Stock Idea - KSL Holgings

AmInvest

Publish date: Fri, 10 May 2024, 09:45 AM

Company Background. KSL Holdings (KSL) is a leading property developer in Johor, Malaysia and has been established for over 30 years. Its core business comprises 2 divisions: property development, which accounts for 82% of FY23 revenue with most of the balance in property investment. The group has diversified its operation to include ventures into the Klang Valley and has a strong presence within the Iskandar region. Currently, KSL owns 4 crucial assets under its property investment division: (i) KSL City Mall, (ii) KSL Hotel & Resort, (iii) KSL Hot Spring Resort, and (iv) KSL Esplanade Hotel & Mall, Klang.

Prospects. (i) As at 31 Dec 2023, KSL owns 2,550 acres of land spread across strategic areas in Johor and Klang. With a robust balance sheet, the group plans to further acquire more land in strategic locations to sustain its property developments and project pipeline, (ii) Actively seeking opportunities to expand the group’s property investment portfolio to further strengthen recurring income streams, (iii) Enhancing promotional efforts through campaigns, events and roadshows to boost foot traffic at its shopping malls/hotels/resorts, and (iv) Prioritising affordable housing in strategic locations, aiming to meet rising demand spurred by a stronger economy and increased homebuyer purchasing power, especially in the Iskandar region.

Financial Performance. In FY23, KSL posted a higher revenue of RM1.14bil (+99% YoY) with a PAT of RM416.8mil (+2.3x YoY). This was mainly contributed by flagship projects in the property development division in Johor Bahru and Klang as well as robust performance from the property investment division.

Valuation. KSL is currently trading at an attractive trailing P/E of only 4.5x, compared to the Bursa Property Index’s 5-year forward average of 14.2x. For comparison, UOA Development, which engages in property development, including residential and commercial ventures, as well as investment properties, trades at a much higher FY24F P/E of 20x.

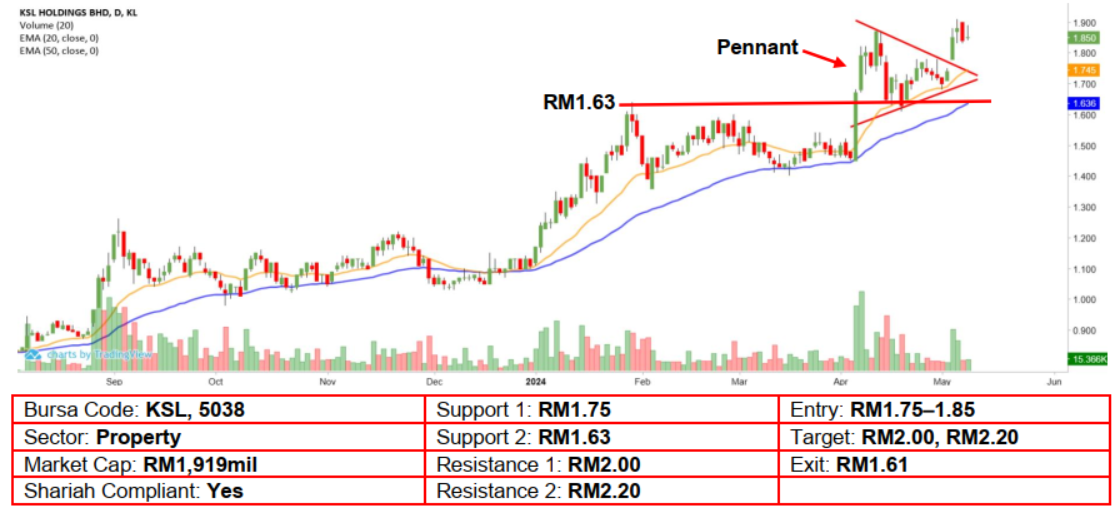

Technical Analysis. KSL broke out from its 1-month bullish pennant pattern a few sessions ago, implying that the previous uptrend may have resumed. As the stock has surged to a new multi-year high, it may see additional strength in the near term. A bullish bias may emerge above the RM1.75 level with stop-loss set at RM1.61, below the 50-day EMA. Towards the upside, near-term resistance level is seen at RM2.00, followed by RM2.20.

Source: AmInvest Research - 10 May 2024

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|