Brands Asian Loves!

weighted

Publish date: Fri, 21 Aug 2020, 04:32 PM

Summary

-

Dairy Farm operate brands like 7-Eleven, Ikea and Guardian.

-

Operations are diversified throughout Asia.

-

Selling below replacement cost.

If there is a criteria for the everyday investor, the investment has to be a name that they are familiar with; a brandname which they frequent and is comfortable to buy and hold for the long term.

In term of investing, it is always the sitting that makes most of the money. If you have a investment that went up 10x or 100x, then your investment journey would be highly rewarding.

“After spending many years in Wall Street and after making and losing millions of dollars I want to tell you this: it never was my thinking that made the big money for me. It was always my sitting. Got that? My sitting tight! - Reminiscences of a Stock Operator by Edwin LeFevre

If the investor is comfortable drinking Starbucks, shopping for furniture in Ikea, buying convenience food from 7-Eleven, then the buying become easier and the holding as well. Since this is the time of pandemic, how about throwing in a grocery retail operations in China, Hong Kong, Indonesia, Malaysia, Philippines and Singapore into the business mix.

Questions:

-

Do you think this is a good set of businesses to purchase and own?

-

How much would you pay to own the rights to operate brands like Starbucks, Ikea, 7-Eleven in the most dynamic regions in Asia?

So lets have a preview of all the brands this company owns and the regions they are operating in.

2019 Annual Report

Caveats:

-

First, such good and diversified operation usually do not come cheap!

-

Second, if the company appears cheap, then there must be more caveat to this investment.

The company that we had been rattling about is Dairy Farm International (DFI). In term of share price, the company is back to where it was 10 years ago. The fall in share price did not happen due to the pandemic, but it has been happening since 2013.

Do DFI deserve to be derated from USD13 to USD4.27 since 2013?

We certainly do think so.

-

In Financial Year 2013, revenue is 10,357m, borrowing is at 146.4m with an underlying net profit of 446.9m.

-

In Financial Year 2019, revenue is 11,192m, borrowing had ballooned to 1,122m and net profit had decreased to 320.9m1.

On the surface, the operation of the business had clearly worsen over the years which had created a de-rating by the investing community. DFI used to trade at more than 25x Price-Earning Ratio (PE) as DFI is seen as a "safe" stock to own as every consumer "needs" the products they carry.

The caveat to this investment comes in two segments

-

Prior to the Pandemic

-

During the Pandemic

Prior to the Pandemic:

A few things happen from 2014 - 2017 before the current management took over. There is 1. a clear deterioration in the balance sheet, 2. A worsening grocery operation in South-east Asia. 3. A worsening retail sentiment in Hong Kong.

Ballooning Loans:

As revenue growth dissipated and borrowing ballooned, the PE de-rating happened.

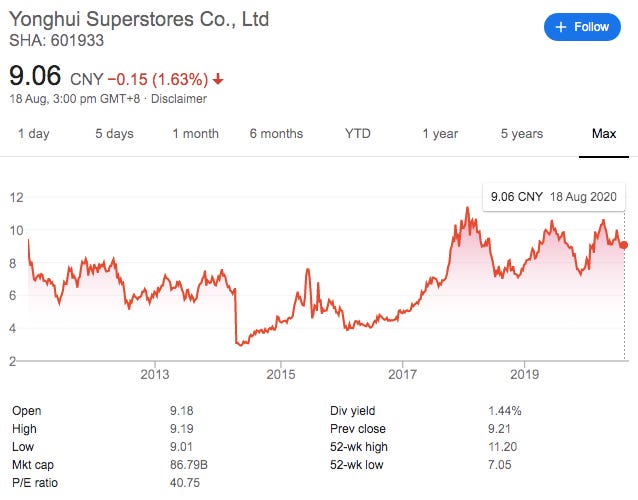

The piling of the loans happened in 2014 when DFI acquired a 19.9% stake in Yonghui for USD 925m and then in 2016 paid another USD 190m for new shares to maintain its shareholding percentage.

The Yonghui stake still takes up bulk of the 1,365.8m loans in 2020 2Q. The investment in Yonghui has been profitable. DFI 19.9% stake in Yonghui is currently worth 2,400m. As Yonghui continue to power higher, the de-rating continues for DFI.

The shrinking "Giant" in South-east Asia:

In 2014 - 2017, DFI is facing huge headwind in their grocery brand - Giant in Indonesia, Malaysia and Singapore.

Anyone who had shopped in Giant in Malaysia or Singapore would have known that the retail chain had been under neglect for many years. Their original format of hyper-mart has been declining in popularity. Due to under-investment, their supply chain had been unable to provide good and affordable fresh produce required by their customers who wanted more fresh produce.

Since 2018, management had proceeded to revamp Giant by closing down a lot of stores. In just over a year, Giant had proceeded to lose it crown of being the largest supermarket and hypermarket operator in Malaysia by reducing their store count from 128 stores in Feb 2019 to 62 early 2020.

Filing with the Companies of Malaysia shows that Giant posted a net loss of 235m on revenue of 4.61b in 2017 and had incurred a total loss of 243m from 2014 - 2017. Things should have gotten a lot worse in 2018 and 2019. By getting smaller and revitalising the stores, DFI is clearly looking at the bottomline instead of revenue growth. While they are concluding this corporate exercise, the pandemic hit.

Umbrella movement in Hong Kong:

The problem facing the health and beauty businesses in Hong Kong is well known. Brands such as Bonjour, Sasa and Mannings which had been reliant on the tourism dollar from China had been affected since the umbrella movement in 2014.

The 2019-2020 Hong Kong protest further brought about a further reduction in tourists and a further need to reduce capacity in health and beauty retail. In addition, DFI 50% owned associate Maxim's food outlet had been targeted during the protest which could have weaken its revenue prior to the pandemic.

During the Pandemic:

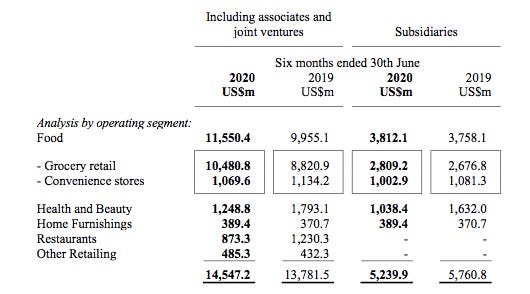

Except for grocery retail and furnishing, everything suffered. So lets dwell into the details.

The "Lipstick index" :

In the past, whenever there is a recession the "lipstick index" kicks in. The "lipstick index" which is coined by Leonard Lauder, chairman emeritus of the international cosmetics company Estée Lauder just after the Sept. 11 attacks said that in times of economic uncertainty, affordable luxuries like a striking lipstick shade help prop up select retailers. With mask covering most of our face, there may be a drop in lipstick sales? Or would that extra dollar shift to mascara and nail polish index instead?

The biggest worry for health and beauty retail sales is not the temporary shift between beauty products but the possible permanent shift toward e-commerce. For the first time, DFI brands of Guardian, Mannings and Rose will need to contend for attention with other resellers and other brands on multiple platforms. Unlike a retail front which require a large upfront cost and comes with limited supply (good frontage), the online space is free for all to compete on.

Health and beauty used to be a consistent revenue generator for DFI. After the pandemic, we may see a permanent resetting of that business. If their brands continue to provide good range of exclusive brands and low prices, coupled with e-commerce options, we could see that they can hold on to their market share but at vastly reduced margins.

With health and beauty contributing around 25 - 30% of the revenue of DFI, this could be a possible major hit.

Convenience at the doorstep:

Prior to the pandemic, convenience store is one of the fastest growing format in South-east Asia. But with the pandemic and the drop in footfall, convenience store sales had also decreased.

Unlike health and beauty, we think that this reduction is temporary and as the restriction on lockdown eases throughout Asia, we would expect an gradual increase in footfall and revenue.

Beauty of the business:

While there is many headwinds for DFI, we cannot ignore that there is much to love about the operations. It is a diversified operation across different brands and different territories. Each brand and territory offer a different growth profile allowing the management to allocate resources differently across brands and regions.

Iconic Brands:

Brands under DFI

We are very sure that anyone living in Asia will recognise some of the brands. The operating rights of some brands such as 7-Eleven and Ikea will not come by again and will cost lots to acquire.

Extensive distribution:

While the retail brands may have lesser moat around their businesses and categories, their scale and distribution capability will be hard to replicate. Asia is unlike United States or China. There is different jurisdiction to deal with and scaling across Asia is generally tough as the language and culture of doing business differs.

Valuable Associates:

While owning Yonghui comes with a 1,115m price tag, the 19.9% stake in Yonghui is currently worth a lot more at 2,400m. In addition, DFI's 20% stake in Robinsons in the Philippines is also worth around 399m. The sale of either stake would help to reduce their debt substantially. There is very little reason to do so as Yonghui and Robinsons are continuing to grow strongly.

DFI 50% associate which operates over in China, Hong Kong, Macau, Malaysia, Singapore, Thailand and Vietnam is a monster restaurant operation. To understand how dominant they are...

According to the HKSAR Census and Statistics Department, total HK restaurant receipts in 2018 (including restaurants, fast food shops and bars) were HK$119.6bn ... based on the group web site we assume about 80% of turnover, or $16.2bn, is still in HK. That would give Maxim's a 13.5% market share of HK restaurant receipts. That would mean HK's citizens spend about HK$44m per day in Maxim's, or about $6 per citizen per day. - Webb-Site

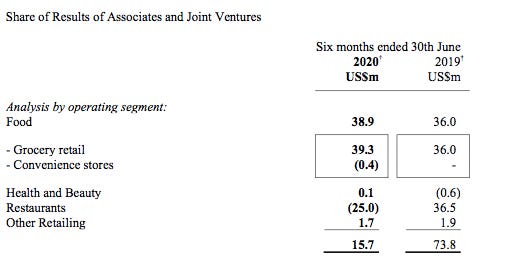

With the pandemic, we could be sure that they are badly hit. In the recent release 2020 2Q results, restaurant operation lost 25m. While we expect the worst month for the pandemic to be over in Hong Kong, the restaurant business in Hong Kong will not be expected to recover to previous level anytime soon.

Maxim's owns and operate Chinese, Asian and Western restaurants, quick service restaurants, bakery shops, coffee shops, Japanese chain restaurants and institutional catering, while providing a range of festive products, including the award-winning HONG KONG MX Mooncakes.

Maxim's is also the licensee of renowned brands including Starbucks Coffee, Genki Sushi and IPPUDO Ramen, The Cheesecake Factory and Shake Shack in various territories. Altogether, it has over 1,700 outlets in Hong Kong and Macau regions, Mainland China, Vietnam, Cambodia, Thailand, Singapore and Malaysia.

Financial Strength:

While debt of 1365.8m may seems excessive and net financing charge of around 150-200m, the debt is affordable by DFI standard since their normalised operating profit should come in at 300-400m in 2020.

In terms of balance sheet, the implicit backing of Jardine Matheson and their stakes in Yonghui, Robinsons and Maxims should help assure the bankers to continue providing them the loans (with no covenants).

Management:

Ian Mcloed who is brought in as CEO in 2017 had known of the problems in the grocery business in South-East Asia and had acted swiftly on it by closing some , refurbishing the others. His track record is a tad patchy due to some career misstep but he had been on track so far since his appointment.

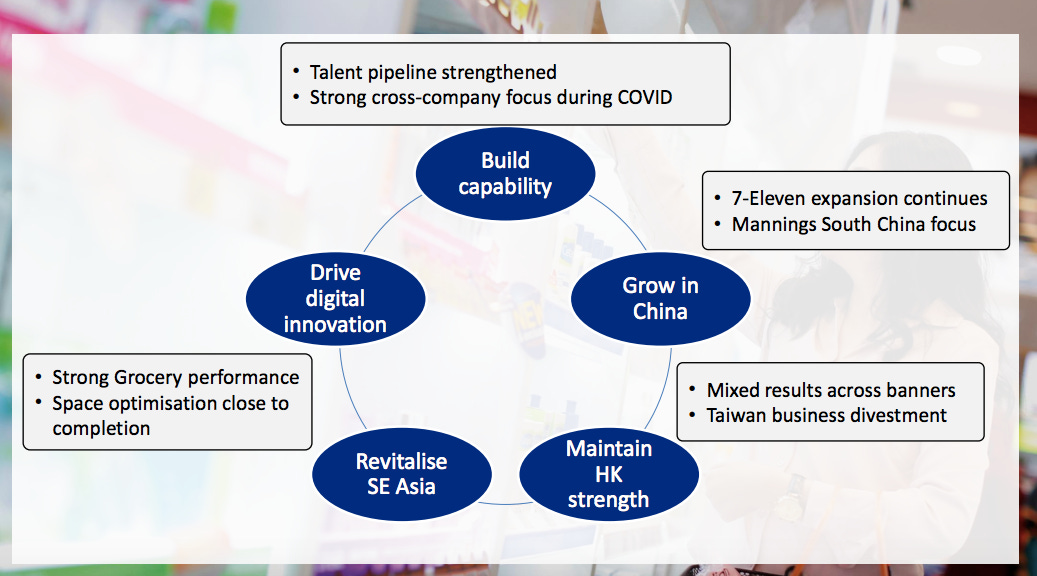

The most important thing in transformation is speed in execution. Ian said the strategic transformation will take 5 years starting from 2018. Let's see how much he had achieved.

Other than digital innovation which could be tricky and hard to execute. It seems that they had been quick in other areas. 7 out of the 10 person in the leadership team in DFI came after Ian.

7-Eleven will continue to grow and the convenience store format should continue to thrive as China urbanise. As for Mannings in South China, lets just treat that as a wild card. It is hard to estimate how things will work out for Mannings China expansion.

Mannings price investment programme which basically meant everyday low prices will help them to draw back customers and effectively fight against the e-commerce player. The leverage on economies of scale should have to maintain market share, thou the CEO had indicated that tourism will remain key as there is overcapacity in the market.

The South-east Asia revitalisation is almost complete with almost 100 Giant stores revamp.

We would say that he had passed on the speed criteria.

Operational Capability:

The beauty of operating multiple brands over a territory is that you would be able to do capital allocation across the brands. How about swapping a Ikea store for a supermarket store in 5 months? This type of retail capital allocation can only be done when you have the capital to divert your existing resource to a higher yielding assets.

The Sentul store below is a good indication on how well DFI can execute on a local level.

In-house brands:

If you have shopped at Costco before, you would have bought Kirkland products. Kirkland is Costco in house brand and they are known for offering high quality value across various different products.

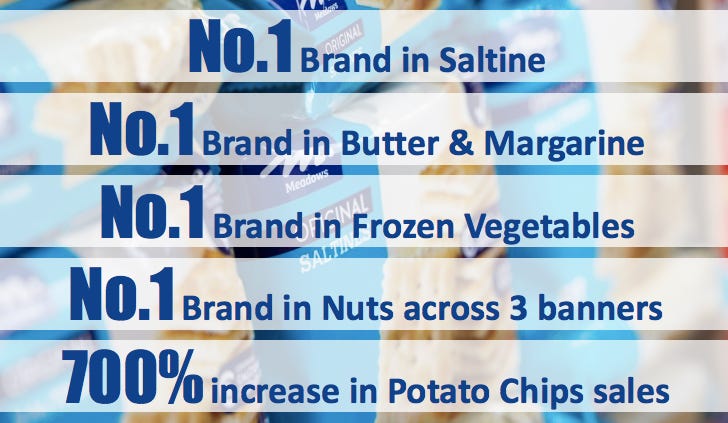

Taking a leaf out of that playbook, DFI is creating Meadows which will be distributed across their grocery operations in Asia. They have started with the easier products like nuts and potato chips.

And in a short period of time, they had come to "dominate" some of the item categories.

We have issues with the first line item on the slide. No.1 brand in Saltine? We are very sure that there is no category known as Saltine or that Meadow is the only brand that carried Saltine in their Giant retail operation in Singapore. While we have issues with the slides below, we have to agree that in our consumer research tasting, Meadow's Saltine is really tasty at an affordable price.

Anyway, housebrand executed properly could bring about a strong customer loyalty and moat allowing the retail operation to thrive and do well. Just look at Kirkland....

Investment Valuation:

Sometimes, the brands and operation is so valuable that it makes no sense to discuss if the investment is valued at 5x, 10x or 15x earnings. If we can get the assets at replacement cost, we are getting a bargain. DFI is currently selling slightly below replacement cost.

Let’s project 1-2 years out when the pandemic is of distant memory, what would such a branded retail operation be worth?

DFI is currently valued at 5,700m. Their stake in Yonghui and Robinson is already worth 2,800m on current market value. Let's be conservative and value that at 2,000m for easy calculation.

Maxim's operation is one helluva operation. Just imagining building up an operation that takes in 1 out of the 7 dollar of restaurant taking in Hong Kong and in addition owns the right to operate Starbucks Coffee, Genki Sushi and IPPUDO Ramen, The Cheesecake Factory and Shake Shack in various territories. There are some other similar players like Minor International - BKK: MINT, and the recently delisted Breadtalk in Singapore but none of them hold the capability like Maxim's. With a normalised earning of 80 - 100m in earnings, we would value DFI's stake in Maxim's at a 800m2.

The core business of convenience retail in Hong Kong and Singapore had been doing well. Giant operation in Malaysia is being turned around by cutting the number of stalls and doubling down on the stores that work. Grocery sales could top around 5,000m. Assuming that margin revert back to 4% and go no higher, the grocery business would have gross 200m in net profit which should bring about a valuation of around 2,000m2.

7-Eleven convenience stores operation gross around 80m in net profit in normal times bring valuation to around 800m2. For comparison, 7-Eleven Malaysia Holdings trade at > 20x earnings.

Ikea should gross around 50m in earnings for the year bring about a valuation of around 500m2 in valuation.

The Health and Beauty business should gross around 100m in net profit this year a drastic drop from 296m from the year before bringing a valuation of 1000m2.

Investment Thesis:

The beauty of a diversified business is that one will definitely get hit when something as dramatic as the pandemic happens. On the other hand, there will be bound to be some cushion as the businesses are widely diversified.

At 5,700m the business is definitely worth more when broken up than kept together. But with Jardine Matheson as the ultimate shareholder, a breakup is simply unimaginable.

Well run consumer retail companies with a good branding continues to dominate spending in the ever affluent Asia. To grab a cup of Starbucks coffee, an occasional Shake Shack burger, grabbing a overpriced can drink at 7-Eleven, a constant remodeling of our houses has become the norm. And of course we need to grab some fresh produce at our neighbourhood supermarkets and the latest facial product to look healthy and good. DFI permeated every part of our modern life and should continue to do so in the future.

And finally, they should pay a dividend yield higher than 0.3%.

Average Purchase Price: USD 4.23

Holding Period: Till it revisit it historic high again.

Disclosure: At the time of publishing Wee Hiang has a position in the above company. Holdings are subject to change at any time. This report, and disclosure, should not be considered to be a recommendation.

Reference:

1 There has been changes in accounting rules in 2019 which had made comparison between 2013 and 2019 somewhat misleading. But the profitability of the business had worsen over the years.

2 For simplicity and conservative sake, we will value most of the business at 10x earnings.

More articles on https://weightedresearch.substack.com/

Created by weighted | Aug 31, 2020

weighted

Anyone been to Giant Malaysia recently? Has the retail experience improved?

2020-08-21 16:55