Stock on The Move - SDS Group

AmInvest

Publish date: Thu, 10 Nov 2022, 09:10 AM

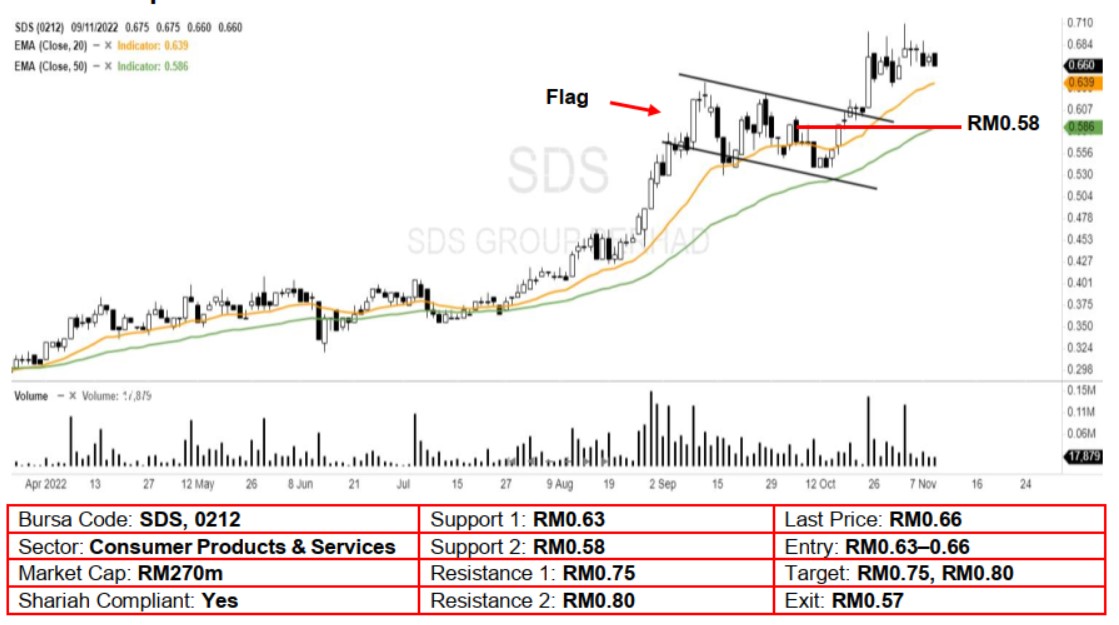

Technical Analysis. We believe the buying interest for SDS Group is back after it pushed out from the bullish flag pattern with a long white candle on 25 October. With the stock trading near its all-time high, supported by its rising EMAs, likely indicates that the upward momentum may be picking up. A bullish bias may emerge above the RM0.63 level, with a stop-loss set at RM0.57, below the 50-day EMA. Towards the upside, the near-term resistance level is seen at RM0.75, followed by RM0.80.

Company Background. SDS Group Berhad and its subsidiaries are primarily involved in the manufacturing and retailing of bakery products since 1984. It grew from its Johor homebase throughout Peninsular Malaysia with its 3 brands, namely the retail brand “SDS” and two wholesale brands, “Top Baker” and “Daily’s”.

Prospects. (i) Retail segment: Expanding in the Central Region of Peninsular Malaysia for new retail outlets and upgrading its online store and platform to offer a wide range of products (ii) Wholesale segment: Growing its geographical footprint and logistic fleets across Malaysia with new distribution centres - currently the wholesale distribution network is covering 10 states in Peninsula Malaysia. (iii) The R&D arm of the group continues to introduce new F&B offerings to meet customers’ tastes and expectations.

Financial Performance. In 1QFY23, the group posted a higher revenue of RM60.9m (+53.1 YoY) with a net profit of RM4.5m (11x YoY) due to higher influx of customers (re-opening of borders between Malaysia and Singapore) and same-store sales growth. In FYE22, the group recorded a healthy revenue growth of RM198.3m (+14.1% YoY) with a PAT of RM10.6m (+46% YoY). This was mainly attributable to the increase of footfall in the retail channel and increased of demand for wholesale channel.

Source: AmInvest Research - 10 Nov 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on AmInvest Research Reports

Created by AmInvest | Nov 18, 2024

Created by AmInvest | Nov 15, 2024