Trading With A View

(Tradeview 2020) -

tradeview

Publish date: Tue, 24 Mar 2020, 03:24 PM

Dear fellow readers,

Once again, these writings are just my humble highlights (not recommendation), feel free to have some intellectual discourse on this. You can reach me at :

Telegram channel : https://telegram.me/tradeview101

Website / Blog : http://www.tradeview.my/

Facebook : https://www.facebook.com/tradeview101/

or Email me at : tradeview101@gmail.com

__________________________________________________________

"Cash Is King", this age old adage or wisdom you may call it has ring true in the many years of financial markets history of mankind. The reason why bank continues to grow and prosper is because it serves the very fundamental needs of mankind since the invention of currency (money) as the methodology of trade. When you see the headline news articles in 1997 Asian Financial Crisis, 2000s dotcom bubble, 2008 Global Financial Crisis and today, the Covid-19 2020 Global Meltdown, you will see the truth in this wisdom.

But what does this phrase actually means? Have a look at this video below by Warren Buffet where he gives his perspective on what cash is king really all about.

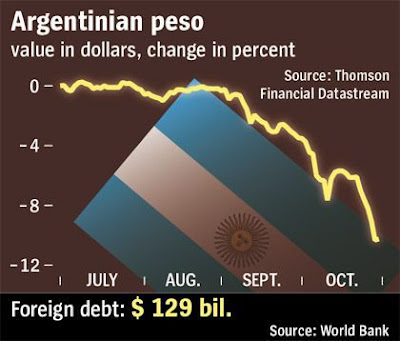

The logic of having lots of cash is to deploy when necessary. It is not a form of collection but it is a tool to be used when the occasion arises. However, due to ever competitive and changing business model landscape in today's economy, most governments and private sector companies are highly leveraged or geared as a whole. Running on budget deficits seems to be a common notion. In the chase of revenue growth, many top companies bleed cash year in year out. What more governments? Few practice fiscal prudence. Example : Argentina

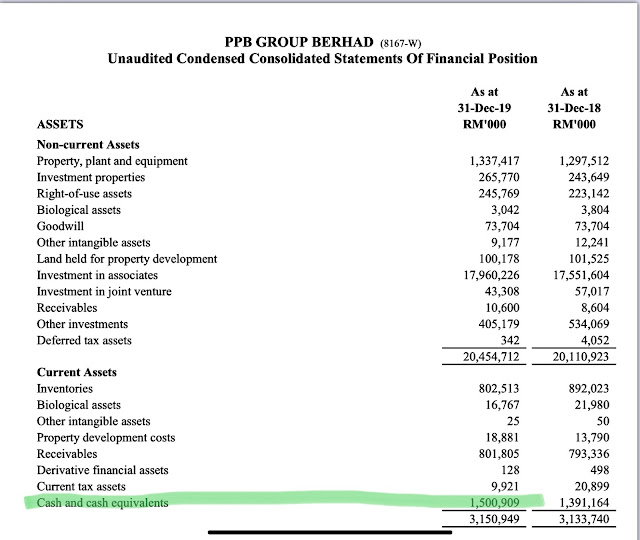

That is why people and companies belonging to the likes of Warren Buffet, Li Ka Shing, Robert Kuok are highly admired because their businesses churns out good profit and cash flow, above and beyond that, they have substantial cash reserves stashed away for rainy days and to be used for occasion like the current market sell down we are facing. We don't have to even look far, let's look at one of the many companies of Malaysia richest man Robert Kuok, PBB Group, the cash holdings is a staggering RM1.5 billion.

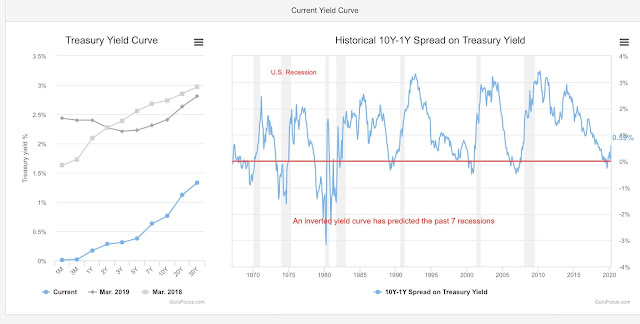

I have had numerous discourse with extremely intelligent people on their view on the market. Some would be hesitant to call this a recession as a recession has to be shown by data of negative growth over a prolong period of time. Yet, why is it even the common man on the street knows that this is a recession or recession looming? Well very simple answer to that would be the stock market usually reacts ahead of time. It is one of the best indicators. Usually the stock market, the property market, then the job market. Now can anyone disagree with me that all the markets mentioned above is not suffering?

Therefore this would bring me to the conclusion that we are indeed facing a recession and with our cash in hand, is it time to deploy?

1. Savings for Rainy Days :

I think most people would be a net debt position instead of net cash. This includes many listed companies as well. High net worth individuals mostly also leverage up on their wealth to build more wealth. So all in all, most people have more debts than cash. Few have substantial savings to weather the storm but I do think that many have some emergency funds or savings set aside.

If we are to dig deep and look at our reserves, do we have the necessary extra funds to invest in the market? Please make sure whilst reading my articles on investment, I will never ever ask my readers to take margin, borrow money, rack up credit card debts just to buy shares. THIS IS WRONG.

My priority and goal towards financial independence is always premised on using excess cash / extra funds to invest in the market. Delay instant gratification like buying a nice car or luxury items, instead use those allocated funds for such gratification to invest in quality value stocks for the future income / wealth. So first thing first, make sure you set aside at least 25-30% of income to savings for rainy days, children's education, health care fees, insurance etc. These are funds you cannot touch and utilise for investment no matter what. Beyond that, you can consider for other usages such as investment.

2. Deploying Excess Funds for Good Stocks Now :

How many times have you all heard older folks sharing last time Public Bank only RM5, Maybank only RM3, Genting RM1 etc? I am sure countless. Now whenever you hear that, did you ever ask them why they didn't bought back then?

Of course, everyone has different circumstances. For those in the market, probably they got stuck with large amounts in their shareholdings unable to get out before the sell down. Some require excess funds for their own business and personal expenses. Hence my viewpoint above, deploying EXCESS Funds for Good Stocks NOW.

Many authors of articles write very carefully as they are afraid readers will blame them in case anything go wrong. So in their articles, it is always pointing out the obvious, or sharing observations with no transparent guidance on their calls or picks or direction. We would like to make it very clear, if you have spare funds lying around or excess cash, delay buying a new car or new toy or new luxury jewellery or whatever it may be, use the funds to buy into good fundamental stocks whacked down terribly due to the current situation. I know many are under lockdown, working from home, you would have some time compared to working hours to study and understand the market. For those who do not know and are lazy to study, following us and our articles, we have shared multiple times before on our stock picks below. We share it again here now.

We previously shared the following stocks as our favourite :

- CCK

- OCK

- RCE Capital

- DKSH

- Riverstone Holdings Ltd (Singapore listed)

- Pintaras Jaya

- GCB

- MFCB

- Scicom

- RHB Bank

- Pentamaster

- Public Bank

- QL Resources

If any of you all have been reading and following and entered as our articles are published, I am sure most would be in +Ve position as the market has rebounded over close to 100 points since then.

Please stay tune for our next write up on "Principles of Investing - Rule 1: Buy Good Quality Companies Which Will Still Be Around In 5 years".

_______________________________________________________________

Telegram channel : https://telegram.me/tradeview101

Website / Blog : http://www.tradeview.my/

Facebook : https://www.facebook.com/tradeview101/or

Email me at : tradeview101@gmail.com

Food for thought:

More articles on Trading With A View

NST Business x Tradeview No.3 - Adam Yeap, Owner of 212 Hospitality and co-founder of Wonderbrew

Created by tradeview | Oct 18, 2021

NST Business x Tradeview No.2 - Muzahid Shah, CEO of SteerQuest Sdn. Bhd.

Created by tradeview | Sep 28, 2021

News Straits Times Business x Tradeview - Sharing Stories of Retail Investors & the Stock Market

Created by tradeview | Sep 15, 2021

Tradeview (2021) - Peterlabs Holdings Berhad Long Term Value Stock (Update)

Created by tradeview | Jun 01, 2021

Tradeview Commentaries - The Glove Surge, A Mirage or A Path To Oasis?

Created by tradeview | Apr 08, 2021

(Tradeview 2021) - Are Research Analysts' Reports Worth Their Salt?

Created by tradeview | Mar 17, 2021

Discussions

3 people like this. Showing 6 of 6 comments

https://klse.i3investor.com/servlets/pfs/123026.jsp

Support VenFx (Armada An Quantum Leap Stock In 2019/2020)

2020-03-26 15:47

sumting wrong wit u Ahbah, u c the mkt up 9% since? Rallying la mkt, apalah ahbah

2020-03-26 16:38

zhangliang

TQVM !

2020-03-24 17:53