Stock Idea - Superlon Holdings

AmInvest

Publish date: Fri, 29 Mar 2024, 10:18 AM

Company Background. Superlon Holdings (Superlon) is primarily focused on manufacturing thermal insulation materials in Malaysia. With over 30 years of experience, the group specialises in producing nitrile butadiene rubber (NBR) foam insulation products. These products are utilised for insulating heating, ventilation, air-conditioning and refrigeration (HVAC&R) systems, effectively reducing vibration, sound and corrosion. Currently, Superlon's products have attained a global market presence, serving a diverse customer base spanning 70 countries, including regions across Africa, Asia, Europe, the Americas and Oceania.

Prospects. (i) The expansion of a new factory in Vietnam, which commenced operations in June 2023, strategically positions Superlon to serve both domestic and international markets. Boasting a production capacity of 1,700 tonnes per annum, this underscores the group’s commitment to meeting demand in emerging markets, (ii) Aim to expand internationally while strengthening its domestic presence, improving production and product quality through research & development and enhancing global visibility & distribution networks, and (iii) Consistently distributed dividends in previous financial years in accordance with its dividend policy of least 30% of its annual net profit.

Financial Performance. In 3QFY24, Superlon posted a higher revenue of RM30.4mil (+18.7% YoY) with a PAT of RM3.9mil (+6.3x YoY). This was mainly driven by higher demand for insulation products from both export & local markets together with lower cost of materials, supported by favourable foreign exchange environment.

Valuation. Based on Superlon’s 9MFY24 annualised net profit, the stock is trading at an attractive 2024F P/E of 11.7x, which is lower than its 5-year historical average of 20x and Bursa Industrial Production Index’s 17x currently. As a comparison, Thailand-based Eastern Polymer Group, involved in manufacturing closed cell tube and sheet insulation, trades at a much higher trailing P/E of 15.3x.

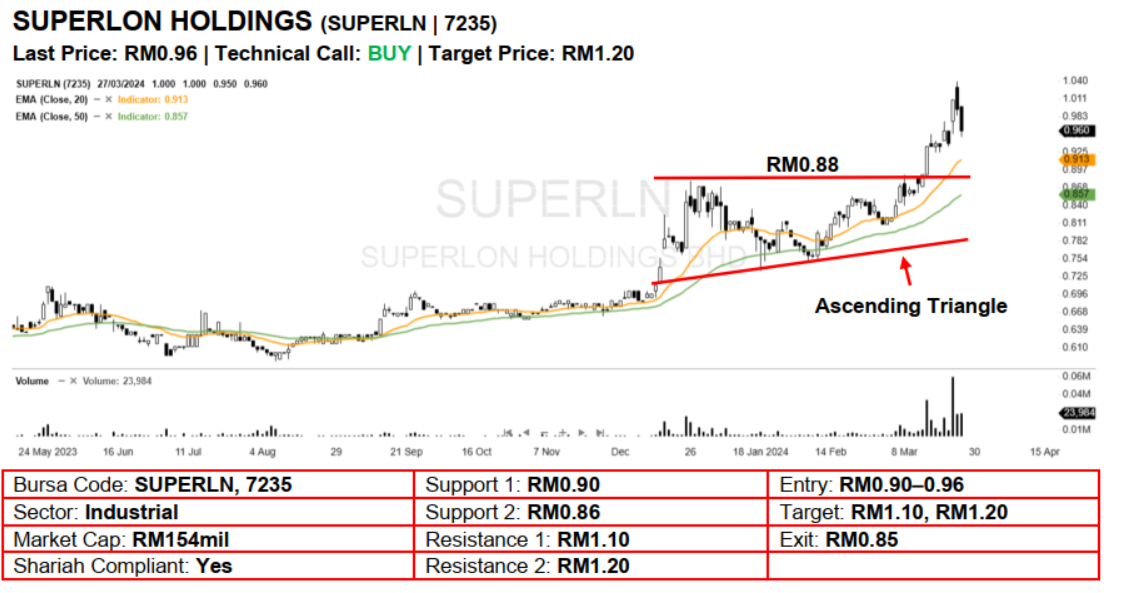

Technical Analysis. Superlon may trend higher after it surged to a new 52-week high and closed above the RM0.88 resistance 2 weeks ago. Given that the stock has also broken out from a 3-month bullish ascending triangle pattern, additional strength may be present in the near term. A bullish bias may emerge above the RM0.90 level with stop-loss set at RM0.85, below the 50-day EMA. Towards the upside, near-term resistance level is seen at RM1.10, followed by RM1.20.

Source: AmInvest Research - 29 Mar 2024

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on AmInvest Research Reports

Created by AmInvest | Dec 20, 2024

Created by AmInvest | Dec 19, 2024