The Funds Flow of Bursa (1818) Before and After the Reimplementation of CMCO

TheFFAPractitioner

Publish date: Tue, 20 Oct 2020, 09:25 PM

If you have read my first series on funds flow analysis on Hartalega , you will have reaped significant profits by now. Contrary to popular belief, Harta has proven to be the strongest glove stock in recent weeks, rising to a high of RM19.20 as of 20th October 2020. Heartiest congratulations to those who followed closely.

Moving on with Bursa Malaysia Berhad...

______________________

Fundamental Recap:

__________

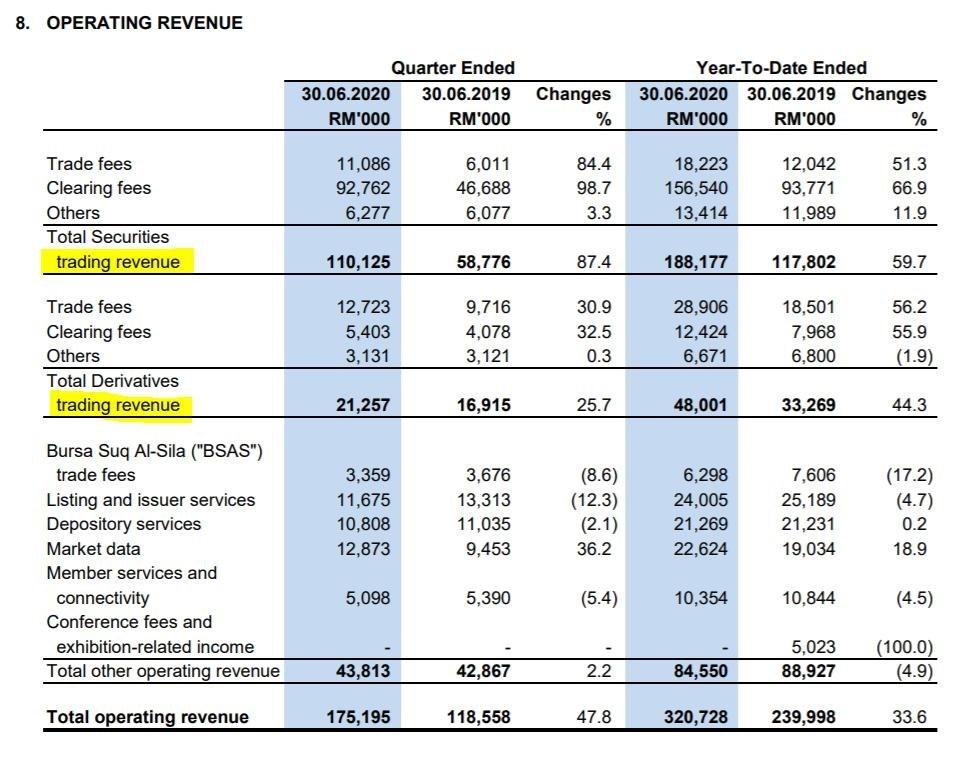

Back in July, Bursa rose from RM7.2 to a high of RM10.80 within the span of a few weeks. This was a 50% increase in price compared to its pre-breakout price. As per the fundamental rules of engagement, the sharp rise in the price was attributed to the increase in trading volume revenue and non-trading revenue. Soon after, the share price fell from the peak of RM10.80 to RM7.85 after the results for Bursa's quarter ending 30th June 2020 was announced. The fall of the stock price was to be expected due to the fact that the net profit did not meet a few analysts' expectations. From a funds flow perspective, the rise of Bursa's share price in July did not yield enough profit taking to sustain the uptrend, and hence, did not satisfy the rules of funds flow triangulation.

___________

Now, we have recapped the events of Bursa in the recent months. Let's take a look at how we analyse the funds flow of Bursa moving forward. One of the biggest flaws of technical analysis is the inability to determine a conclusive rebound pricing after a sharp fall. Indicators such as Fibonacci and price supports do not suffice, as retailers can easily be mistaken as smart monies, prompting what we call 'catching the falling knife'. Rather, technical analysis gurus instead opt to buy into the share price on a technical confirmation of rebound. However, this results in the buyer being unable to collect the share price at the absolute low.

One must remember that ALL movements of a stock price regardless of any factors are determined solely by big monies (defined as strong forces pushing a stock) and should not be confused with smart monies (whom silently collect).

The stock price of Bursa fell sharply after the announcement of the quarter report, triggering a technical rebound on the 10th of September. Interestingly, we detected smart monies flowing in on the 8th and 9th of September. Collection was heaviest between the share prices of RM8.34 to RM8.65 on the 9th of September. Smart monies continue to collect in recent days, prompting an increasing amount of retailers to take positions around the prices of RM8.80 to RM9.00. Bursa should now continue to resume its uptrend. In the short term however, expect a dip to around the 8.7 area as the stock is currently overbought. This dip will provide traders with a final opportunity for entry. However, expect trading volume to continue falling, which will have a dip in the earnings of Bursa in quarters to come. Fundamentally, this may impact the potential target price.

Disclaimer:

The descriptions and analysis in the blog are of the personal opinion of the author and is solely for knowledge purposes. No buy/sell call is given. Investors should do their own prior research before committing to an investment.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Funds Flow Analysis by TheFFAPractitioner

Created by TheFFAPractitioner | Nov 13, 2020

Discussions

@Geraldyam17 we recommend taking a look at Bursa-C33, C35 and C40.

Trade at your own risk.

2020-10-22 14:55

.png)

Geraldyam17

Which warrant is good?

2020-10-21 16:55