Tradeview Commentaries (28th Jan 21) - Of GameStop, Gloves, Short Selling & Short Squeeze

tradeview

Publish date: Thu, 28 Jan 2021, 12:07 PM

Most by now would have heard about the parabolic rally of GameStop of 1600% since 12th Jan 21. Some are calling it a mania, some argue it's the sign of a bubble, some say it's due to the Fed's liquidity. The fact of the matter it was a case of short selling went awry due to organised retailers fighting back, over-selling by shortsellers who couldn't get enough stocks from the market to cover their position and prominent names lending weight during the height of the frenzy. It became a movement and sparked unprecedented wave of reactions in the investment community. Now, what has this got anything to do with us back home in Bursa?

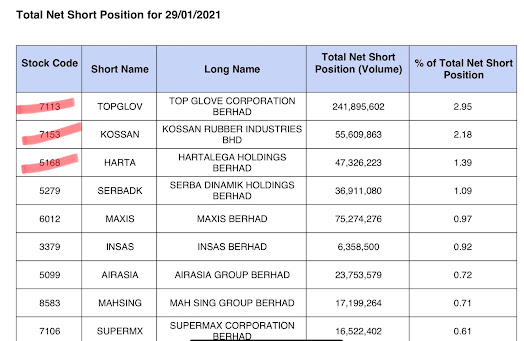

The top 3 most shorted stocks in Bursa since the lifting of RSS in 2021 would be Top Glove, Kossan, Hartalega. RSS known as Regulated Short Selling require approval from the exchange. Primarily, large funds / institutions are involved in RSS who take a view to short the stocks in return for profits. In order to execute RSS, they need to have in hand or access to large amount of quantity of stocks they plan to short. This was why, we saw EPF ceased to become substantial shareholder of Top Glove on 8th Jan 21 when it lend its shares for short selling (SBL). Recently, EPF recalled closed to 55 million shares and became substantial shareholder again.

When a Foreign IB research came out with an outlandish sell report in December 2020, I was perplexed by the entire premise and analysis of the report. I have never came across a report like that. What bewildered me wasn't the questionable analysis but WHY would a sell side initiate the first report on the glove sector as a strong sell with ludicrously low target price across the board. I spoke to analysts and those in the industry, where they too were surprised. As Bursa is generally a long market, sell side rarely initiate with a strong sell for new coverage. Come January 2021, it became clear what the true purpose of the report. It was to facilitate short selling of these 3 stocks in Bursa immediately upon lifting of RSS where funds can execute short selling through this Foreign IB. This Foreign IB would make huge fees from the execution of RSS for their clients.

After doing some channel checks, it turns out this Foreign IB in fact made a huge profit in 2020 facilitating foreign fund flows into our Glove sector during the rally in 2020. Now, this Foreign IB is simply doing the opposite. This was why, the Foreign IB research produced 4 reports during January month reiterating the sell call, when the glove sector sustained and at one point rallied back due increased in Dividend payout ratio by Top Glove, Share Buy Back by Kossan and Major shareholder buy back with own funds by Hartalega.

Of course, we have all witnessed Hartalega's record shattering results recently to know well enough that the glove sector is not only doing well, its strong earnings are sustainable even with the vaccines announcement since Nov 2020. Hartalega at USD 55 per carton could deliver record earnings, what more other glove makers who have much higher ASP.

The issue at hand is the earnings visibility, strong fundamentals and sustainability of ASP due to demand far exceeding supply due to a structural step up in demand, heightened hygiene awareness and large healthcare budget allocations by government all around the world. Based on these reasons, it is clear that the institutions and market participants took profit too soon expecting a speedy recovery of economy due to vaccine without considering the possibility of even a MCO 2.0. The short selling via RSS by funds further exacerbated the irrationality of valuation towards the glove sector.

I am a believer of fundamentals and think the glove stocks are undervalued by all metrics regardless of what is being misrepresented by some to mislead investors. These are wonderful Malaysian companies that have stood the test of times and are now world leaders. To invest or otherwise, that's a decision only you can make.

Telegram channel : https://telegram.me/tradeview101

Website / Blog : https://www.tradeview.my/

Facebook : https://www.facebook.com/tradeview101/or

Email me at : tradeview101@gmail.com

Food for thought:

More articles on Trading With A View

Created by tradeview | Oct 18, 2021

Created by tradeview | Sep 28, 2021

Created by tradeview | Sep 15, 2021

Created by tradeview | Jun 01, 2021

Created by tradeview | Apr 08, 2021

Created by tradeview | Mar 17, 2021