Stock Idea - Powerwell Holdings

AmInvest

Publish date: Thu, 07 Mar 2024, 10:21 AM

Company Background. Powerwell Holdings (Powerwell) is a switchboard manufacturer & power distribution solutions provider in Malaysia, principally involved in the design, manufacturing and trading of electricity distribution products. The group possesses extensive expertise in delivering customised low voltage switchboards and medium voltage switchgears tailored to the unique requirements of various infrastructures and facilities. Currently, Powerwell operates 2 manufacturing facilities in Selangor and an assembly plant in Johor for facilitating the assembly of motor control centre panels.

Prospects. (i) Expand product portfolio and enhance market share by targeting segments such as data centres, semiconductor factories, renewable energy, electric vehicle charging and utility projects, (ii) With a proven track record in renewable energy infrastructure, the group has secured an order to supply substation equipment for a solar power plant project located in Bangladesh, (iii) For rail infrastructure projects, the group has secured some Rapid Transit System (RTS) Link contracts with anticipated completion by 4Q2024, and (iv) Expansion initiatives primarily focused on diversifying product portfolio & solutions in overseas markets, particularly in Indonesia and Bangladesh.

Financial Performance. In 9MFY24, Powerwell posted a higher revenue of RM132.9mil (+31% YoY) with a PAT of RM13.2mil (+3.3x YoY). This was mainly attributed to higher gross profit margins realised from key projects, particularly in data centres, commercial property, solar power plants and semiconductor plants.

Valuation. Based on Powerwell’s 9MFY24 annualised net profit, the stock is trading at an attractive 2024F P/E of 10.4x, which is lower than its 5-year historical average of 16.9x and Bursa Industrial Production Index’s 16.5x currently. As a comparison, UMSNeiken Group, which designs/manufactures/trades electrical products, trades at a much higher trailing P/E of 17.4x.

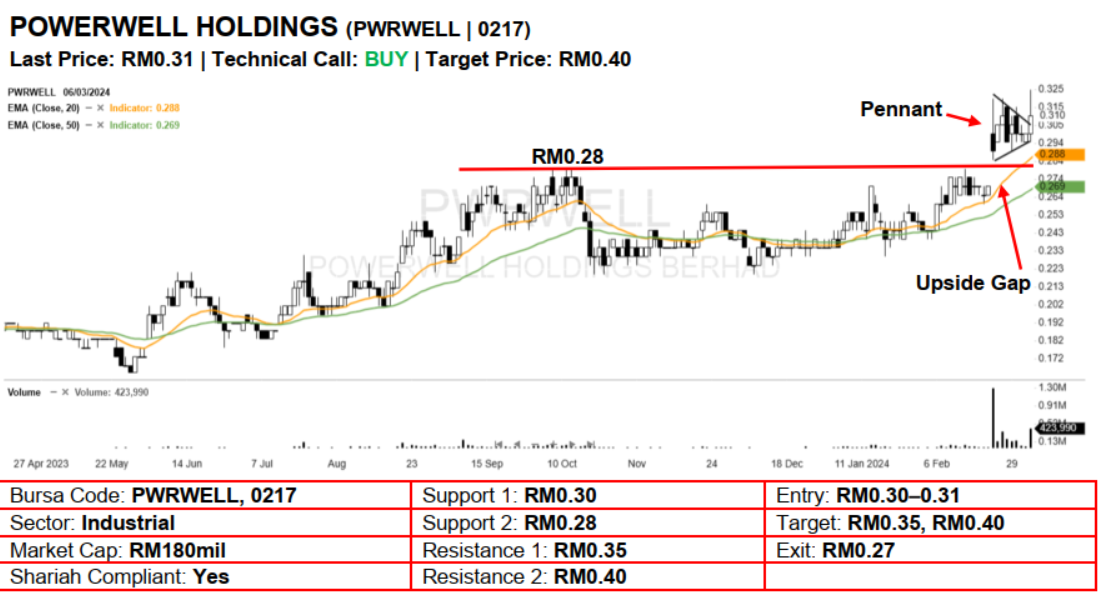

Technical Analysis. Powerwell’s buying interest is back after it broke out of the 2-week bullish pennant pattern with a white candle yesterday. In view of the uncovered upside gap formed on 23 Feb with rising EMAs, the upward momentum is likely to pick up further. A bullish bias may emerge above the RM0.30 level with stop-loss set at RM0.27, below the 20-day EMA. Towards the upside, nearterm resistance level is seen at RM0.35, followed by RM0.40.

Source: AmInvest Research - 7 Mar 2024

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on AmInvest Research Reports

Created by AmInvest | Nov 01, 2024