Undervalue Growth Stock Radar

CARIMIN - (The Black Horse)

Xeno

Publish date: Tue, 04 Dec 2018, 09:04 PM

Lazy to write much. Let the QR speak for itself.

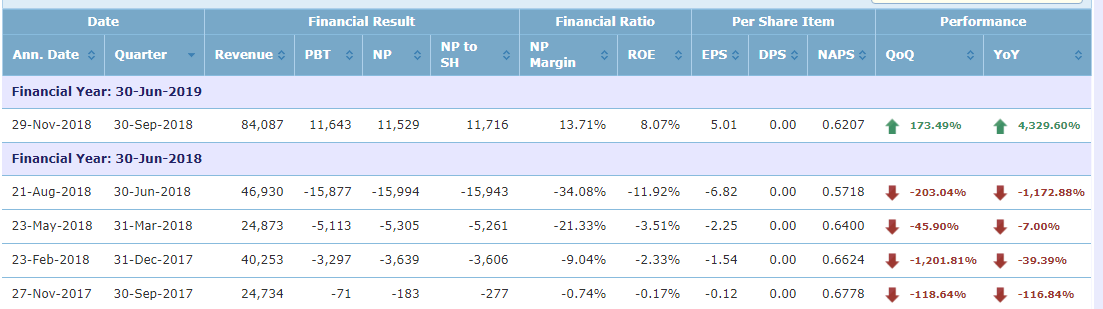

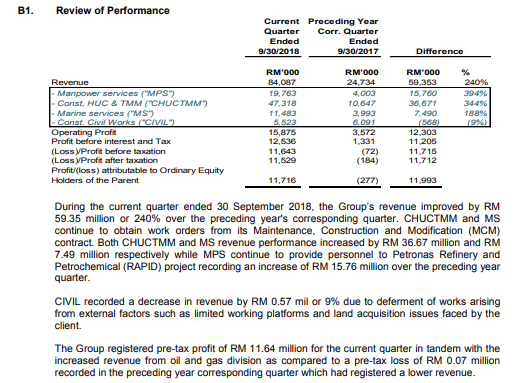

Renevue for all segment has improved 300% compared to last year.

CARIMIN is currently trading at Rm 0.305:

1) Forward P/E = 1.5

2) Net Asset per share = RM 0.6207 (50% discount to market price)

3) Low Current ratio = 0.5 (DAYANG current ratio is 2.6!! which means dayang is on huge debt with low current asset)

4) Technical Chart = UPTREND

HOW MUCH DO YOU THINK CARIMIN CAN GO?

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

Discussions

Be the first to like this. Showing 0 of 0 comments