Airasia - Time to Buy Now!

kelvin_ik4u

Publish date: Fri, 10 Aug 2018, 11:24 AM

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Discussions

oh easy ma. ask tf the ticket price put high as mas then get more profit lo..

2018-08-12 07:18

The author seems to want to focus on the real thing, so I say as below:

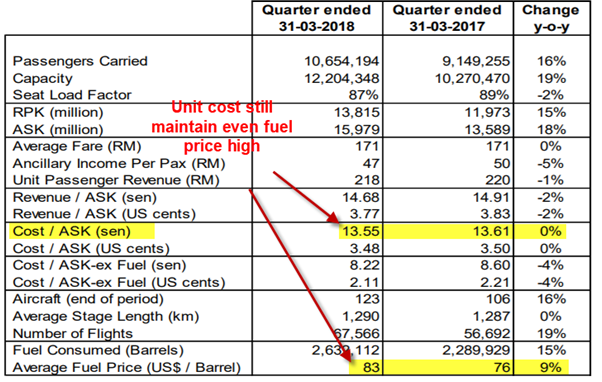

1. Expenses is increasing at a faster pace than revenue.

2. The world has changed (to be more honest), but TF hasn't.

3. While most subsidiaries still unprofitable, Airasia wants to venture into building airports again. I believe selling most of that businesses and focus in principal activity is the right move. Airasia was in the right direction (since 8501) for about two years and now going in multiple direction again.

4. Now is August 2018, the special dividend of RM0.82 to RM1.02 supposed to be distributed this month, however it is unlikely to be materialized. (A lot of) people has been waiting for close to three years.

5. Efficiency is a comparative thing, and also a continuous process. Airasia is slowing down....The moment you stop to be creative, your share price stop too....

2018-08-12 10:57

ivy88_

Good to recalled back on past AA analysis report. That's true. If investor patience, we will reward handsomely per Warren Buffet's invest strategy.

2018-08-10 12:19