APEX Securities Berhad IPO Note - Synergy House Berhad

fireinabidin999

Publish date: Thu, 18 May 2023, 01:30 PM

APEX Securities Berhad IPO Note - Synergy House Berhad

A cross border e-commerce seller and RTA home furniture exporter that specialises in affordable products

Investment Highlights

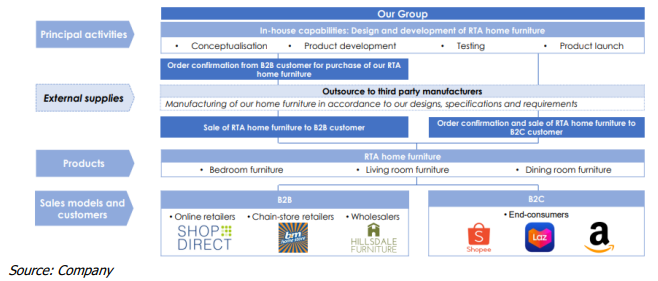

Cross border e-commerce furniture seller and exporter. Synergy House Berhad (Synergy) is principally involved in the design, development and sales of ready-to-assemble (RTA) home furniture to online-retailers, chain store retailers and wholesalers via B2B sales model. As well as directly to end-users through online-store like Amazon, Shopee and Lazada via B2C sales model.

Riding on the thriving era of e-commerce. The Group is well-positioned to capitalise on the growing global furniture e-commerce market via their B2C sales model, which yields better profit margin. According to the IMR report, global furniture e-commerce sales grew at a CAGR of 17.8% from 2019-2021 and is expected to grow further with the continuous adoption of online shopping amongst consumers.

Cross border e-commerce yields better high profit margin. Despite Synergy's products being priced affordably to target young consumers, the group manages to achieve a favorable profit margin by selling its products to high-income countries. Moving forward, we anticipate an increase in their profit margin following the easing of supply chain constraints, including the normalization of shipping costs and lower cost of input materials. Nevertheless, the potential benefits of lower operating costs may be offset by higher marketing and sales expenses as the Group aggressively expands its business and aims to secure a larger market share.

Asset-light business model. The asset-light business model without owing any production facility has enabled Synergy to focus on product development and marketing as the Group is not limited by any manufacturing capacity. This model has provided them the flexibility to cater to the changing consumer trends.

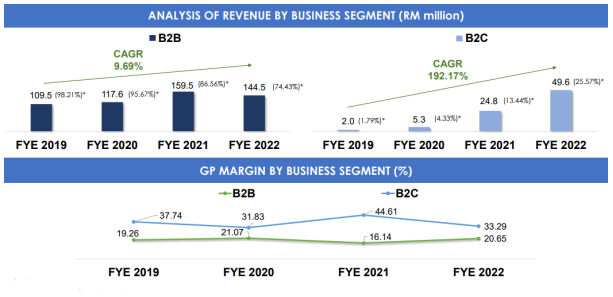

B2C business segment as growth catalyst. In the past few years, the Group’s B2B business has shown modest growth (CAGR 9.7%), but the B2C business has experienced significant growth (CAGR 192.1%). Moving forward, Synergy will continue to focus on its B2C business to drive financial growth by expanding customer reach through selling its products on more third party e-commerce platforms with new market focus.

Expansion plans. As mentioned above, the company plans to prioritize the growth of its B2C business through various initiatives includes increasing marketing activities, establishing a new warehouse in Muar, Johor and Port Klang as its e-commerce fulfillment center. Additionally, the group intends to expand its product offerings by diversifying into bathroom furniture and kitchen furniture categories.

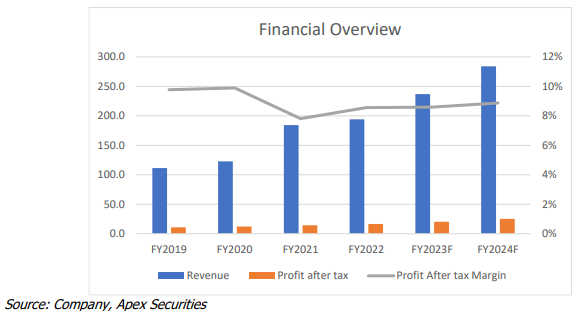

Robust financial growth. The Group has recorded a strong financial performance where revenue grew at a CAGR of 20.3% from FY19 to FY22. The robust growth was mainly attributed to the thriving of e-commerce furniture during the pandemic and the significant growth from the Group’s B2C business segment. We are forecasting a double-digit yoy growth in Synergy’s FY23 and FY24 revenue (FY23: 22% yoy and FY24: 20% yoy growth) in line with its aggressive expansion plans and growth of its B2C business segment. Our net profit forecast stands at RM 20.1m which is expected to grow by 21% YoY in FY23F and then increase further by 25% YoY in FY24F (RM 25.1m).

Valuation / Recommendation

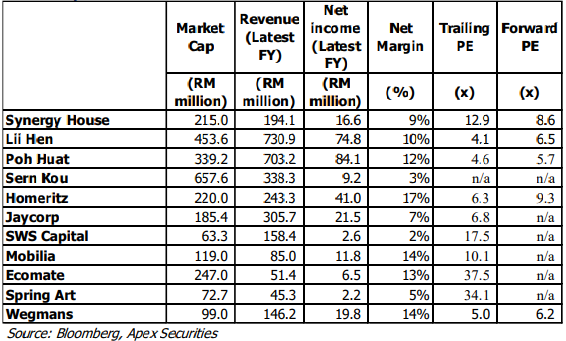

We derive a target price of RM0.50 for Synergy House Berhad. Our valuation is based on the 10x PER of Synergy’s FY24F EPS of 5sen which is in line of the peer’s PER at the range of 8x – 11x. We assigned a relatively higher PER as the Group has directly benefitted from the thriving e-commerce era for furniture products and being asset-light gives them a greater degree of flexibility compared to other industry players, allowing them to easily adapt their strategies in response to changing market conditions.

Our target price of RM0.50 represents a 17% upside against the listing price of RM0.43.

Business Overview

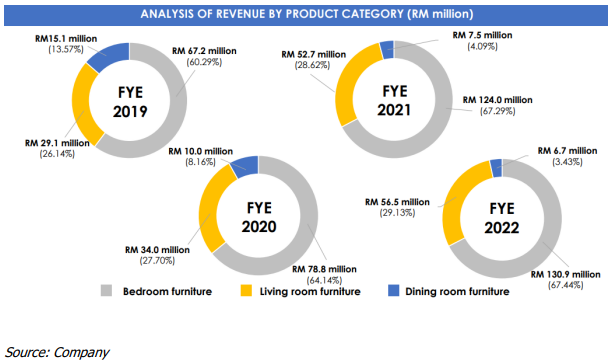

The range of RTA home furniture offered by Synergy comprises bedroom furniture, living room furniture and dining room furniture.

Synergy’s expertise in designing RTA home furniture covers key aspects in furniture design, including conceptualisation, product development, testing and product launch. This is backed by its in-house design and development (D&D) team which is involved in all aspects in furniture design, supported by the sales and marketing team. The D&D team stays abreast of changing consumer lifestyles and preferences as well as market trends globally, and incorporates inputs and feedback from the sales and marketing team gathered from the customers, to continuously develop innovative home furniture that suit the latest demand from consumers globally.

As Synergy focuses on the design, development and sale of RTA home furniture, it does not manufacture its own home furniture, but outsource all manufacturing works to third party Autocount Dotcom Berhad 4 Please read carefully the important disclosures at end of this publication Apex Securities Berhad (47680-X) manufacturers where they are responsible for purchasing raw materials, manufacturing and packaging of the home furniture in accordance to Synergy’s designs, specifications and requirements.

Synergy’s products are sold locally and exported overseas. In recent years, for sales to B2B customers, Synergy primarily exports home furniture to the UK, the USA, United Arab Emirates and other countries as well as local customers in Malaysia.

As for sales to B2C customers, home furniture are sold to local end-consumers in Malaysia through third party e-commerce platforms and their in-house online store, and to end-consumers in the USA, Canada and the UK through third party e-commerce platforms.

Synergy's business model as follows:

Peer Comparison

Financial Summary and Outlook

The Group has recorded a strong financial performance where revenue grew at a CAGR of 20.3% from FY19 to FY22. The robust growth was mainly attributed to the thriving of e-commerce during the pandemic and the significant growth from the Group’s B2C business segment. We are forecasting a double-digit yoy growth in Synergy’s FY23 and FY24 revenue (FY23: 22% yoy and FY24: 20% yoy growth) in line with its aggressive expansion plans and growth of their B2C business segment. Our net profit forecast stands at RM 20.3m which is expected to grow by 22% YoY in FY23F and then further increase by 24% YoY in FY24F (RM 25.2m).

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on My News

Created by fireinabidin999 | Jan 06, 2025

Created by fireinabidin999 | Jan 02, 2025

Created by fireinabidin999 | Dec 21, 2024

Created by fireinabidin999 | Dec 20, 2024

Created by fireinabidin999 | Dec 20, 2024

Created by fireinabidin999 | Dec 19, 2024

Created by fireinabidin999 | Dec 19, 2024

hafizzysoftdrink

Osome! macam solid company! finally a good IPO in a long time!

2023-05-18 13:59