Stock Idea - TMC Life Sciences

AmInvest

Publish date: Mon, 08 Jan 2024, 10:08 AM

Company Background. TMC Life Sciences (TMCLS) operates an integrated healthcare platform in Malaysia, which includes providing specialist healthcare services through its multi-disciplinary tertiary hospital and fertility centres. Its business comprises hospital division, TMC Fertility, TMC Care Pharmacy and Thomson TCM. Thomson Hospital Kota Damansara (THKD) is the flagship hospital of the group, equipped with advanced medical technology & modern infrastructure to deliver quality healthcare solutions.

Prospects. (i) The alignment of population growth and healthcare demand presents ample opportunities for THKD to carve a stronger niche as a hub for children & women's healthcare while simultaneously strengthening its comprehensive range of tertiary healthcare services, (ii) On an expansion trajectory with a significant increase in capacity and capabilities expected over the next 3 years, the group is developing a new integrated medical hub – Thomson Iskandar – in Johor Bahru. The hub is on track to be completed within 1-2 years after the Rapid Transit System at Bukit Chagar becomes fully operational, and (iii) Expand its referral centres in Vietnam and Indonesia to further boost medical tourism.

Financial Performance. In 1QFY24, TMCLS reported higher revenue of RM92.4mil (+28.6% YoY) with a PAT of RM15mil (+2.4x YoY). This was mainly due to the increase in capacity of THKD, recovery of fertility business, successful recruitment of healthcare professionals in its facilities and continuous marketing effort to boost local & international branding.

Valuation. Based on TMCLS’ 1QFY24 annualised net profit, the stock is trading at an attractive 2024F P/E of 21.7x, which is lower than its 5-year historical average of 38.7x and Bursa Heathcare Index’s 36x currently. As a comparison, IHH Healthcare, involved in operating hospitals and healthcare businesses, trades at a much higher FY24F P/E of 31x.

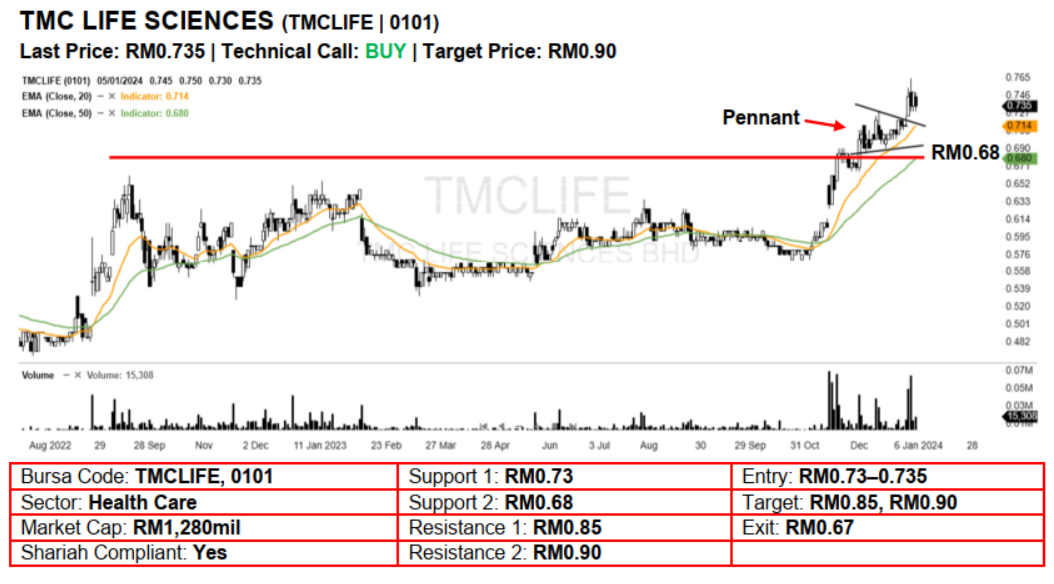

Technical Analysis. TMCLS’s buying interest is back after breaking out of its 6-week bullish pennant pattern with a long white candle a few sessions ago. As the stock has surged to a new 52-week high, the near term bullish trend may still have legs. A bullish bias may emerge above the RM0.73 level, with stop-loss set at RM0.67, below the 50-day EMA. Towards the upside, near-term resistance level is seen at RM0.85,

Source: AmInvest Research - 8 Jan 2024

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on AmInvest Research Reports

Created by AmInvest | Dec 20, 2024

Created by AmInvest | Dec 19, 2024