Stock on Radar - TAS Offshore

AmInvest

Publish date: Fri, 09 Feb 2024, 09:50 AM

Company Background. TAS Offshore (TAS) primarily focuses on shipbuilding operations with secondary involvement in ship repair activities in Malaysia. The group operates a well-equipped shipyard located in Sibu, Sarawak. With a diverse portfolio, TAS constructs vessels for various industries, including transportation, timber, mining, oil & gas, and harbour operations. These vessels encompass ferries, tugboats, barges, landing craft, anchor handling tugs, utility/support vessels and workboats. Shipbuilding constitutes 98% of TAS' FY23 revenue, with key markets in Indonesia (87.6%) and Singapore (10%).

Prospects. (i) In FY23, TAS' order book reached RM200mil (5.6x FY23 revenue) with 27 shipbuilding contracts signed, primarily from Indonesia. These contracts are expected to have a positive impact on the group's FY24F-FY25F performance, (ii) Global coal consumption is currently soaring, fueled by robust growth in Asia for power generation and industrial applications, notably from India and China. This positive outlook for Indonesia's coal mining sector is anticipated to increase demand for tugboats, facilitating interisland transport of bulk materials, and (iii) Robust demand for tugboats is also attributed to rising global demand for nickel (used in stainless steel production & electric vehicle batteries) with Indonesia having the world's largest nickel reserves.

Financial Performance. In 2QFY24, TAS posted higher revenue of RM28.4mil (+3x YoY) with a PAT of RM4.5mil (+14x YoY). This was mainly attributed to the increase in number of vessels delivered to ship owners in Indonesia & Singapore, improved overall cost management and better sales mix

Valuation. TAS is trading at an attractive FY24F P/E of 11.3x, which is lower than its 5-year historical average of 19.6x and Bursa Transportation Index’s 18.6x currently. As a comparison, India-based Cochin Shipyard trades at a much higher FY24F P/E of 40x and China-based China CSSC Holdings at 21x.

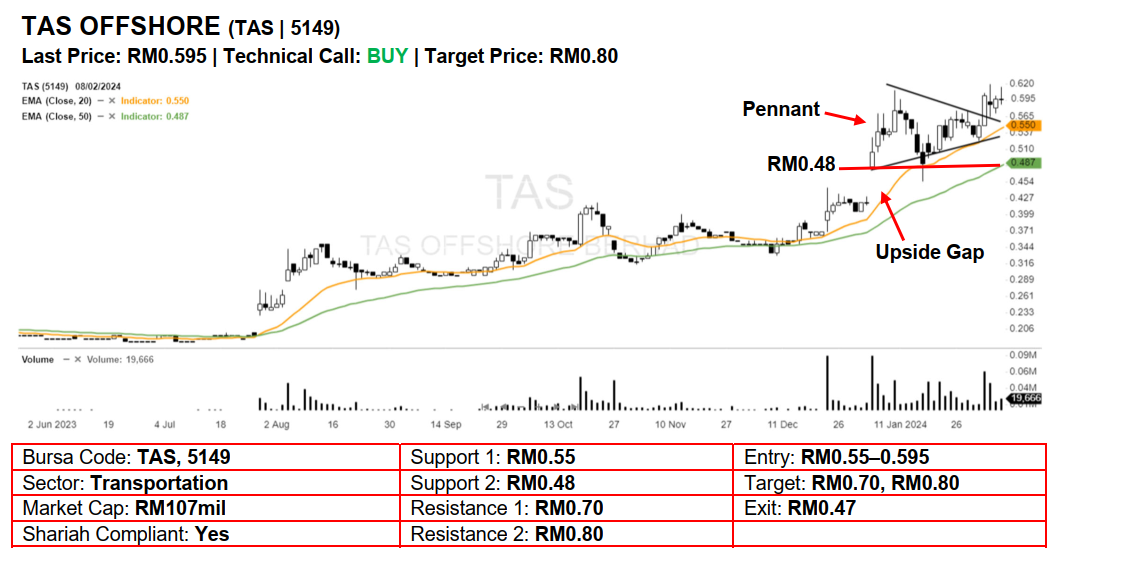

Technical Analysis. TAS broke out from a 1-month bullish pennant pattern a few sessions ago, implying that its previous uptrend may have resumed. In view of the uncovered upside gap formed on 4 Jan and together with rising EMAs, upward momentum is likely to pick up further. A bullish bias may emerge above the RM0.55 level, with stop-loss set at RM0.47, below the 50-day EMA. Towards the upside, near-term resistance level is seen at RM0.70, followed by RM0.80.

Source: AmInvest Research - 9 Feb 2024

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on AmInvest Research Reports

Created by AmInvest | Dec 20, 2024

Created by AmInvest | Dec 19, 2024