Trading With A View

Tradeview Commentaries 2020 - Pfizer's Vaccine Is Not Distributed Via The Rain (Importance of Diversified All Weather Portfolio)

tradeview

Publish date: Tue, 10 Nov 2020, 10:08 PM

KLCI Bursa has not rallied in such record quantum in a long time (3.3% for the day). The vaccine positivity truly spread across global markets with huge funds rotation away from Glove and Tech stocks into recovery, laggards and beat up stocks.

Today by far, I received the most questions from readers who are panicking over the selloff in glove stocks. The common 2 questions : Should I sell / cut loss now then buy back later? & Should I buy O&G, Tourism, Recovery stocks? I will be blunt - both are wrong questions to ask.

In my Principles of Investing article series, Rule 4 - Diversification Is the Best Defence written in my blog April 2020 shortly after the "March Plunge", I emphasised the importance of having a diversified portfolio and techniques of doing so. Often when the stock market or particular sector is doing well, investors forget about this important rule. Only when something bad happens, the "what ifs" comes in.

Most readers know I am one of financial writers who is very confident with the prospects of Glove stocks. I have publicly written on 5 of those. Am I still holding gloves in my portfolio, the answer is yes. Am I still confident? The answer is yes. Do I intend to buy more glove stocks? The answer is yes but on weakness. Where does my confidence stem from despite the announcement of Pfizer's "Great News for Mankind" yesterday? The answer is fundamentals.

As a fundamental investors, I look at the earnings, yield, balance sheet, prospect, management and various factors assessing the company before deciding to buy. If there is no structural change to a stock, my view remains valid. However, if there is structural change to the company, I will make an objective decision whether to buy or sell. So the fact remains - glove stocks will have earnings visibility for the next 12 months, minimum. Vaccines cannot reach most of the population in the next 12 months. Remember, Pfizer's vaccine even if proven 90% effective, it is not distributed via the rain, where it pours over the globe to vaccinate everyone and eradicate Covid-19 overnight.

I do not deny the risk for the investment thesis of gloves have risen. But it also does not mean the investment thesis for recovery / laggard stocks automatically becomes viable. Many are loss making and will continue to suffer, the worst being tourism related and oil & gas. The Pfizer vaccine or others to follow reduces the default risk / bankruptcy risk of these companies. That is the important truth.

Coming back to my topic. Diversification is a form of risk management in investing. When one falls, another rises. Then it covers the losses and ensure your position is hedge against any form of potential "black swan event". This is why I am confident to buy and hold gloves stocks as well. I am not a thematic investor, I do not look short term. I invest to build a portfolio for a sustainable returns over a long duration in time. This means I invest whenever I see value, not when the news reports something.

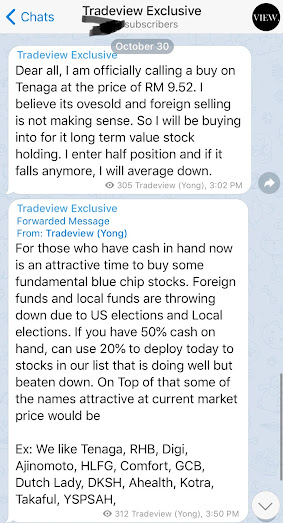

Do you all remember in my last week commentaries I shared publicly some of the stocks I have advocated to my private subscribers to buy on weakness before the US elections? In the list, there was only 1 glove stock amongst all. You can refer to the picture again above. All of it today, has rallied and cover the fall in gloves stocks. It negates the potential impact if I were to only hold a single sector stock.

This brings me to my key message. Avoid chasing stocks that has rallied, always buy on weakness and you will have the margin of safety to protect you. Avoid rushing to buy on dips, exercise patience, let it settle and buy when you feel the fear in your gut. Lastly, headlines creates gyrations. Market is never rational, that is why it moves up and down. Often the sways are very violent in one direction or another, but at the end of the day, it will normalise and find an equilibrium. This too is a fact.

_______________________________________________________________

Telegram channel : https://telegram.me/tradeview101

Website / Blog : https://www.tradeview.my/

Facebook : https://www.facebook.com/tradeview101/or

Email me to sign up as private exclusive subscriber : tradeview101@gmail.com

Food for thought:

More articles on Trading With A View

NST Business x Tradeview No.3 - Adam Yeap, Owner of 212 Hospitality and co-founder of Wonderbrew

Created by tradeview | Oct 18, 2021

NST Business x Tradeview No.2 - Muzahid Shah, CEO of SteerQuest Sdn. Bhd.

Created by tradeview | Sep 28, 2021

News Straits Times Business x Tradeview - Sharing Stories of Retail Investors & the Stock Market

Created by tradeview | Sep 15, 2021

Tradeview (2021) - Peterlabs Holdings Berhad Long Term Value Stock (Update)

Created by tradeview | Jun 01, 2021

Tradeview Commentaries - The Glove Surge, A Mirage or A Path To Oasis?

Created by tradeview | Apr 08, 2021

(Tradeview 2021) - Are Research Analysts' Reports Worth Their Salt?

Created by tradeview | Mar 17, 2021

.png)