PWRWELL (0217) - Construction Resumes With Safety Measures

xiaoqing88

Publish date: Thu, 23 Apr 2020, 07:43 AM

RSI & MACD showing uptrend.

All Pwrwell needs now is one big volume and break the resistance of 0.27.

If the resistance broke, it will fly to 0.29 and 0.33.

If you buy at the support 0.235, the upside & risk rewards is very good.

If you're goreng construction theme, and forgot this GEM..You will be missed this golden opportunity.

Lets recap what is Pwrwell actually doing.

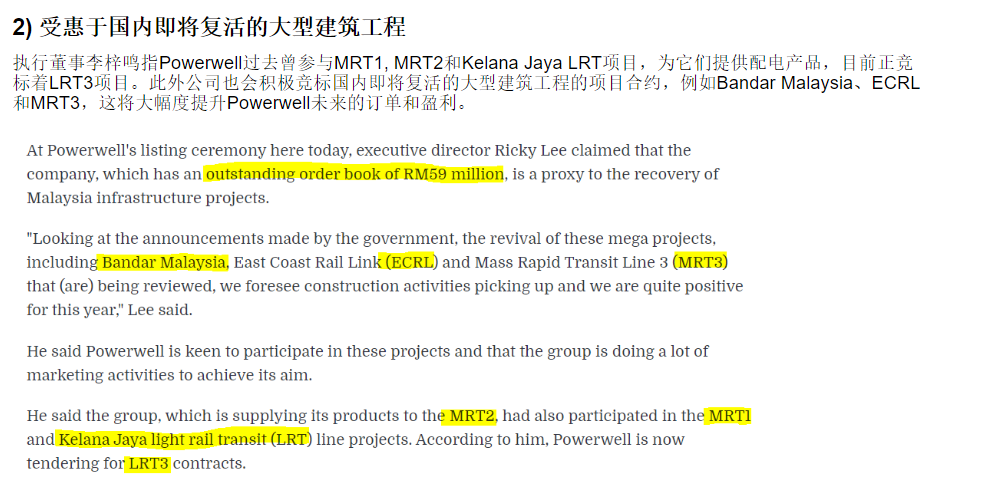

Improving demand for electricity distribution products boosted by increasing construction activities in FY2020 bodes well for Powerwell Holdings Bhd (“PWRWELL”). PWRWELL is making its debut on the ACE Market today and we recommend a BUY with a target price of RM0.33 based on 14.4x PER FY20 as per the Bursa Malaysia Industrial Production Index.

PWRWELL is primarily involved in the design, manufacturing and trading of electricity distribution products, comprising of low voltage (“LV”) switchboards, medium voltage (“MV”) switchgears and related products. With over 25 years of experience, PWRWELL is wellrecognised supplying to main contractors, mechanical and electrical players, EPCC companies for various developments. Bulk of the revenue (~58% in FY18) is derived from Malaysia along with strong presence in regional markets such as Vietnam, Bangladesh and Indonesia. PWRWELL is the authorised partner with Siemens and Schneider in manufacturing and selling switchboard and switchgear products.

47% or RM10.3m of the IPO proceeds will be utilised for capital expenditure to purchase and upgrade machinery and equipment in addition to enhance enterprise resource planning system and hardware. PWRWELL also intends to develop its own “Powerwell” branded MV switchgear where the initial preparation has started in May 2018. To increase competency, RM3.9m is allocated for certification expenditure to obtain International Electrotechnical Commission standards-compliant certifications on additional products including the “Powerwell” branded MV switchgear.

Meanwhile, RM3.6m will be used for working capital while the remaining is for listing expenses. Management plans to expand their business into refurbishment projects as they see opportunities arise from the segment in present Malaysia Market.

As at 30 Sept 2019, the group has an orderbook of RM52.8m to be recognised in 24 months. Balance sheet is healthy with net cash of RM13.8m. Moving forward, we expect PWRWELL’s earnings to be supported by gradual enhancement of local construction activities which will in turn increase the demand for electricity distribution products.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Xiaoqing88 Blog

Created by xiaoqing88 | Aug 12, 2020

Created by xiaoqing88 | Jan 10, 2020

Discussions

No need power supply parts during the crisis. Even after the MCO, the pace of orders will be slow!

Better switch to this stock below. More contracts more a spike rally in the share price!

https://klse.i3investor.com/m/blog/fatprofitstock/2020-04-25-story-h1506132918-FORGET_GLOVE_RELATED_PLAY_THIS_STOCK_CAN_RALLY_A_SPIKE_EVEN_MORE.jsp

2020-04-25 07:00

alphajack

By the time it even run to 28c Howah Genting ready over 30c. Slow.

2020-04-23 19:52