Stock on The Move - Sunview Group

AmInvest

Publish date: Tue, 29 Nov 2022, 10:58 AM

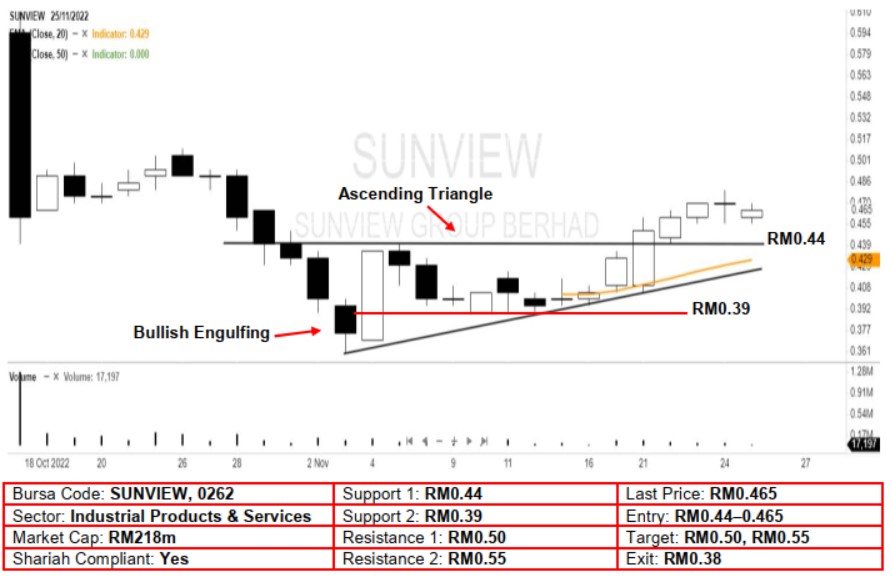

Technical Analysis. Sunview Group broke out from its 3-week bullish ascending triangle pattern on 21 Nov, implying that a bullish reversal sign may have occurred. As the stock is still trading above its 20-day EMA and coupled with the bullish engulfing pattern formed on 4 Nov, a positive outlook can be expected here. A bullish bias may emerge above the RM0.44 level, with a stop-loss set at RM0.38, below the 11 Nov low. Towards the upside, the near-term resistance level is seen at RM0.50, followed by RM0.55.

Company Background. Sunview Group (Sunview) is principally involved in the engineering, procurement, construction and commissioning (EPCC) of solar photovoltaic (PV) facilities, solar PV construction and installation services, solar power generation and supply as well as associated services and products.

Prospects. (i) As of Aug 2022, Sunview has an unbilled order book of RM558.3m – including 7 new EPCC for large scale solar (LSS) PV plant projects which are expected to be completed progressively between FY23 and FY24. (ii) Expanding its solar power generation segment for recurrent revenue and income via Build-Own-Operate-Transfer (BOOT), Build-Own-Operate (BOO) and Acquire-Own-Operate (AOO) strategies. (iii) Market expansion by setting up a new office in the Southern region to address potential opportunities in the EPCC of rooftop solar PV facilities such as commercial and industrial applications.

Financial Performance. In 1QFY23, the group reported revenue of RM31.5m with a PAT of RM1.8m. No comparative figures for the preceding year’s quarter are available as Sunview Group is a newly listed company on 17 Oct 2022. Prior to the listing, the group’s revenue recorded a CAGR growth of 94% while the group’s PAT registered a CAGR growth of 88% in FY20-FY22.

Source: AmInvest Research - 29 Nov 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on AmInvest Research Reports

Created by AmInvest | Nov 18, 2024

Created by AmInvest | Nov 15, 2024