(AlgoQuant) A Takaful Titan & Analysis of Listed Insurance Companies (TAKAFUL)

AlgoQuant

Publish date: Wed, 04 Dec 2019, 07:41 AM

Highlights & Background

Established in 1984, Syarikat Takaful Malaysia Keluarga Berhad (TAKAFUL 6139) is the sole listed pure play Islamic Insurance company on Bursa Malaysia

The business is divided into Family Takaful ('life insurance') and General Takaful ('general insurance') along with a small overseas operation in Indonesia.

Diversified distribution channels. STMB employs a multi-distribution channel strategy through direct acquisition, agencies, and brokers. Also, it has bancatakaful tie-ups with a wide network of > 15 banks - preferred partners are Bank Islam, RHB, Bank Rakyat, Affin, Bank Simpanan Nasional, and AmBank. For Family Takaful, banca (50%) and direct distribution (30%) were STMB’s main sales channels. In General Takaful business, agencies (40%) led, followed by banca, direct, and brokers (equal contributions of c.20%).

Financials

Remarks:

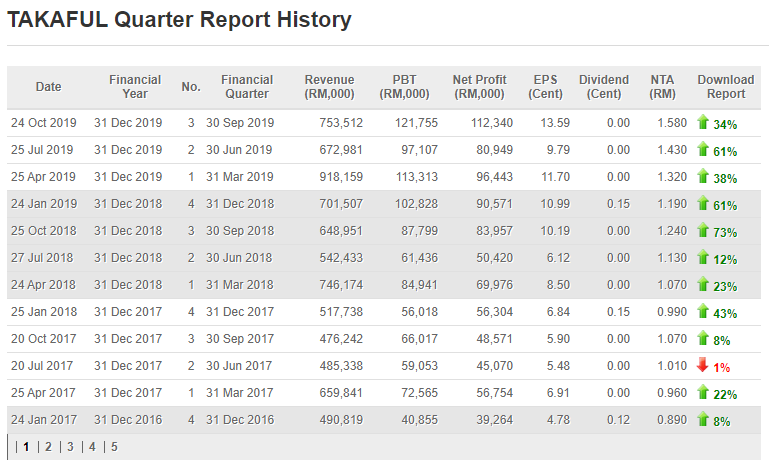

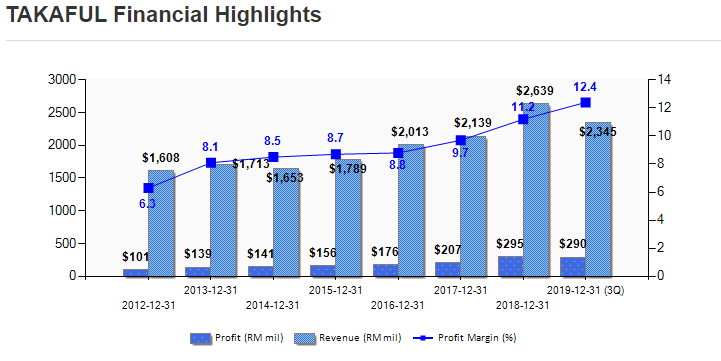

- Strong growth from FY2017 to FY2018 of close to 50% and 9M19 net profits already matching FY2018 profits

** The International Accounting Standards Board (IASB) has decided to defer the IFRS 17 Insurance Contracts effective date to reporting periods beginning on or after 1 January 2022. This is a deferral of one year compared to the current date of 1 January 2021.**

Source: https://eyfinancialservicesthoughtgallery.ie/iasb-agrees-defer-ifrs-17-2022/

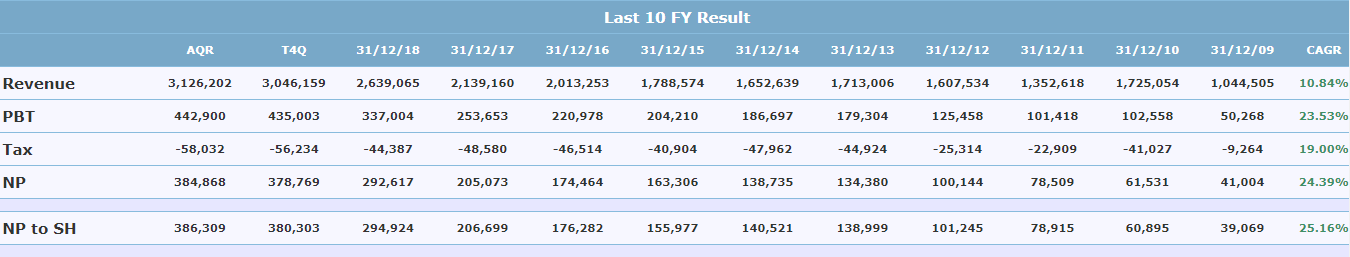

Past 10 Years Financial Results

Remarks :

- Revenue has shown Compound Annual Growth Rate (CAGR) of over 10% since 2009 with Net Profit growing at an astounding CAGR of over 25%

- This translates to a Net Profit growth close to 10x times from RM39mil (FY2009) to RM380mil (T4Q)

- Despite the Global Financial Crisis, Takaful Malaysia was profitable and grew strongly from 2009-2010 (structural shift to islamic finance)

SUMMARY

- At current price of RM5.83, Takaful is trading at a P/E of only 12.67x and a P/BV of 3.68x

- Short-Term Target Price pegged to P/BV 4.75x - RM7.50 (1-3 months)

- Target Price based on P/E 18x - RM8.28 (similar to LPI)

- Target Price based on P/BV 6x - RM9.48 (historical P/BV)

** Read on below for valuations and comparisons of listed insurance companies

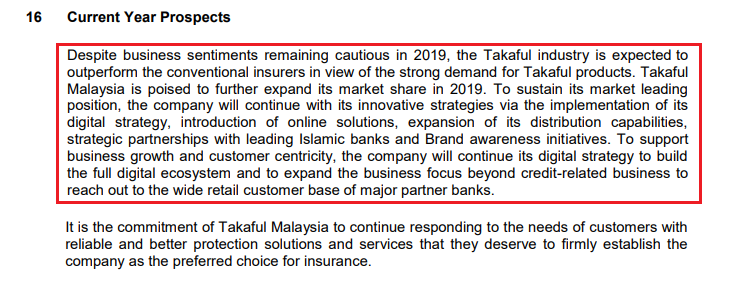

Growth Prospects

Supported by a still low Takaful penetration rate and double digit growth :

KUALA LUMPUR: Takaful penetration rate among Malaysia's 32 million population is expected to surpass 16 per cent in 2019 from last year's 15.2 per cent, said Malaysian Takaful Association (MTA).

MTA chairman Muhammad Fikri Mohamad Rawi sees the low insurance penetration rate and young demographics as significant market growth opportunities that has yet to be tapped by the takaful sector.

Latest statistics from MTA revealed last year’s new takaful protection grew 14.5 per cent to RM324.2 billion [2018] in sum assured for all policies combined, compared with RM283.1 billion in 2017.

This year [2019], he forecast the total sum insured to expand by double digits to reach RM400 billion.

(Source: https://www.nst.com.my/business/2019/03/470953/takaful-companies-forecast-16pc-penetration-rate-year)

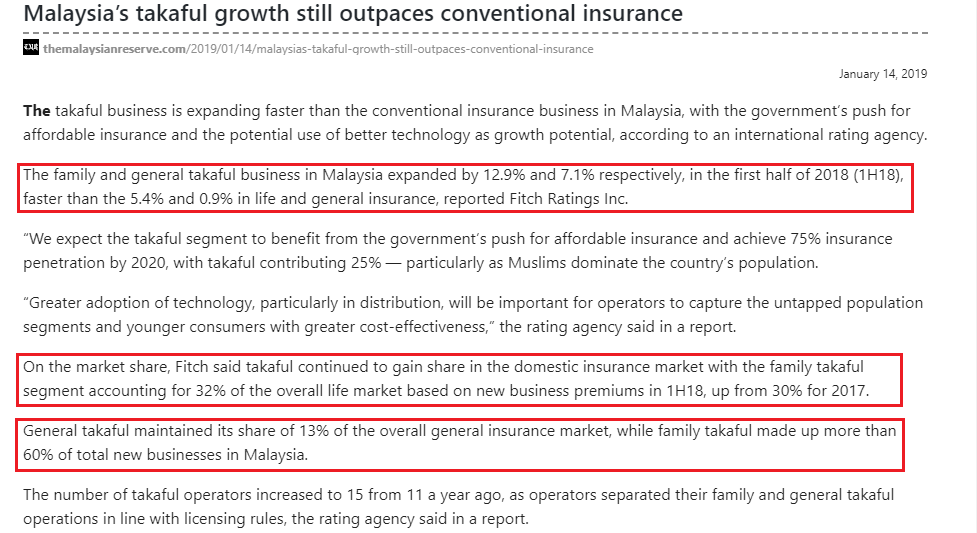

With i) Takaful Insurance outpacing Conventional Insurance growth ;

and ii) Family Takaful outpacing General Takaful growth :

Key Points :

"The family and general takaful business in Malaysia expanded by 12.9% and 7.1% respectively, in the first half of 2018 (1H18), faster than the 5.4% and 0.9% in life and general insurance, reported Fitch Ratings Inc."

"On the market share, Fitch said takaful continued to gain share in the domestic insurance market with the family takaful segment accounting for 32% of the overall life market based on new business premiums in 1H18, up from 30% for 2017."

"General takaful maintained its share of 13% of the overall general insurance market, while family takaful made up more than 60% of total new businesses in Malaysia."

Boost from favourable demographics

Malaysia’s young demographics and the faster growing Muslim population should help the takaful market to flourish. Besides, a rising middle class (40% of total population) is expected to spur overall demand, considering they are more educated, willing, and capable of being insured. Moreover, we see the increasing need for healthcare services (given Malaysia’s progressively aging population) and high medical inflation, encouraging the take up of insurance products.

** BOTTOMLINE: The Takaful Industry is experiencing Structural Growth **

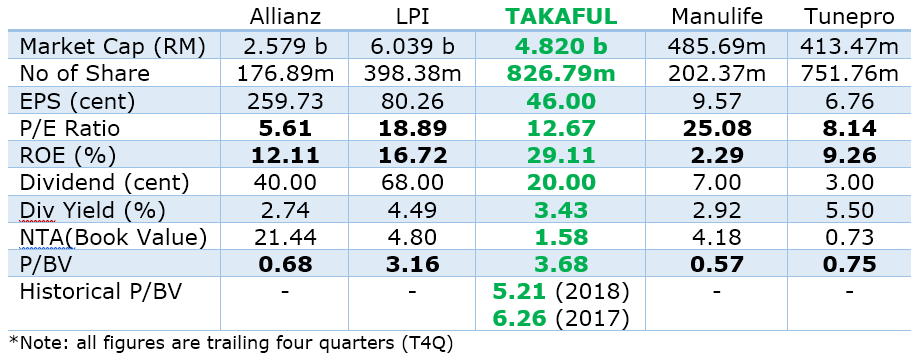

VALUATIONS AND COMPARISON OF LISTED INSURANCE COMPANIES :

Remarks :

- TAKAFUL has an industry-leading ROE of 29.11% compared to LPI of 16.72%, but currently has a P/BV of only 3.68, compared to LPI’s P/BV of 3.16.

- TAKAFUL's P/E of 12.67x is far behind the P/E of 18.89 of LPI

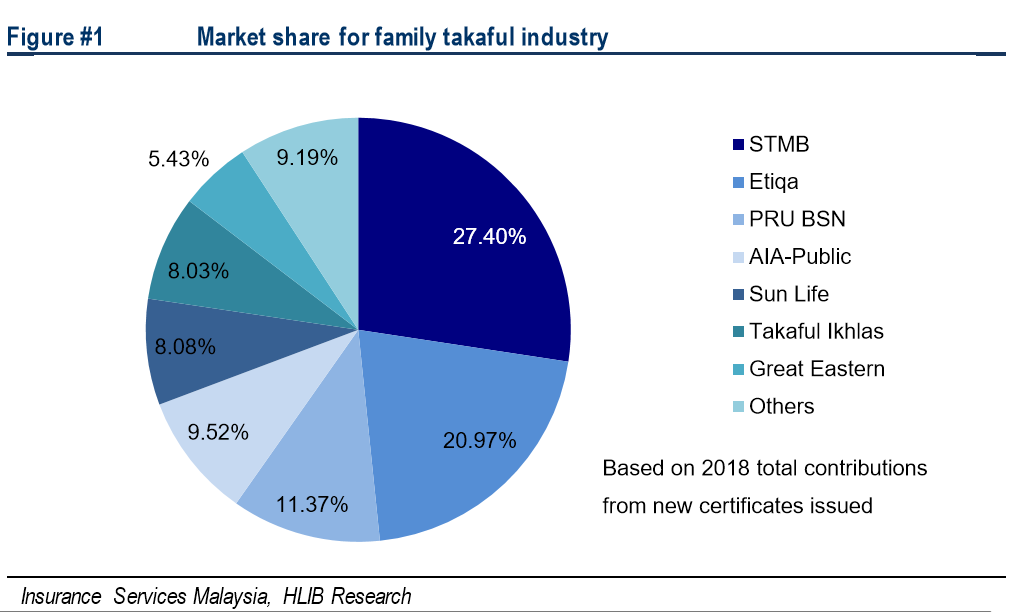

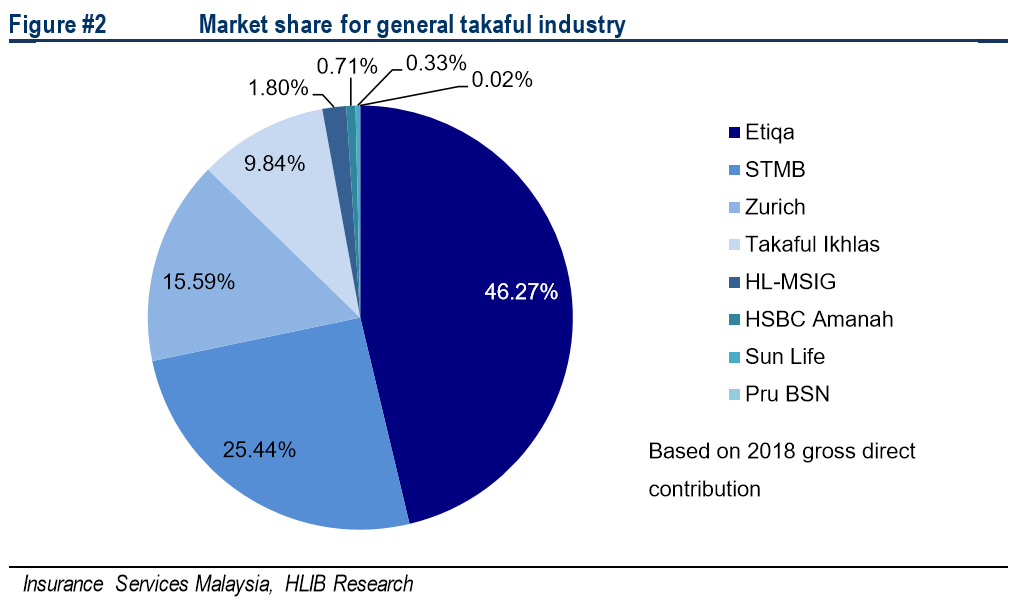

- TAKAFUL has delivered much higher growth (FY2016 - FY2019 profit growth > 100%) and has higher growth potential in the Takaful/Islamic Insurance industry, being the LEADER in the Family Takaful space in Malaysia and the second largest in the General Takaful space (higher P/BV). Trust, recognition, brand and loyalty are important factors in Islamic insurance

- TAKAFUL’s Historical P/BV has ranged from 5.21 (2018) to as high as 6.26 (2017) (source: analyst reports; Bloomberg)

- Its P/BV has actually contracted where share price has lagged the company’s financial performance / profit growth i.e. profit has more than doubled (increased > 100%) since FY2016 but share price has only moved from RM4.0x to RM5.8x now (increased < 50%)

- Since FY2016, dividends have actually declined for LPI (80c > 68c), Manulife (10.5c > 7c) and Tunepro (5.2c > 3c).

** Takaful Malaysia had just on 3 December 2019 announced a record high interim dividend of 20c ex-date 18 December 2019, which translates to a Dividend Yield of 3.43%. **

Conclusion :

- 9M19 results have exceeded earnings estimates and all expectations, and there's no reason for this outperformance to end anytime.

- Based on past results, 4Q19 is typically strong and a Y-o-Y growth (vs 4Q18) is expected (QoQ profit growth would be an added bonus)

- FY2020 onwards, Takaful Malaysia is set to ride on the Islamic insurance wave and positive structural sector dynamics.

- Takaful insurance outpacing conventional insurance. At the same time, STMB is taking market share from competitors (Family 28%; General 25%).

- The top takaful operators continue to grow while others are playing catch-up or falling behind (competitive advantage). Latest quarterly results of Manulife vs Allianz tell the tale of two very different state of affairs eventhough they operate within the same industry (conventional insurance)

- At current price of RM5.83, Takaful is trading at a P/E of only 12.67x and a P/BV of 3.68x

- Short-Term Target Price pegged to P/BV 4.75x - RM7.50 (1-3 months)

- Target Price based on P/E 18x - RM8.28 (similar to LPI)

- Target Price based on P/BV 6x - RM9.48 (historical P/BV)

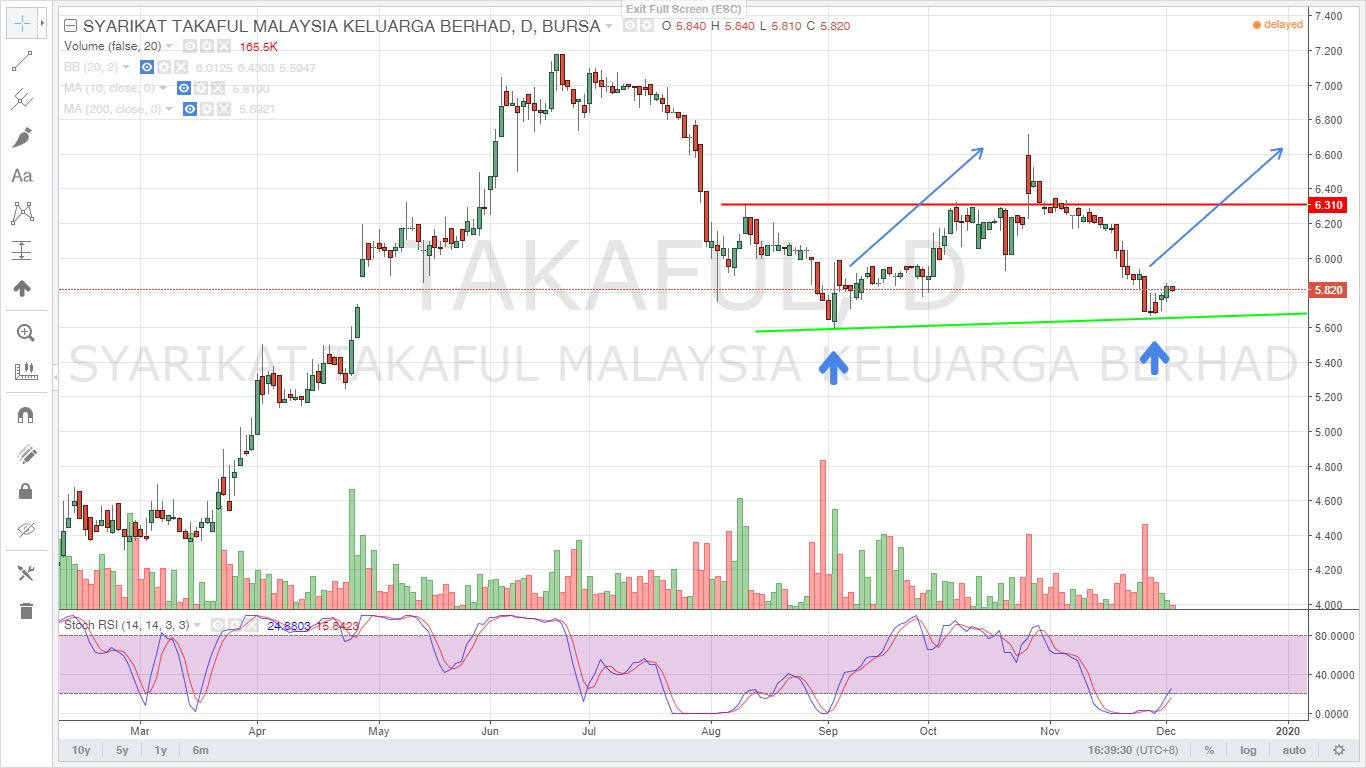

Price Chart

Remarks :

- The share price drop has been overdone and is a function of fund's taking profit and locking in gains for the financial year 2019, rather than any conceivable fall in profits or a structural decline in the takaful industry.

- Hence, we see share prices decline from a high of RM6.7x upon 3Q19 results on 25 Oct 2019 that exceeded expectations to low of RM5.6x end-Nov 2019 eventhough earnings have increased by 39% to RM112.3mil on a QoQ basis (2Q19: RM80.9mil), while many other companies which have reported declines in profits have maintained share prices, as these funds hold on to their losses (a symptom of loss aversion, unfortunately).

Remarks :

If history is anything to go by, the stage is set.........

We protect. We care. We Share. Syarikat Takaful Malaysia Keluarga Berhad (TAKAFUL 6139).

Disclaimer: The information and opinions expressed here are for educational purposes only and the contents of this report should not be considered financial advice and does not constitute a buy or sell call. Consult your investment advisor before making any investment decision.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Discussions

Posted by PaulNewman > Dec 4, 2019 7:57 AM | Report Abuse

Fundamentals has been reflected in the share price

Ans:

At current price of RM5.83, Takaful is trading at a P/E of only 12.67x and a P/BV of 3.68x

LPI trades at P/E 18x and P/B of 3.1x with a (much) lower ROE of 16.72% vs Takaful Malaysia's ROE of 29.11%

This is without including the Growth factor - the Takaful / Islamic Insurance will outpace that of the Conventional Insurance sector due to low penetration rates, structural shift etc

Hope this helps

2019-12-04 10:59

not sure why you compare life with general insurance, they are valued based on completely different methodologies.

2019-12-04 21:37

Jarklp not sure why you compare life with general insurance, they are valued based on completely different methodologies.

04/12/2019 9:37 PM

Ans:

You are concerned with the Management of these companies and it is a fair though misguided endeavor.

We are concerned only with the Valuations of companies and hence it makes no difference whether these companies are in life or general:

[Manulife (conventional - life), Allianz (conventional - life and general), LPI (conventional - general), Tunepro (conventional -general)].

In fact, it makes no difference what is the management expense ratio or commission ratio or retention ratio because as at the end of the day as equity shareholders, we are concerned only with how well these companies generate returns for shareholders.

In investing, never lose sight of the big picture.

Hope this helps

2019-12-05 10:07

paperplane Algo quant, sinxe you so technical. Can advise is it better buy bimb for pickup trading of takaful

11/12/2019 10:55 PM

Ans:

To value BIMB Sum-of-Parts is appropriate based on Bank Islam being a financial institution and Syarikat Takaful Malaysia Keluarga Berhad being an insurance company

BIMB shareholders will get 0.25 share of Takaful for every 1 BIMB share (after the enlarged shares from the corporate exercise)

Investing in BIMB or Takaful will depend on your preference:

BIMB due to Value (it is currently undervalued on a P/B basis but may continue to stay undervalued, due to the fact that after the distribution-in-specie, its growth driver which is Takaful would be taken out)

** To own 1 share of Takaful (currently at RM5.9x) you would have to buy 4 BIMB shares (currently valued at RM4.4x) therefore exposure to 1 Takaful share would require capital of RM4.4x * 4

Takaful due to Growth (pure exposure without "paying for the lower growth BIMB stake")

Hope this helps

2019-12-13 10:43

PaulNewman

Fundamentals has been reflected in the share price

2019-12-04 07:57