KIA LIM (6211): Significantly Undervalued given the Improvement in Earnings for the past 2 Quarters

valueinvestorklse

Publish date: Wed, 06 Mar 2024, 02:51 PM

Many of us might have overlooked this company given its low number of shares outstanding (about 61Mn) and also, it's a stock that is not commonly heard; at least among the traders/investors in KLSE.

Couple weeks ago, RHB started to cover this stock and it seems that the company's fundamental has been improving together with its earnings (this was evident in the last two quarters). In fact, the company has outperformed the forecast for FY23 based on report by RHB (we shall discuss more on this later).

RHB Full report can be downloaded here.

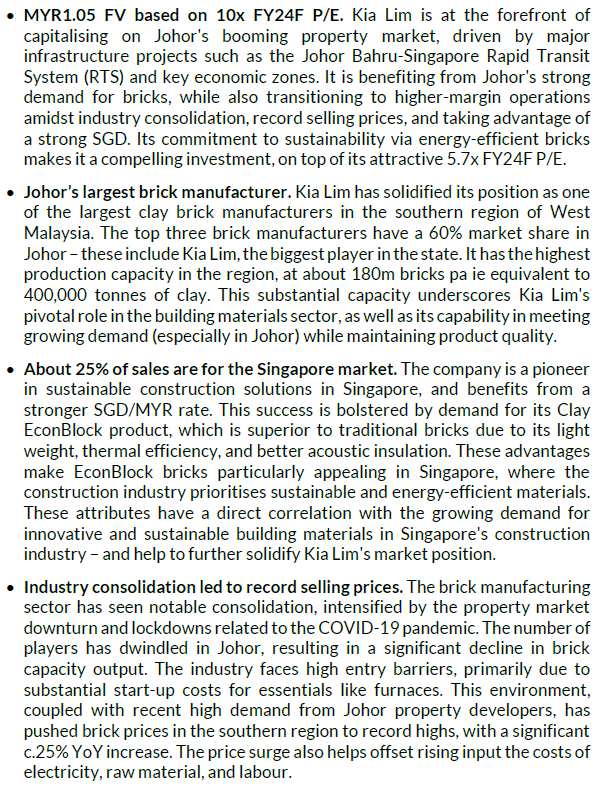

Some of the key points based on the report by RHB.

The company reported their Q4 earnings last week and it was very impressive. Also, it is visible from below that the company has started to perform well from Q3 2023 onwards.

Now comes the very important question. What's the target price for this company?

From RHB's report, they have assigned fair value of RM1.05 (the current stock price is RM0.70). Even though one has to be aware that the company has outperformed the FY23 forecast estimated by RHB in the report hence the fair value now would be much higher than RM1.05.

However, keeping things conservatively and not to be very optimistic in using PE valuation, we can derive the following value.

EPS Q3 + EPS Q4 = 3.91 + 5.37 = 9.28 cents

assuming annualized return remains the same as the past two quarters which then will be 9.28 cents x 2 = 18.56 (to obtain four quarters).

Now, assigning a PE of 5 (which is very low but let's be conservative and say that the company continues to maintain its current earnings for the next 5 years), then fair valuation will be 18.56 cents x 5 = 92.8 cents. That's 32.5% above the current market price of 70 cents.

Disclaimer: This is not a buy/sell recommendation as only accredited investments professionals/institutions shall provide such recommendations based on the Securities Commission law. However, the above is just for kind sharing of our thoughts on Kia Lim.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|