5 Rules of Investing by Cold Eye - Portfolio Simulation

Tan KW

Publish date: Mon, 12 Aug 2013, 01:41 PM

I am wonder what will be my return if I buy the stock that pass the 5 rules from cold eyed once it is poted to i3investor.

And, I try to create a portfolio in order to simulate the transaction at http://klse.i3investor.com/servlets/pfs/19852.jsp

The transaction created based on following assumption:-

- Initial Portoflio Value - RM80K Cash

- Allocation - Max RM10k for each stock

- Transaction Commission - 0.1% with min RM8

- Buy Transaction based on the date and price when the stock posted to i3investor.com

- All dividend will be recorded during the ex-Date

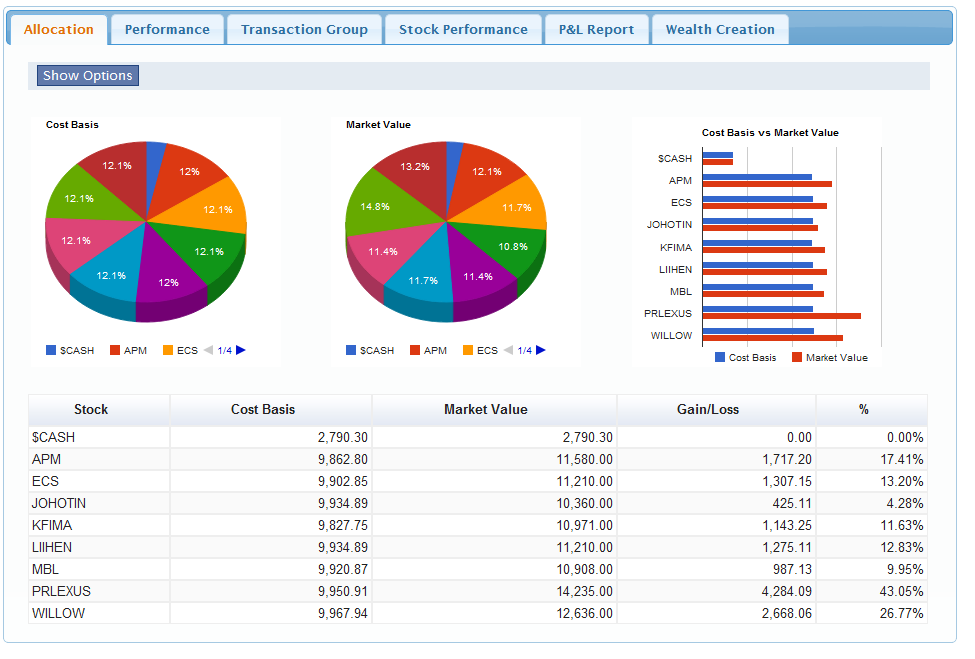

Let's review the portfolio as of today - 12-Aug-2013 1:30PM

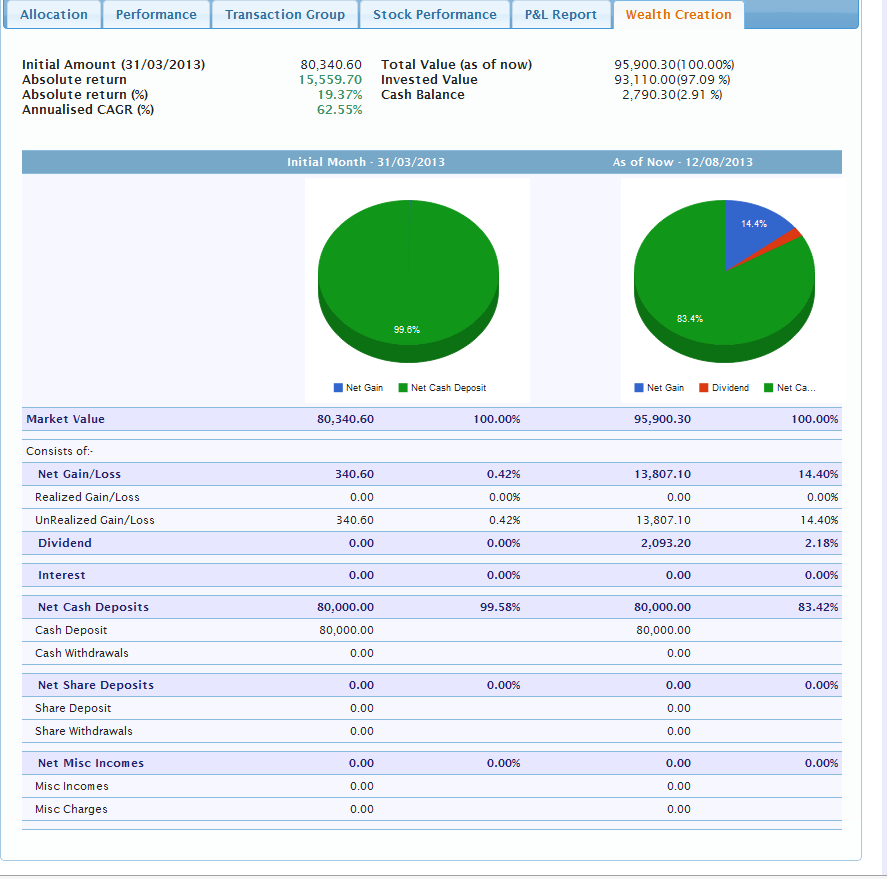

All time Performance 19.88% Perhaps, the result is not so impressive as some memebers claim that he can earn > 20% for a trade. But, bear in mind, we just setup this portfolio on March 2013 and it is just around 5 months old.

Guess, what is my CAGR? Annualised CAGR (%) 62.55%

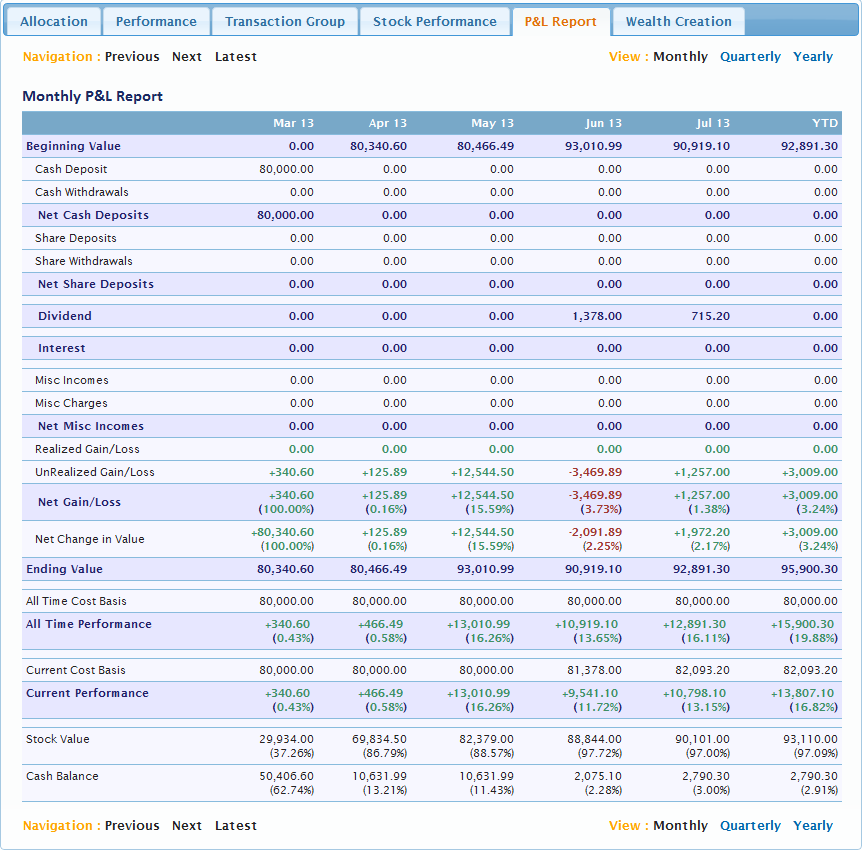

below is the monthly P&L

Click here to view the portfolio

And lastly, see kcchongnz comments on the result....

Posted by kcchongnz > Aug 12, 2013 12:04 PM | Report Abuse

TanKW,

Good effort. Something bothers me. How come all those stocks which I gave a pass using the cold Eye 5 yardsticks are all in green and those which failed are all in red? Did you manipulate the results? It is unusual.

I am wonder why unusual? CAGR 62.55% is too much or too less?

Are you interested in to understand more on the 5 rules? You can visit the stock picks with explanation and listen to cold eyed(冷眼) speech.

Further Reading:-

More articles on The 5 Rules of Investing by Cold Eye (冷眼) - kcchongnz

Discussions

hi kc,

can i have your excel template to learn more.

my e-mail is mlg833@yahoo.com

thanks

2013-08-12 15:00

Hi kcchongnz,

possible to have your excel template for me to learn too ? if yes, pls email to yklim33@gmail.com -- I am your fan too : )

2013-08-12 16:45

hi kcchongnz,

Would appreciate a copy of your FA template with regard to the 5 rules of investing.Hope you can send to cb.mong@gmail.com.

Thank you.

2013-08-12 23:25

Hi KCchongnz, could you please forward a copy of your FA analysis template to my email ykk.84@hotmail.com, Thanks a lot!

2013-08-12 23:44

Posted by Charles Lee > Aug 13, 2013 11:54 PM | Report Abuse

Hi KCCHONG, do u possess a CFA cert?

What a good question. Shy to answer lah. No, i don't. So what I am doing is the work of a non professional.

But think of it, I doubt any of the great investor has any CFA; Warren Buffet, Peter Lynch, Charles Munger, Nasim Taleb, George Soros etc etc.

No, I am not comparing myself with those guys. Don't start attacking.

2013-08-14 03:51

i think charles was impressed la... f you had a cfa, no wonder. if you don't have one, it's a omfg :D

2013-08-14 10:12

"Don't start attacking" was not directed to Charles. It was directed to the one and only one who likes to kachau me. Anyway, I would like to share with you this:

Isaac Newton once said

“If I have seen a little further it is by standing on the shoulders of Giants.”

We know from hindsight that Newton was brilliant, if not genius, in the field of science, physics and mathematics. But as he says, he did not get there by himself. He took the wisdom and knowledge of Giants who paved the way before him and made it into his own.

Who are the giants in finance and investing? Let me start with a few first. Others can add on.

Warren Buffet, Philip Fisher, Charles Munger, Peter Lynch, Benjamin Graham, George Soros

2013-08-14 10:41

Hi can some forward the FA analysis template to me. Email at kelvinongbk@hotmail.com

2013-08-15 13:35

hi, would appreciated if you can send me FA analysis template @ phsilon@yahoo.com.cn

2013-08-19 22:48

A great and respectful investor is not measured by its qualification but rather the philosophy he carries.Cheers

2014-05-09 09:19

kcchongnz

TanKW, well done. You have very good skills. Just some comments here.

In investing, past performance may not be an indicator of the future. Short-term performance is not an indicator for long-term return. More important is the long term return because investing is a long term endeavor.

But the Rules Cold Eye uses is widely used by value investors. They are intuitive. Research has shown that excess returns were earned by the value investing rules.

2013-08-12 14:14