it will increase the liquidity of trading in the market. Shareholders of Tecfast who need cash can easily dispose it in an open market. This could attracts larger institution investor or future potential investor.

Institutional Investor

Reading annual report through the movement of largest shareholders is an important rule of thumb, to understand the reaction of shareholders. Why do we need to do so? There’s no guarantee that the company you hold onto is growing or not. But with their help, this could determine you are doing a right choice.

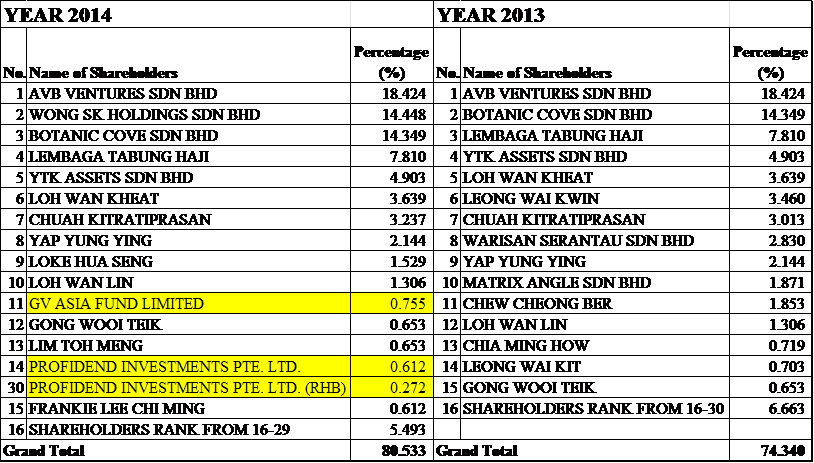

Let’s us compare the annual report of 2014 and preceding year’s annual report (2013).

GV Asia Fund Limited very eager in their investment, they entered FFHB and they have made a good return for the past 2 months. And they entered Tecfast quietly during 2014. Based on the diagram, foreign investment of Tecfast increased to 1.639%. This is a good indication that be able to attract foreign investment.

Private Placement

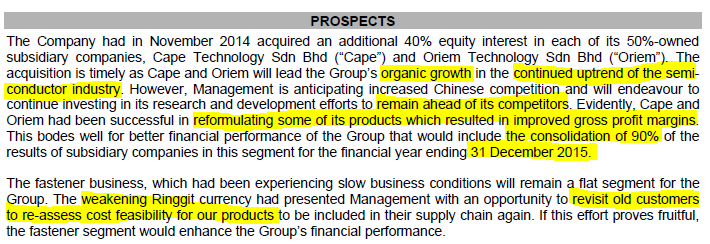

Private placement amounted RM2.8 million that exercised by Tecfast on 19th August 2015, was used to expand fastener business in the United States and Europe. Hopefully the expansion of fastener will be fruitful with the recovery of United States and Europe. The company also plans to expand the business of rubber sheets and LED encapsulated products into China. Tecfast, similar with KEINHIN, had applied organic growth and acquisition strategy (Cape Technolgy Sdn Bhd and Oriem Technology Sdn Bhd). I believed semi-conductor industry still remains resilient in amidst of vulnerable market.

Dividend Payout

The company stops paying dividend on year 2015, in order to reserve its resources to pay off the balance of the consideration for the acquisition of the additional 40% equity stake in each of Cape and Oriem (Adopted from Annual Report 2014). With current free cash flow in hand, Tecfast is expected to pay 0.5cent dividend in 2016. With current share price of Tecfast of 22cents, the dividend yield is expected to be 2.2%.

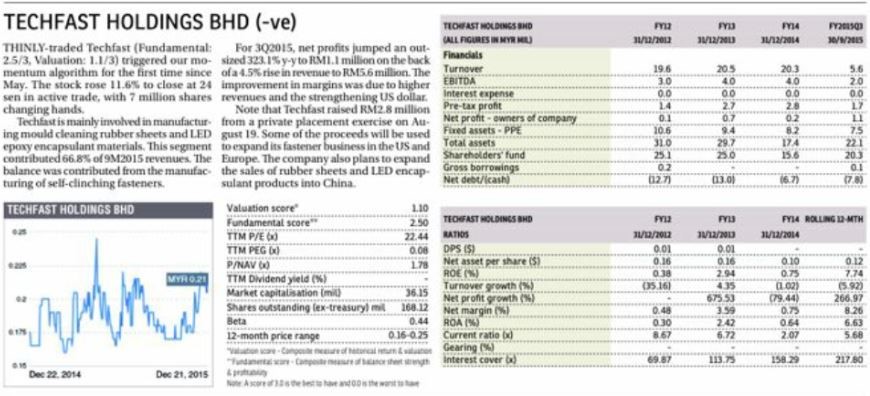

I forecasted Tecfast with the upcoming next quarter with the real earning per share with 0.8 cents in Q4.

|

Current Financial |

|

|

|

|

|

Financial Year |

31-Dec-14 |

31-Mar-15 |

30-Jun-15 |

31-Dec-15 |

|

Status |

Actual |

Actual |

Actual |

Forecast |

|

Quarter |

1 |

2 |

3 |

4 |

|

EPS |

0.37 |

0.14 |

0.73 |

0.8 |

With current share price of RM0.22, I projected Tecfast’s PE 10.5. Hopefully upcoming earning which will release on February 2016 is much better and augurs well with the expansion.

|

Valuation |

Forecast |

|

PE |

10.7 |

|

EPS |

2.04 |

|

Share price |

0.22 |

|

NTA |

0.14 |

This is merely my own sharing only. Do your own analysis and be much more astute about handicapping the long-range prospects for a particular company before you take the plunge. Once again, invest on your own risk.

Appendix

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on TECFAST

Discussions

Good sharing. Like your post always Gary Poh. Shall buy this stock more on tomorrow.

2016-01-19 22:35

Fayetan,their business are first to goreng AMEDIA,after that char kwai theu BRIGHT,

And coming soon is to KFC Techfast.

2016-01-20 02:34

$ 20 million turnover. Should not even be listed . Should be the play ground of venture capitalist and mezzanine financing.

Now, everyone can pretend to be venture capitalist and professional.

2016-01-20 02:43

probably a good thing to have Ace market..........

but only for Aces Go Places.

2016-01-20 03:05

edlishah79

Good article

2016-01-19 20:24