Stock on Radar - EG Industries (EG)

AmInvest

Publish date: Tue, 03 Dec 2024, 10:03 AM

EG Industries (EG | 8907)

Last Price: RM2.06 | Technical Call: BUY

| Support 1: RM2.05 | Resistance 1: RM2.35 |

| Support 2: RM1.86 | Resistance 2: RM2.50 |

| Shariah Compliant: Yes | Sector: Industrial |

Company Background. EG Industries (EG) is a leading provider of electronics manufacturing services (EMS) and vertical integration for various sectors, including consumer electronics, data storage, automotive, ICT, and telecommunications. The group's core business operates in two core segments: printed circuit board assembly (PCBA) and box-build. The PCBA segment produces both high- and low-mix printed circuit boards, while the box-build segment offers a comprehensive range of services to electronics providers, encompassing design, manufacturing, testing, and delivery of finished products directly to end users.

Prospects. (i) Positioned for growth, driven by rising demand for advanced optical and AI modules. Key agreements, including a USD117mil order for 5G photonics products and exclusive next-gen optical module production, reinforce its leadership in wireless networking and data infrastructure expansion, (ii) The Smart Factory 4.0 in Batu Kawan, set to launch in 1QFY25, will drive expansion by enhancing production efficiency and scalability for advanced 5G and photonics products, unlocking opportunities with both existing and new customers, and (iii) The partnership with Thailand-listed N.D. Rubber positions EG to expand into the 5G photonics-embedded EV market, gain access to the branded EV sector, and integrate into the global EV supply chain for accelerated growth.

Financial Performance. In 1QFY25, EG posted a higher revenue of RM338.6mil (+30% YoY) with a PAT of RM35.8mil (+3.3x YoY). This was mainly driven by higher sales orders from key customers, a more favorable product sales mix and net foreign exchange gains, as well as improved yield from 5G wireless access and photonic-related products.

Valuation. EG is trading at a trailing P/E of 13x, which is lower than its 5-year historical average of 17.4x and the Bursa Industrial Production Index's 22.8x. In comparison, Aurelius Technologies, which provides electronic manufacturing services for networking and communications as well as semiconductor components, trades at a higher trailing P/E of 25x.

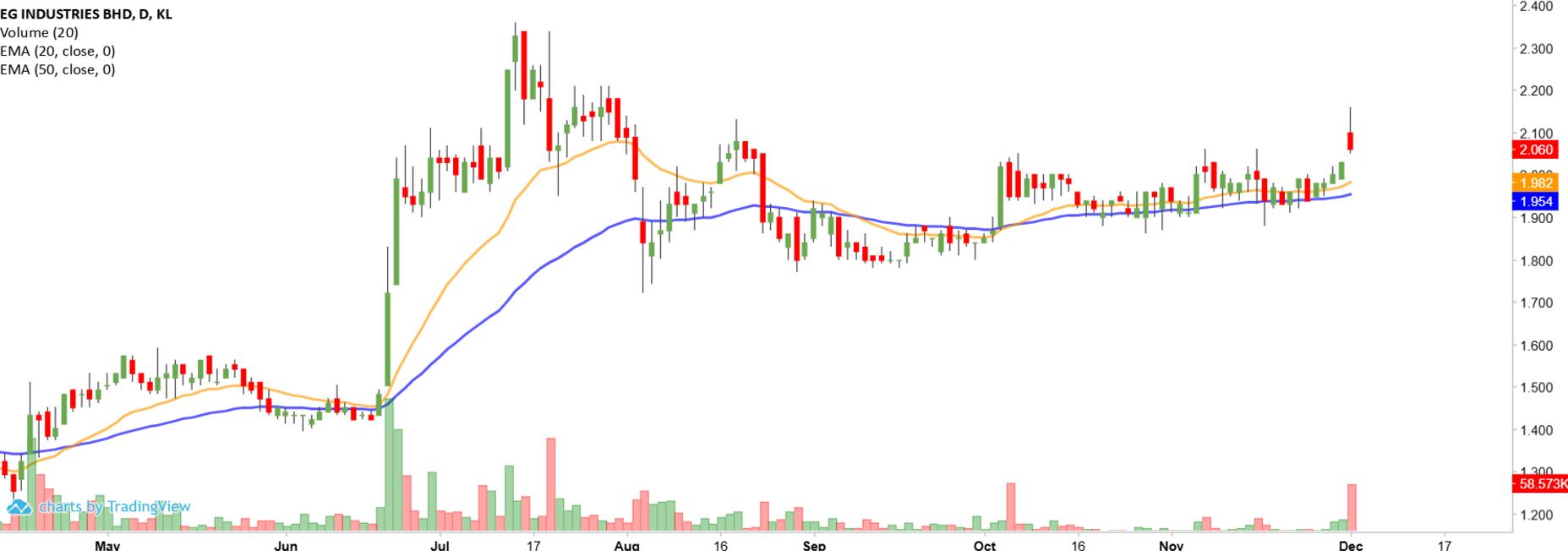

Technical Analysis. We expect further upside for EG after it gapped up and closed above the RM2.05 resistance yesterday. With its 20-day and 50-day EMAs starting to trend higher again, additional upside strength may be present in the near term. A bullish bias may emerge above the RM2.05 level with stop-loss set at RM1.84, below the 28 Oct low. Towards the upside, near-term resistance level is seen at RM2.35, followed by RM2.50.

Entry: RM2.05-2.06

Target: RM2.35, RM2.50

Exit: RM1.84

Source: AmInvest Research - 3 Dec 2024

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on AmInvest Research Reports

Created by AmInvest | Jan 24, 2025