A Bold New Horizon for Handal Energy Bhd: Strategic Diversification Plan Revealed

Nathan92

Publish date: Fri, 30 Jun 2023, 01:39 AM

Handal Energy Bhd (HANDAL), the accomplished integrated oil and gas services provider, has unveiled an ambitious diversification plan on June 27th, 2023. This roadmap paves the way for HANDAL's expansion into telecommunications and marine sand extraction, setting the stage for a potential transformation of the company.

This diversification initiative begins with HANDAL's wholly owned subsidiary, Handal Digital Sdn Bhd (Handal Digital). Previously, on November 8th, 2022, Handal Digital had secured a Network Facilities Provider License (NFP License) from the Malaysian Communications and Multimedia Commission for a ten-year tenure. This pivotal license allows HANDAL to establish and operate telecommunication towers across Malaysia.

Despite the ongoing Digital Nasional Berhad (DNB) controversy causing uncertainty in 5G allocation, HANDAL's NFP License provides a silver lining. It empowers the company to create private 5G networks, which promise high-speed, low-latency connectivity. This will facilitate real-time data transfer and enhance communication via the incorporation of Internet of Things (IoT) solutions.

Continuing the diversification journey, HANDAL, through Handal Borneo Resources Sdn Bhd (Handal Borneo Resources) — a 49% owned entity, has inked a 15-year agreement with Tanjung Aru Eco Development Sdn Bhd. The latter, a wholly owned subsidiary of the Chief Minister of Sabah, will facilitate the extraction and sale of marine sand led by Handal Borneo Resources.

Given that these burgeoning business segments are projected to contribute to a quarter or more of the company's net profits, an Extraordinary General Meeting (EGM) is necessary to secure shareholder approval.

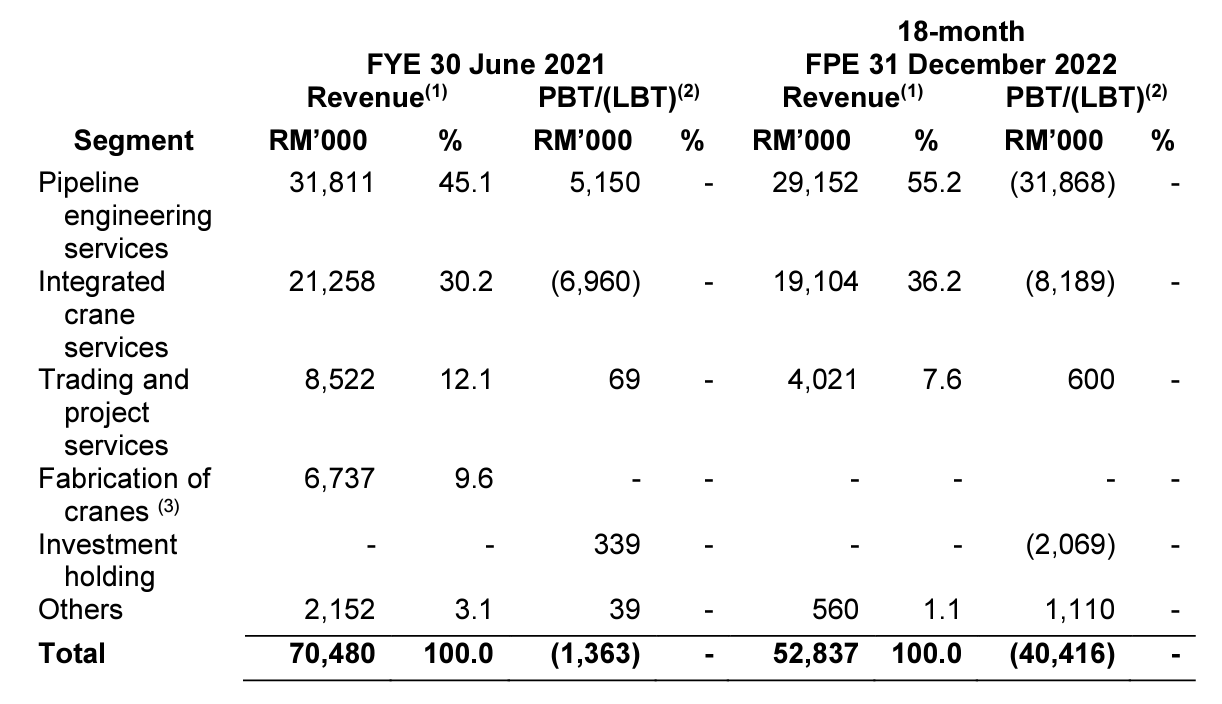

HANDAL's traditional integrated oil and gas business has been grappling with intensifying competition and escalating raw materials and supply costs, leading to 18 months of losses recorded in FPE 2022. This setback is reflected in the company's share price. Nevertheless, with these new ventures, there's potential for value generation, which could be a boon for investors.

Finally, the company's major shareholder – Seaoffshore Capital Sdn Bhd, has demonstrated a robust commitment to HANDAL's future. Their recent acquisition of additional shares from the open market underlines their confidence in the company's diversification plan and expected performance.

Perhaps, we may see more investors’ interest towards the company soon?

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on trendblog

Created by Nathan92 | Jan 18, 2023