Stocks vs Forex

vcplus

Publish date: Thu, 19 Jan 2023, 09:09 AM

The two main markets where most people trade are the foreign exchange market and the stock market. The preference of traders to trade in either the foreign exchange or stock markets is usually determined by their risk tolerance, capital size, and trading timing.

- Trading hours

- Minimal or No commission

- Leverage

- Going short

- Market Influence

- The verdict

Trading hours

The forex market is available 24 hours a day, from Sunday at 5:00 pm EST until Friday at 5:00 pm EST. One of the reasons for the forex market to be tradable for 24 hours is because of the different international time zones.

Stock exchanges are only open during their respective exchanges' opening hours, which are usually from 9:00 a.m. to 5:00 p.m., depending on the country's time zone.

As a result, for those who work full-time, the availability of flexible trading hours of Forex is far more convenient. The forex market's 24-hour trading hours enable traders with full-time jobs to find trading opportunities outside of working hours. It’s one of the best ways to make money while maintaining a full-time job!

Start trading forex with VC Plus! (Free account)

Minimal or No commission

The majority of online forex brokers do not charge extra transaction fees or commissions for any transaction.

However, for each online and offline transaction, most stockbrokers charge a commission or commissions ranging from 0.05% to 0.6%.

Again, this is why many people are drawn to the foreign exchange market.

Liquidity and Volatility

The efficiency or ease with which an asset or security can be converted into cash without affecting its market price is referred to as liquidity. The degree to which an asset's price fluctuates around its average price is referred to as volatility.

Forex is the clear winner When it comes to market liquidity and volatility. It is the world's largest trading market, with $6.6 trillion traded every day on average. The largest stock market, on the other hand (New York Stock Exchange, NYSE), has a daily trading volume of about $45 million. This means that in the forex market, you can enter and exit trades more easily than in the stock market. This enables traders to profit in a shorter period.

Leverage

One of the reasons people enjoy trading in the forex market is the use of leverage. This is because the standard lot size in the forex market is 100,000 units, and leverage is widely used. Leverage allows you to purchase standard lots with a small amount of money.

Forex brokers typically provide a relatively high leverage ratio (approximately 1:100 to 1:500) on your money, allowing you to maximize your profits.

The leverage available in the stock market, on the other hand, is much lower. Traders can typically obtain a capital leverage ratio of one to three.

While leverage can increase your profits, it can also increase your losses. As a result, you must fully understand your risks when using leverage to trade in the forex market. Live backtesting can help you to determine the winning rate, average exit duration for all possible exit strategies, risk reward ratio, etc of each trade to further strengthen your trading plan and increase your chances of winning.

Try automated backtest analysis on VC Plus now!

Going short

Going short in the forex market is more common compared to the stock market.

In the foreign exchange market, there are usually no restrictions on shorting. There is no directional bias in the market because forex trading always involves buying one currency and selling another. Traders will have the ability to trade in both rising and falling markets. As a result, shorting is just as common as longing.

When it comes to the stock market, and when you want to short-sell, there are usually rules and regulations that must be obeyed by traders. Because of the fundamental nature of stocks, traders prefer to be long in the stock market. In general, businesses are expected to perform well and make money in the long run. As a result, shorting in the stock market is uncommon.

Market Influence

Another important factor to be considered when trading is the factors that affect market prices. Generally speaking, foreign exchange and stock markets are mainly affected by market supply and demand, but there are more potential factors that affect price movements.

In Forex, your focus is on a wider context than solely on the chart. You need to consider a country's macroeconomics, such as gross domestic product (GDP), inflation, unemployment, and political news and events. You can always read daily market news on websites such as MTDesk for free.

In the stock market, along with macroeconomic factors, you also need to look at microeconomic factors, including the performance and financial condition of individual companies.

The verdict

In short, the decision to invest in the foreign exchange or stock markets is heavily influenced by the trader's trading style and risk tolerance. Market hours, leverage, and volatility are all important considerations.

As a general rule, active traders who are looking for opportunities may prefer the fast-paced forex market, whereas investors looking to buy and hold may prefer the stock market.

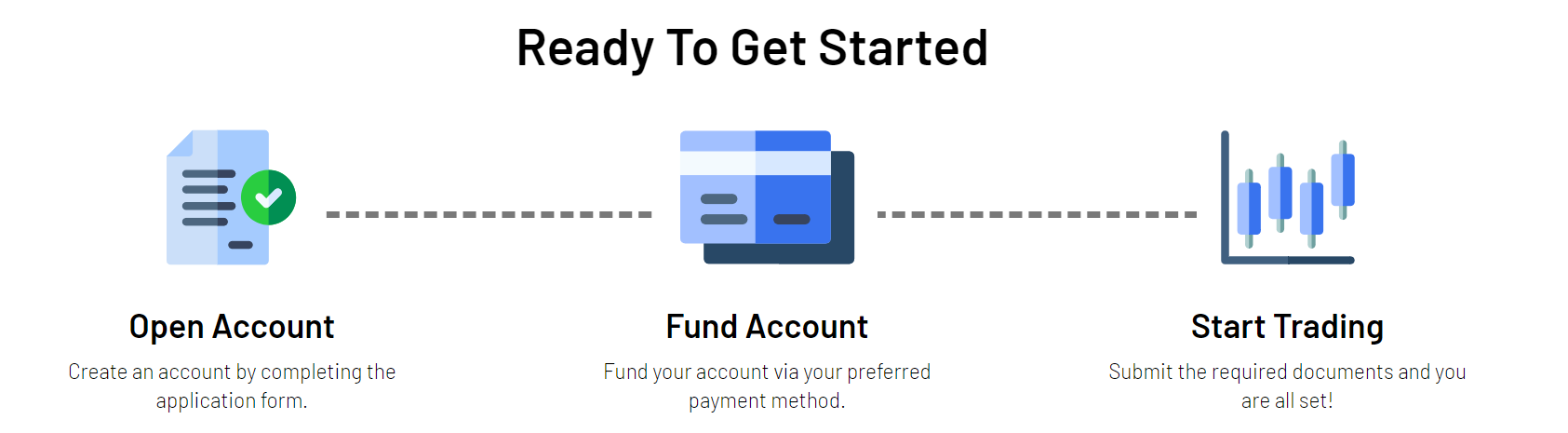

Trade forex in 3 steps with VC Plus now! (Free)

VC Plus is a trustworthy one-stop web-based platform, a member of FINTRAC

More articles on VC Education Series

Created by vcplus | Nov 23, 2023