Stock Idea - SUCCESS TRANSFORMER CORPORATION

AmInvest

Publish date: Thu, 18 Jul 2024, 09:01 AM

Company Background. Success Transformer Corporation (STC) is primarily engaged in designing, manufacturing and distributing electrical apparatus and industrial lighting. Over the years, the group has expanded its operations and established several in-house brands, including QPS for transformers, NIKKON for LED lighting products, and an intelligent light control system (iLCS) for smart solutions. In 2022, STC further expanded its downstream activities to include a die-casting business specialising in aluminum diecasting for both local and overseas markets.

Prospects. (i) With its in-house brand QPS specialising in low voltage transformers, the group's products are expected to see robust demand from data centres, industrial machinery and medical industry due to rising need for cloud storage management, (ii) Energy transition trend, coupled with the adoption of ESG principles through green technologies, will continue to drive growing demand for the group's energy-saving products, including LED lighting, iLCS and sensors, and (iii) In the die-casting business, the group has expanded its role as a global original equipment manufacturer (OEM) partner for aluminum die-casting parts and broadened product range to include motorcycle components.

Financial Performance. In 3QFY24, STC reported higher revenue of RM55.5mil (+7% YoY) with a PAT of RM4mil (+20% YoY). This was mainly due to higher sales recorded in local/overseas markets and a better product mix together with higher income from shortterm investments and rental assets, as well as foreign currency exchange gains.

Valuation. STC is currently trading at an attractive 11.6x trailing P/E, which is lower than Bursa Industrial Production Index’s 5-year forward average of 19x. As a comparison, China-based Sanbian Sci-Tech Co., which is involved in manufacturing and marketing various types of electric transformers used in the power industry, trades at a much higher trailing P/E of 20x.

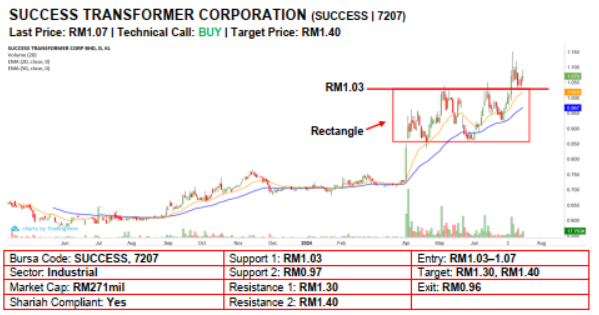

Technical Analysis. STC broke out from a 3-month bullish rectangle pattern 2 weeks ago, implying that its previous uptrend may have resumed. As the 20-day and 50-day EMAs have established their bullish crossover since early April, additional upside strength may be present in the near term. A bullish bias may emerge above the RM1.03 level with stop-loss set at RM0.96, below the 50-day EMA. Towards the upside, near-term resistance level is seen at RM1.30, followed by RM1.40.

Source: AmInvest Research - 18 Jul 2024

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|