10-Minutes to understand [over-allotment option & stabilization] of IPO

duitKWSPkita

Publish date: Sun, 24 May 2015, 08:44 PM

- Definition of 1)over-allotment option 2)underwriting and 3)stabilization mechanism

- General rules of listing (mainly on Bursa Market)

- How stabilization mechanism works

- Stabilization impact to Balance Sheet

- Conclusion

1. Definition of 1)over-allotment option 2)underwriting and 3)stabilization mechanism

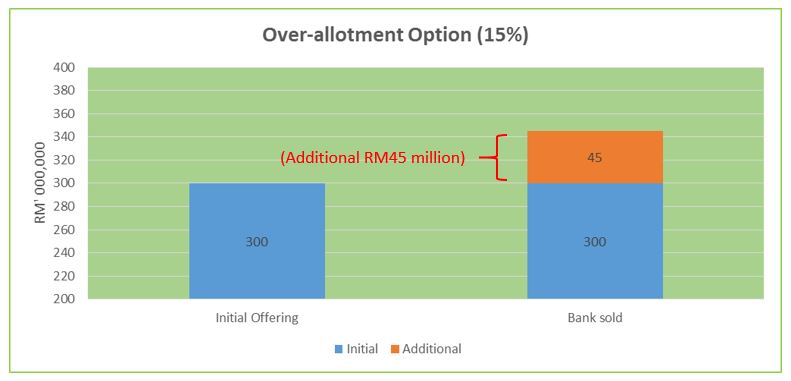

Over-allotment option:- An option for UNDERWRITER(S) to sell extra (15% max) shares than originally planned. All the 15% shares can be exercised (sell or buy) within 30 days from the listing day.

Underwriting:- One or few parties(usually banks) jointly to carry out the process to raise investment capital (IPO) from investors on behalf of corporation (listing company). When there is a big corporation's IPO project, it might involve several underwriters and shall be led by one Lead Underwriter. Underwriter(s) are responsilbe from draft, planning until the end of the listing event.

Stabilization: More commonly called as GREEN shoe option is a legal act for Underwriter to 1) SELL when share price UPPER than IPO price or 2) BUY up to 15% company shares when the price LOWER than IPO price to stabilize(reduce risk) the price structure.

Primary market: Primary market is a trading activfity whereby prime investors such as Banks, Private Equity, Big Corporation and Government buy securities direct from the IPO company. This primary market activity will affect cash flow to the issuer company.

Secondary market: The transaction does not affect cash flow in the company, usually it happens after the listing day. NOTE: Primary market involves the transaction in the listing while Secondary market involves the trading after listing.

2. General rules of listing ( Bursa Market):

Reference: http://www.mia.org.my/new/downloads/professional/regulatory/sc_bursa/knowledge/2012/Practical_Guide_to_Listing_SMEs.pdf

Estimated timeline for the entire listing process from start to finish

3. How stabilization mechanism works ; but before start ask yourself:

- Why GREEN shoe come into the game?

- How to exercise the 15% additional shares? To who?

- Who bear the cost when underwriter buy in shares to stabilize the price?

- ABOVE or BELOW IPO price, what impacts to the IPO company?

The term "greenshoe" came from the Green Shoe Manufacturing Company (today called Stride Rite Corp.), founded in 1919 as it was the first company to adopt the greenshoe clause into their underwriting agreement. GREEN SHOE IS TO BE IMPLEMENTED 1)TO AVOID THE IPO COMPANY ENCOUNTERS SHARP DROP ESPECIALLY IN THE TURBULENT TIMES PREVAILING IN THE MARKET PLACE and 2)TO MAINTAIN THE REPUTABLE NAME OF THE UNDERWRITER FOR FUTURE IPO BUSINESS.

For example, a company named "Malcolm in the Middle Berhad" - MalMid Berhad (not relevant to Malakoff) plan to sell 300 million shares at RM1 for listing. Presumably it is OVERSUBSCRIBED by 14X (marketing say saje, you BUY you DIE) so now the underwriter sold in total of 345 million shares (300 million X 15%)

When share price up, underwriter exercise the over-allotment option to deliver those oversold shares to cover the over-selling. Underwriter OVERSOLD the shares at IPO price and exercise the option at IPO price too, hence, the additional equity will go to IPO company. Underwriters only gain from the underwriting fees and commissions on these shares, plus additional % of successful hit rate commission. Of course the underwriter gains reputation from the equity market.

When share price down, the underwriter shall support the stock with a view to not let it break the IPO price (theoretically) and fall below IPO price. The lead underwriter shall complete to buy back these shares from the market which helps to stabilize the price and suppress the selling pressure from the market (cut supply). Here involve more complicated technical strategies to stabilize the price(will not be covered in this write up).

4. Stabilization impact to Balance Sheet

Here are the impacts for that IPO company should the Underwriter call option to sell the shares above offering price.

Debit: Cash (increase asset)

Credit: Paid in Capital ( increase equity)

Any IPO’s or secondary offerings raise equity . It will be shown as shareholders equity. only debts will be shown as liability. assets = equity+liability.

5. Conclusion

IPO can be done either for the purpose of business expansion or to pay debt / improve working capital for business need. In order to achieve GREAT IPO performance a company can reduce(undervalue) the offereing price but it will not serve the purpose of fund raising. When an IPO counter performs adversely my friendly suggestion is to track its STABILIZATION records over the 30 days period to examine whether the rebounce is happened due to the REAL buying interest or GREEN SHOE effect.

Lastly, wishing everyone a wonderful trading in IPO.

Warmest Regards,

duitKWSPkita

Discussions

Thank you very much Ks55, think tis is my first time to chat with you. Nice to know you. I read ur comments always. Let me answer in below

Posted by ks55 > May 25, 2015 09:45 AM | Report Abuse

A few questions to ask :

1. Over allocation is it prior to listing? If over subscription is 14x, you mean Maybank (or the underwriter) already issued additional 228m shares to the public before lsiting? It will amount to addition offer with a borrowing script (call option) from Malakoff.

ANS: over subscription is just a marketing gimmick. Insti can arrange their runner to chase the IPO ballot. Not 228 million if based on my example at above. It is up to the max of 15% which is 45 million additional shares.

2. Or is it only after listing, Maybank is permitted to sell up to 228m if the share price above IPO? Again it is shorting with call option.

ANS: No matter up or low against the OFFERING PRICE(aka IPO fixed price)they can do CALL or SHORT also.

3. If share price fall below IPO price, Maybank has to buy up to 228m share within 30 days after listing according to stabilizing agreement.

So who will finance the purchase? Malakoff? Or Maybank itself?

Who will actually own those share purchased under the stabilizing mechanism?

Can Maybank pass the share back to Malakoff as put option?

What happen if the price is below IPO price at the end of stabilizing period, and amount of share purchased still fall short of 228m, is it a breach under stabilizing agreement?

ANS:

Part 1: Not necessary must STABILIZE it. See AAX case, Tony discouraged it to be stabilized as he rather wanted to see real market response. Underwriter(Mayb) will purchase and indirectly Underwriter use the OVERSOLD(eventually go to IPO issuer's EQUITY account) money to finance it. So, BANK tak rugi in this particular transaction. Because Underwriter use different account in the beginning so the BOUGHT shares upon stabilization will be debit-credit to that company. In terms of mass-balance it is same. Because they just use OVERSOLD 15% fund and it wil not affect the initial IPO planned figure.

Part 2: Case to case basis. Perhaps in most of the case like FACEBOOK for instance after stabilization price still far below IPO. Bear in mind that, when come to SECONDARY market (after listing) the performance of share price will affect Underwriter more than IPO company. Because IPO company already obtain what they want, but underwriters need the GOOD PERFORMANCE to get the next business in equity market. So, I must say the method and strategy to suppress the market supply(SELLing) is rather important. Some like to intervene on first day to avoid BREAL CALL while some like to counter attack when SELLING VOLUME is low.

Again, it is a big topic here to be discussed.

Hope my clarification help

TQVM if you can clarify the above doubts.

2015-05-25 10:08

Hi SOP2,

Good morning. How are you?

Futures? No... was busy in everyday's LIMIT UP counters.

You see see wat counters recently?

Posted by SOP2 > May 25, 2015 10:57 AM | Report Abuse

1888.88 ? duit KLCI kita !!! you made money form future index ?

2015-05-25 11:08

Hi SOP2,

Good morning. How are you?

Futures? No... was busy in everyday's LIMIT UP counters.

You see see wat counters recently?

Posted by SOP2 > May 25, 2015 10:57 AM | Report Abuse

1888.88 ? duit KLCI kita !!! you made money form future index ?

2015-05-25 11:09

SOP2,

Tried 5 times also cant post. My bad.

Wishing you a wonderful profiting program. Hope you can perform your own research rather than follow the banker house's calls. They are not "disclose" accurate info on the 11MP matters.

Must not rush to buy. I have no comment on your stock picks until I done the thorough check. So far "U" is acceptable ONLY.

2015-05-25 12:00

Thanks for reading Murali, Lan Yong How and jc2015...

Fardar.....thanks for reading. Yup... take it slowly to understand the mechanism then we only can dance with the UNDERWRITER....

Under Thick Black Chapter 4. 厚黑学本领:与庄共舞!

2015-05-25 14:05

Hi, DUIT, you are my beacon of light in this stormy sea.I have been following all your inputs in this forum.I learnt how they do the book building of the IPO,BUT today I learnt something more important from you.

2015-05-25 15:45

Dear Duit,

We do not need to prove to the world. People who knows, they knows. People who dunno, they will seek to understand. Those who dunno and do not seek to understand does not deserve to be entertained because they are most of the time waiting for luck. Even Steven Gerrard lost his final game at 6-1, but I still think he is a great captain of the team.

Best regards,

Fardar

2015-05-25 16:23

Hi, DUIT, this something is what you write about on over-allotment and stabilization of IPO.I realise that to be able to make money in bursa we need to learn the tricks of the trade and I really thank you for sharing.Yesterday I learnt how to do bottom fishing when you set out the rules in another forum.

By the way I made money from YSPSAH and want to let you know that I made donation tO MUDITA orphanage,offering of robes to the monks on occasion of Wesak day,donation to the Nepalese Disaster Fund.

May I be blessed to receive DUIT'S weekly handouts @ mollyganz48@hotmail.com

MAY ALL BE BLESSED WITH HAPPINESS AND PROSPERITY.

2015-05-26 11:06

Lan Yong How

Thank you very much for sharing...you are a great guy.

2015-05-25 08:53