[ V.S. Industry ] 高净现金股王之一 : 有没有捞底机会??? - J4 Investment Capital

J4InvestmentCapital

Publish date: Sun, 15 Jul 2018, 09:39 AM

[ V.S. Industry ] 高现金股王之一 : 有没有捞底机会???

V.S Industry 是一家制造半导体的公司, 其中也包括了电板设计, 包装设计, 硬体测试 ( Testing ).这家公司拥有一条龙服务可以说是在大马的科技公司中拥有较多的优势, 规模也比较庞大.

在 2018年Q4 的业绩中却隐藏了一些不稳定因素, 让投资者大量抛售, 从一月份的RM 3. 27 最高点, 到如今的 RM 1. 67 , ( 未包括Bonus Issue ) , 跌了将近50 % .

在这不理想的业绩中也提到关于:

- 美国客户产品需求量达到了计划中的数量而终止订单

- 印尼也因为设立的厂暂时无法取得更高的使用率, 而蒙受亏损

- 设置和测试马来西亚新生产线的成本

- 中国订单减少, 原料价格增长,劳工成本

今年年头马币上涨, 美金转弱更让大家不看好多数的科技公司, 政府也在竞选宣言当中提到了将提高最低薪金, 材料价格问题和全球半导体需求量会降低的种种担忧, 因此被视为短期不被看好的一只股. 那现在的价格会不会太便宜了呢?

基本面 :

P/E : 19

ROE : 11.98

DY : 3.46

NTA : 0.78

E/Y : 6.49%

Debt to Equity : 0.40

EV/ EBIT : 15.42

Price to Book : 1.93

Dividend Policy : 40 %

4 Quarters Total Cash Flow : RM 411 mil

基本面上并没有出现任何问题, 自从大选后美金开始上升, 马币贬值, 到现在的 1 USD = 4.05 MYR , 其中近期半导体出口量也有继续上升, 全球需求量持续增加, 让这几股开始有了一些小动作, 从底部反弹了近40% . 个人相信美金在未来季度会持续上扬, 马币也不受看好, 社交也流传今年 Apple 公司将推出 3 种新产品, 相信能推动整个市场. 至于贸易战, 中国中兴近期也已经和美国谈判成功, 获准继续在美国营业, 降低了大马制造半导体公司的压力. 拥有超过 RM 300 mil 的公司也能在未来继续发放更多的股息, 美国和中国的订单也会恢复正常, 印尼厂只要能在近期内提过运作率, 可以给未来的业绩增加不少营业额.

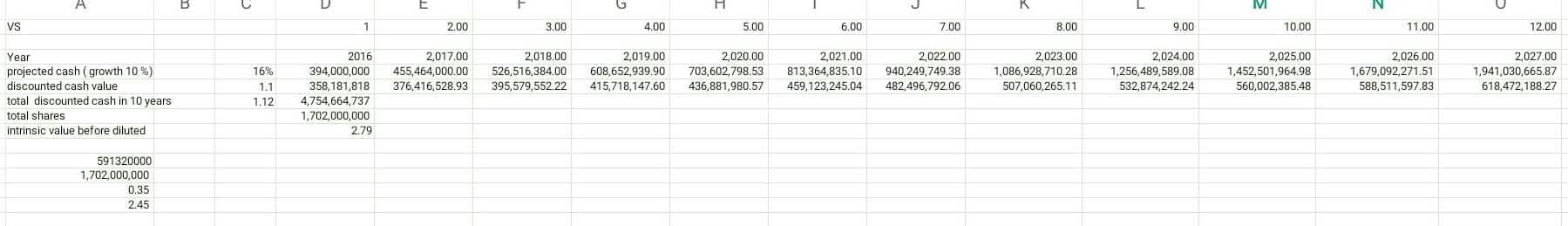

Intrinsic value by using cash valuation method : 2.31 ( all debt factored in)

At the recent trading day (Friday 13/7/18 ) , V.S.(6963) is trading at Rm1.67 closing price which is 27.7 % lower than the intrinsic value .

Current cash projection is based on the estimated growth rate of 16 % , the value will be remaining intact if Vs industry revenue is in line with expectation .

From the perspective of it’s intrinsic value , there is a potential profit of about 30 % .

从技术面也出现了正面的讯号, 可以作为补助作用 :

1) Reversal Signal

The circle highlighted region is showing at the price where it is over undervalue due to bad market sentiment ,however the candlestick chart pattern indicates that there is a trend reversal . ( island reversal day ) The reversal trend is still on its halfway point towards 1.9 which is the major resistance with a backtest towards its support on 1.67 . However , we have make an assumption that VS industry best short term entry point will be at 1.63 , which is indicated on its hourly and 15 minutes chart.

2) GPMMA

It consists of 12 moving average (long term and short term ) , red indicates the long term investor whilst blue indicate the short term investor . This indicator shows that long term investor is bearish on this counter due to fundamental reason . However , middle term will be a moderate bullish .

The downtrend line

The price just breached the 6 months downtrend line to revert into a middle term uptrend .

4) Divergence

MACD : Divergence Accumulation/ Distribution : Divergence

On Balance Volume : Divergence

5) PEG Ratio

Estimated Growth : 16 percent

Current PE : 19

PEG ratio : 19/16>1 ( slightly overvalue)

Fair price Estimated growth x Current Rolling EPS ( Safest Buying Price )

= 16 x 8.8

= 1.41

TP: 1.95 / 2.3

Buying Region : 1.6-1.63

Best Buy : less than 1.4

Conclusion : Not the best timing to buy , but only a good timing .

Disclaimer : Information above is for sharing and education purposes , not a buy and sell advice , please refer to ur advisory for any buy or sell call , buy and sell at your own risk .

Feel free to visit our FB Page and share it out so that we share more things !!!

https://www.facebook.com/J4-Investment-Capital-398139627315097/

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on J4 Investment Capital 3

Created by J4InvestmentCapital | Jul 17, 2018

Discussions

Author's ratio analysis made sense to me...

Just to add a bit, sensitivity of Vsi p.e. likely to be x 15 from its high from > 25 previously.

The key is to wait for Vsi 4Q18.

If 4Q result stabilise and manage to see improving from the short term threat ...

Then, one should appy a x 18 peg for Vsi.

If 4Q18 get worsen, i would happily to wait at $1.20

Thats the golden time ever to pick Vsi.

Good job, for Author dare to see the difference during everyone look down on Vsi.

Opportunity always there, only matter is what is the plan for entry.

2018-07-15 12:29

Ah ! 1 more thread author forgot to mentioned,

Which i think is giod to pay attention to is the mikro components suppy tension (due to globally overwhelm demands) that lead to Vsi's recently weak qtr results. Sector analysis expected the matter to be resolved by 2H2018... let see.

2018-07-15 12:44

peterchu

really cash free? debt around 600million

2018-07-15 10:14