AmInvest Research Reports

Stocks On Radar - Sarawak Oil Palms

AmInvest

Publish date: Thu, 10 Mar 2022, 09:19 AM

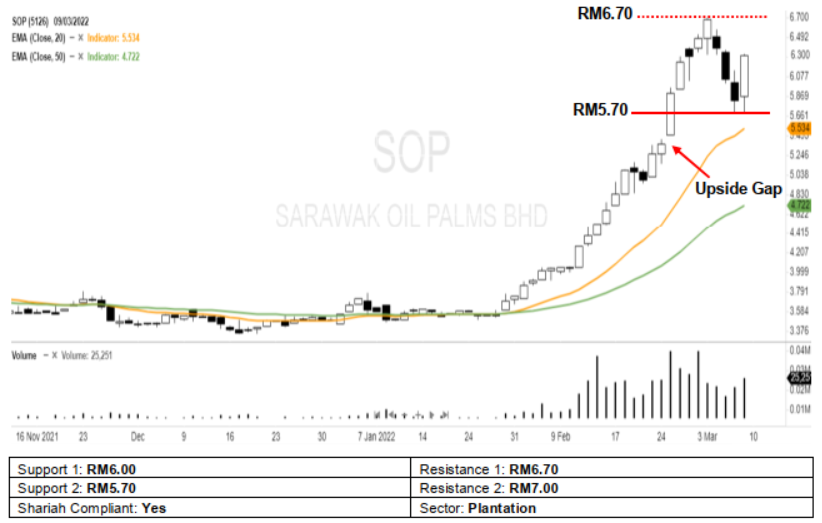

We expect further upside for Sarawak Oil Palms after it recouped the previous session’s losses and pushed higher from its RM5.70 support. In view of the uncovered upside gap formed on 25 Feb and coupled with its rising EMAs, the bullish momentum is likely to pick up further. A bullish bias may emerge above the RM6.00 level, with a stop-loss set at RM5.68, below 8 March’s low. On the upside, the near-term resistance level is seen at RM6.70, followed by RM7.00.

Entry : RM6.00–6.30

Target : RM6.70, 7.00

Exit : RM5.68

Source: AmInvest Research - 10 Mar 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on AmInvest Research Reports

Petronas Chemicals - Closing in to floor on multi-year low foreign holdings

Created by AmInvest | Nov 21, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments