Corporate Updates

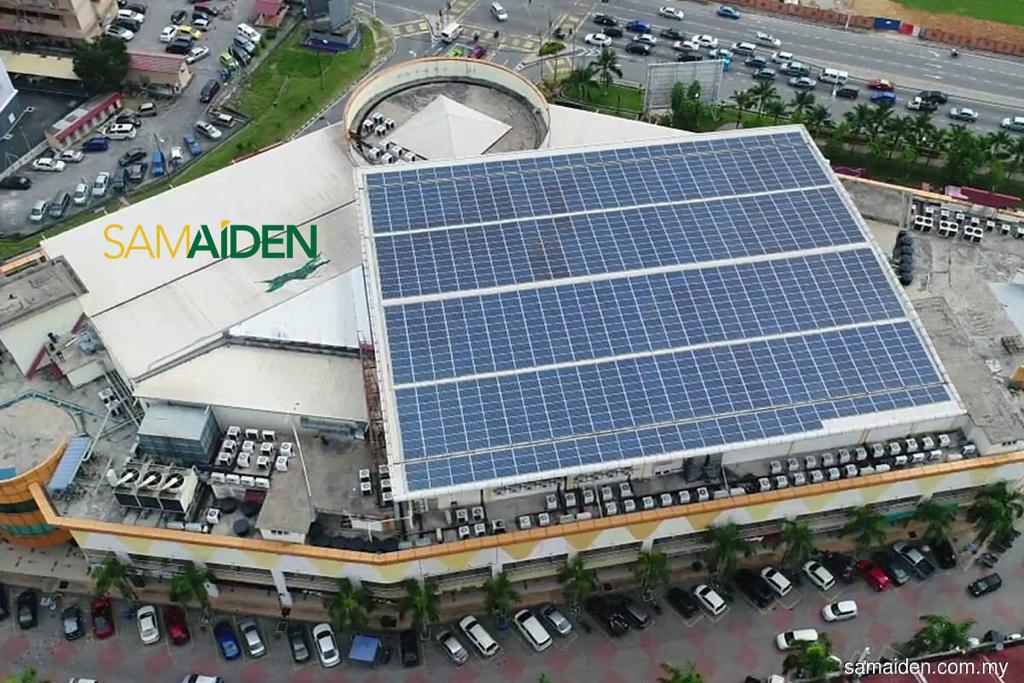

Bright outlook for Samaiden

pinchofsalt05

Publish date: Mon, 28 Feb 2022, 01:48 PM

Bright outlook for Samaiden

Kuala Lumpur (Feb 28) - Solar photovoltaic (PV) specialist Samaiden Group Bhd’s prospects, both for the business and the share price, looks bright.

The company, which is principally involved in engineering, procurement, construction, and commissioning (EPCC) of solar PV systems and power plants as well as the provisioning of renewable energy (RE) and environmental consulting services, posted first-half ended 31 December 2021 (1HFY22) revenue of RM53.2 million, a rise of 176.5% compared with 1HFY21 while net profit climbed 38.7% to RM4.3.

According to a release issued by Samaiden, the commendable performance for the period was due to an increase in the number of EPCC projects as well as larger sums from projects recognised in 1HFY22 compared with the corresponding period of the previous financial year. EPCC services remained the main driver of revenue, contributing more than 95% to the company’s revenue while it has an outstanding order book of RM363 million that will contribute positively to financial performance over the next three years.

What is more interesting is the entrance of a new shareholder, Chudenko Corp, a general equipment engineering company from Hiroshima, Japan with a subsidiary located in Kuala Lumpur. Chudenko is now a substantial shareholder with a 7.2% stake in Samaiden.

Chudenko’s Malaysian website says it develops business through Japanese companies with operations in Malaysia and Southeast Asia, which Samaiden will probably leverage and beef up its order book. The website says Chudenko’s expertise lies in “saving-energy, environment and renovation”.

Given the trend towards more sustainable energy sources, Samaiden’s business prospects look good. This should reflect in its share price valuation, which is now at an ROE of 11.6% and PE of 39.4x. As a comparison, Solarvest Holdings Bhd, a solar energy solutions specialist and one of the first grid-tied solar power installation providers, has an ROE of 5.5% and PE of 70x.

Samaiden’s share price is facing upward pressure after breaking through key technical support at the MA20 and M50 lines. It is now at the threshold of RM1.13, a good entry price level for those looking to companies with the ESG premium.

#samaiden #chudenko

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Corporate Updates

Nasdaq-Listed AGAPE Forges Ahead with Sustainable Energy Business

Created by pinchofsalt05 | Nov 08, 2023

Subang Parade Contends with Unprecedented Flash Flood After Heavy Rainfall

Created by pinchofsalt05 | Nov 06, 2023

Rinani Group Berhad Acquires 5.85% Stake in Malaysian Genomics

Created by pinchofsalt05 | Jul 15, 2023

Unleashing the Power of Speed: New Launch Amazfit Cheetah Sets the Pace for Run Performance

Created by pinchofsalt05 | Jul 03, 2023

hafizzysoftdrink

Solar power is back in the spotlight again..

2022-02-28 14:31