ARBB (7181) – A company that change for a better tomorrow! Berkshire Hathaway move from Omaha to Malaysia

value_trading

Publish date: Thu, 14 May 2020, 12:33 AM

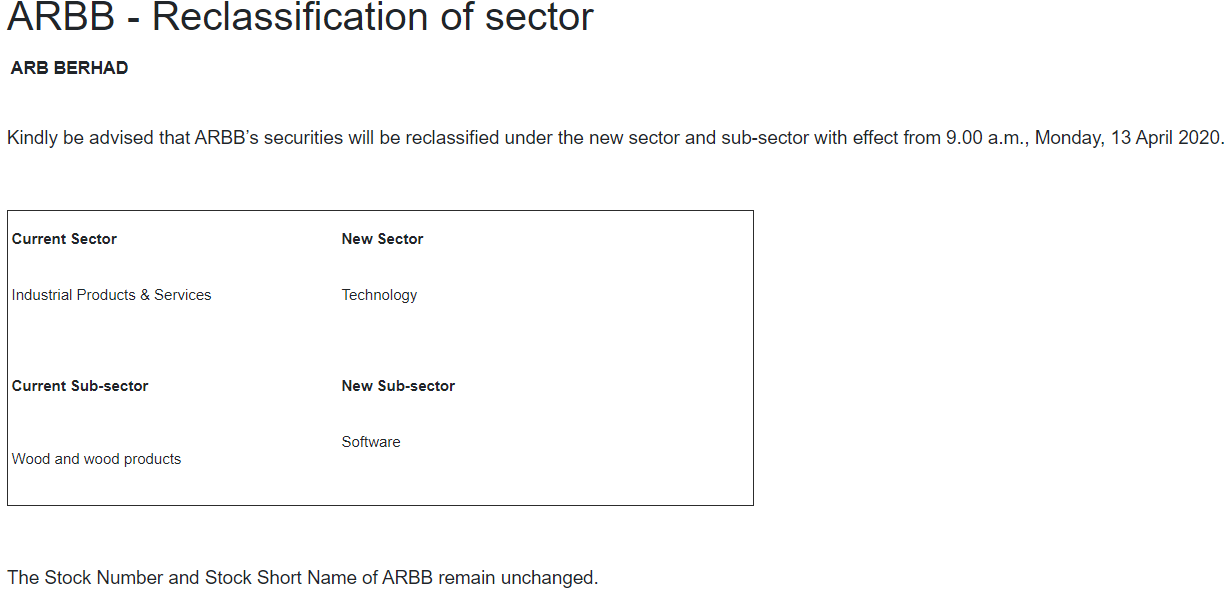

ARB Berhad (Formerly known as Aturmaju Resources Bhd) was founded in1989, currently listed in Mainboard Bursa Malaysia. ARB has its history firmly rooted in timber processing. However, due to the implementation of the new forest legislation by government and reduction in demand, timber processing line has stop since 2018. Their mainstream of business has change from industry (timber) to IT (software) mainly focus in Enterprise Resources Planning (“ERP”) system and Internet of Things (“IoT”) which is the game changer for Industry 4.0 revolution.

In 2018, Hartalega spent RM14 Million to upgrade ERP system to catching up with Industry 4.0 revolution.

What is ERP and IoT?

ERP provides an integrated and continuously updated view of core business process using common databases maintained by a database management system. ERP facilitates information flow between all business functions and manages connections to outside stakeholders.

Internet of Things (“IoT”) is a system of interrelated computing devices, mechanical and digital machines that are provided with unique identifiers and the ability to transfer data over a network without requiring human-to-human or human-to-computer interaction

Extreme, Change , Continuity – Caterpillar transform into butterflies

As the timber processing business was challenging in the past few years, slower demand arises from lesser new house built hence lesser needs of timber for renovation and government restriction that reduce tree supply for timber. In view of the non profiting business, ARBB changed his business focus from timber to IT (ERP and IoT) in 2019. This is in keeping with the company foresight the business need in the world as their industry model moving towards new Industry 4.0 concept.

Below is the milestone of the transformation for ARBB

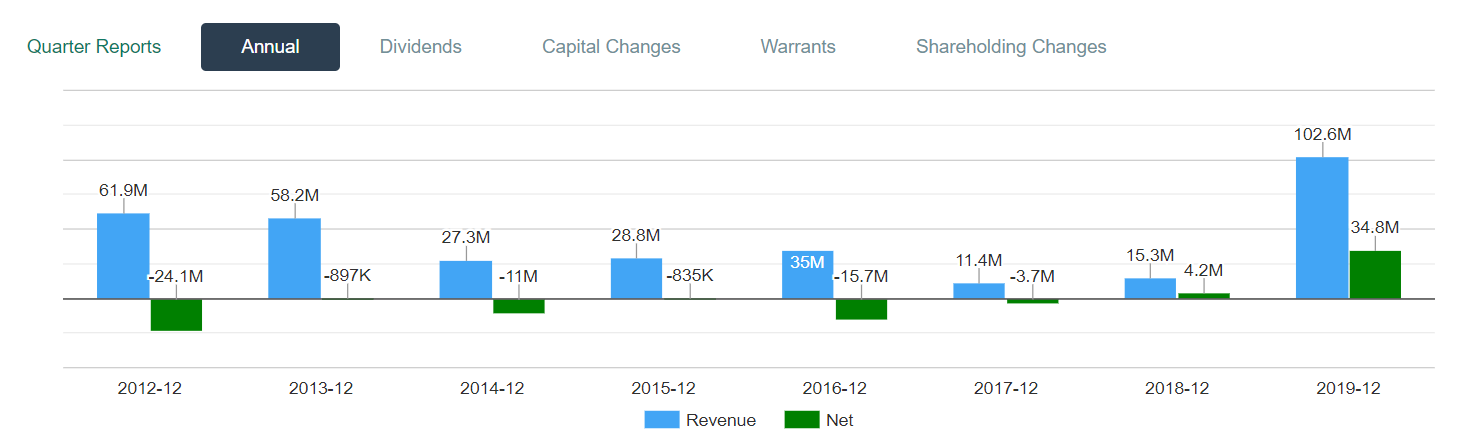

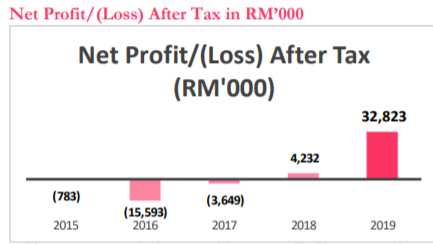

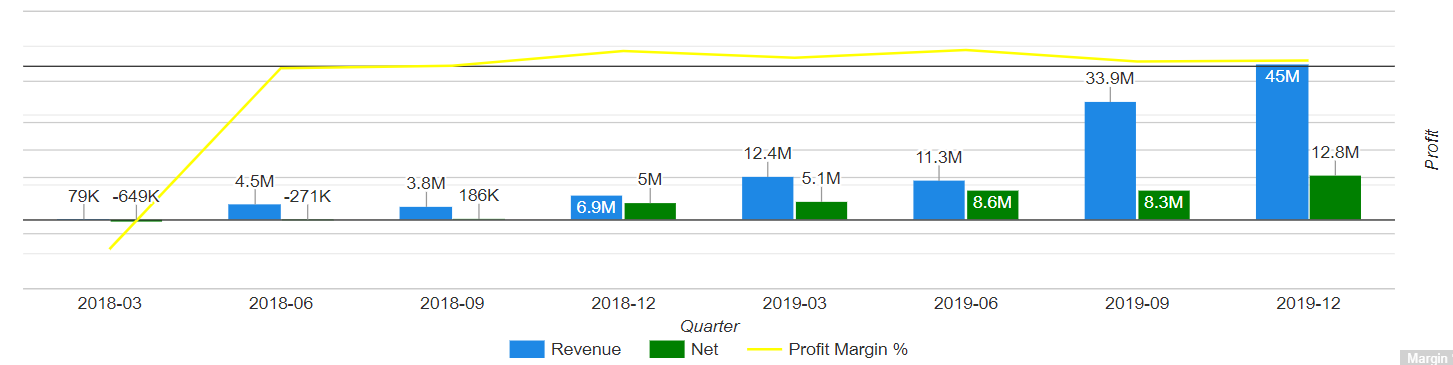

After ARBB move from timber toward IT in 2019, their revenue had growth from15.3 mil to 102.6 mil (570% improvement). The profit margin also jumps from -31% (2017) to 27% (2018) and 32% (2019). That is a huge 58% improvement!

If time flies back, everyone wants to be a shareholder in Berkshire Hathaway. Now this will be the next once in a life chance!

Everyone knows how successful Berkshire Hathaway after Warren Buffett decided to move away from textile business (a sunset industry) to other business that follow the growth of the market. Looking at the amazing improvement of earnings and profit margin of ARBB after changing sector, no doubt that the management team of ARBB have make an excellent decision.

ARBB achieved a record quarterly net profit of RM44.9 million for the fourth quarter ended December 30, 2019 (4QFY19) from a RM 6.9 million for the previous corresponding period, mainly due to stronger and improving revenue from its IT segment.

ARBB is consider one of the companies listed in Bursa who first bring in ERP and IoT. There are hardly any company listed in Bursa provide the similar service like ARBB. This form a good business moat for ARBB and give him a better competitive advantage if in future, other company want to step into this business.

How huge is the impact of preferential share?

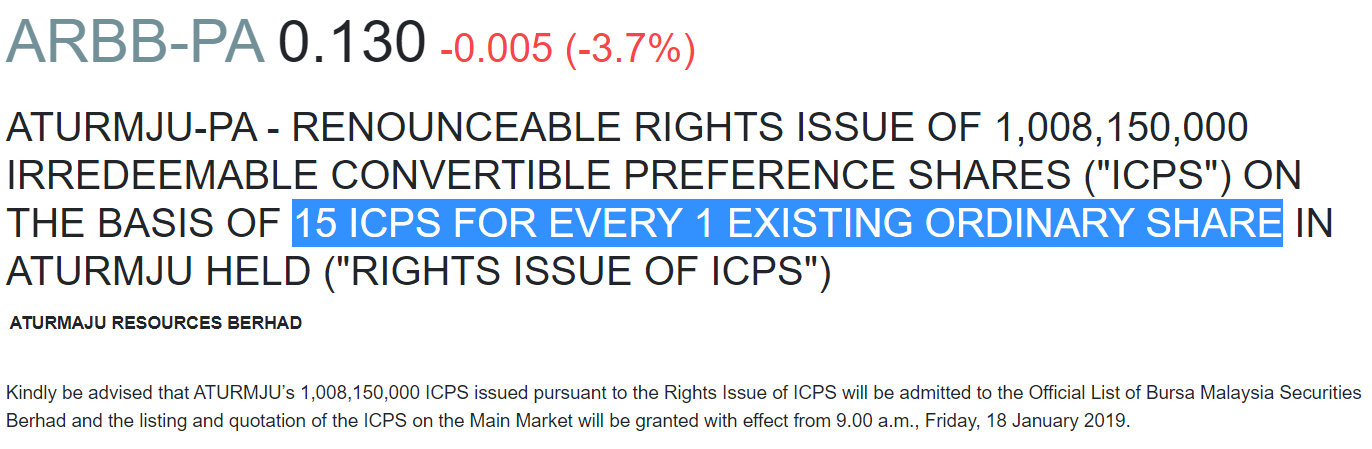

ARBB issued 1,008,150,000 Preferential shares on 18th January 2019,

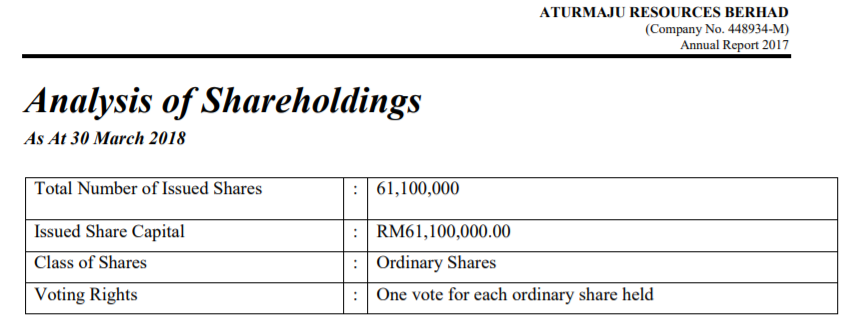

The total number of ARBB mother share before they issue preferential share in March 2018 was 61,000,000.

Worst case scenario, if all preferential share converts to mother share, the total amount of ARBB stock will be 1,069,150,000 (61,000,000 + 1,008,150,000)

Based on the latest earning in 2019 of RM 32,823,000

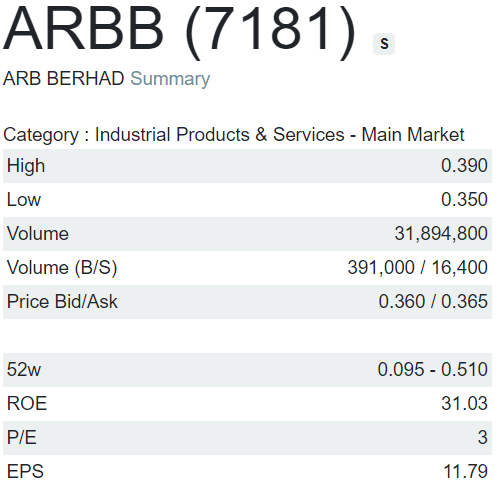

The EPS for total 1,069,150,000 share will be 0.031 (RM 32,823,000/1,069,150,000 share). PE base on today share price of RM 0.365 will be around 11. If PE goes up to 15, the stock price can potentially go up to RM 0.465! Based on today price of RM 0.365 (there is still 27% away from the price target).

With the improvement quarter revenues from the business as showed in the cart below. This directly tells us, the stock price of ARBB should be higher than RM 0.465 given 2020 EPS will be expected higher than 2019.

Fundamental wise, ARBB is a good company giving low PE of 3.1 now, ROE of 31 and huge future business potential.

In short, factors in the risk of excessive preferential share, ARBB will still be undervalue! The price will not stay long at RM 0.365. The value of the stock should be minimum RM 0.465 and above give bright future of this business.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Discussions

Buy opensys better la. 10 years of profit.stable price range..got steady dividen....

2020-05-14 19:03

dodgy company.

Ask you this... Hartalega - a multi billion dollar company spends RM 14m to upgrade ERP system.

Who is YES COMM Enterprise to spend RM20m for ERP? Mind you, Yes comm is merely a handphone retail shop with 4 outlets.

Don't fool yourself from low PE ratio company means value investing.

2020-05-15 01:06

You know something is fishy when article compare a micro cap with Berkshire Hathaway and give the false impression that Arbb might turn out to be something similar.

2020-05-16 21:18

looiting

I can see that you're trying very hard to convince others to buy the stock. Good try

2020-05-14 11:41