Stock Idea - Cloudpoint Technology

AmInvest

Publish date: Wed, 20 Mar 2024, 10:34 AM

Company Background. Cloudpoint Technology (Cloudpoint) is an information technology (IT) solutions provider, focusing on enterprise & data centre networking solutions, cybersecurity solutions, professional IT services as well as cloud services & software applications. It operates under 3 main business models: (i) project-based, (ii) recurring, and (iii) digital applications & cloud services. The group’s customer base largely consists of enterprises in the financial services, insurance, telecommunications industries and other technology service providers in Malaysia.

Prospects. (i) Seize opportunities in the financial services industry by offering artificial intelligence (AI)-based applications & solutions to support digital transformation and innovation, (ii) Aim to become a data centre solution provider by acquiring Unique Central Group, a specialist in the field. This expansion broadens the group’s offerings to include AI and green solutions, providing a comprehensive solution for data centre infrastructural needs, (iii) Venture into providing managed cybersecurity services by establishing a new security operation centre, and (iv) Expand its cloud services & software applications segment by collaborating with both new and existing technology vendors to offer a wider range of options.

Financial Performance. In FY23, Cloudpoint posted a higher revenue of RM110mil (+21.6% YoY) with a PAT of RM16.2mil (+23.4% YoY). This was mainly driven by contributions from solutions implementation, which comprises networking & cybersecurity solutions, recurring income from the offering of professional IT services, as well as new offerings of digital applications & cloud services.

Valuation. Cloudpoint is currently trading at an attractive FY25F P/E of 14.4x, which is lower than Bursa Technology Index’s 25x. As a comparison, Mesiniaga, involved in sales & service of information technology products and related services such as cloud computing/network services/security solutions/software development, trades at a much higher trailing P/E of 22x.

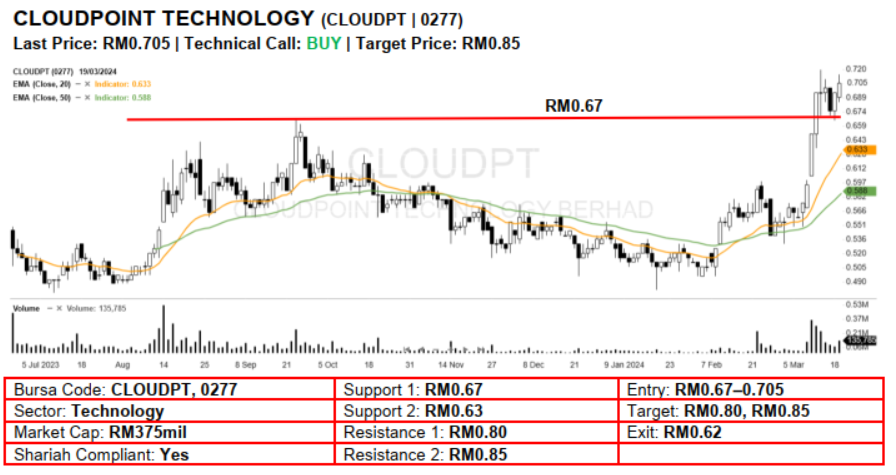

Technical Analysis. Cloudpoint may rise higher after it surged to a new 9-month high and closed above the RM0.67 resistance a few sessions ago. As the 20-day and 50-day EMAs have established a bullish crossover since late-February, the uptrend may continue in the near term. A bullish bias may emerge above the RM0.67 level with stop-loss set at RM0.62, below the 20-day EMA. Towards the upside, near-term resistance level is seen at RM0.80, followed by RM0.85.

Source: AmInvest Research - 20 Mar 2024

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on AmInvest Research Reports

Created by AmInvest | Dec 20, 2024

Created by AmInvest | Dec 19, 2024