First Ever AI-Packaging Solutions in Malaysia–Globetronics Technology

Jimmy97

Publish date: Thu, 07 Mar 2024, 05:48 PM

Figure 1: Snapshot of wafer production line of Globetronics Technology Berhad, The Star.

A bit of background into Globetronics Technology Berhad (KLSE: GTRONIC, 7022); GTRONIC is a Malaysian-based assembly, packaging and testing of integrated circuits (IC) for semiconductor companies, or in the stock market context, we call GTRONIC as an “OSAT”.

Over the years since their founding in 1991 and listing in 1997 on the Main market of Bursa Malaysia, GTRONIC quickly expanded into assembly and manufacturing of sensor based products, which includes light, motion, and gesture sensors for the consumer electronics industry, primarily serving two major customers, where one of them is the leading consumer electronics player across the globe.

GTRONIC is also involved in the assembly and testing of quartz crystal timing devices (QCTD), one such example would quartz-based watches, as well as involvement in wafer and die level services, such as wafer separation, die sorting services, assembly, manufacturing of solid state lighting (SSL) and/or light emitting diode (LED) components.

Unfortunately, the public information of GTRONIC under the helm of the previous major shareholders are scarce, the closest information one could get is from the re-initiation report from BIMB Securities back in 2022.

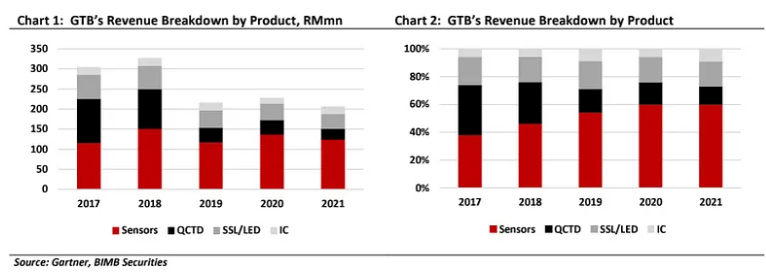

Figure 2: Revenue breakdown from 2017–2021 by products, BIMB Securities.

Fast forward to 2024, GTRONIC’s sensor based services were also impacted by the slowdown in demand in the consumer electronics segment, such as smartphone, wearables and hearables devices. To add salt to the wound, most of the sensor products are largely commoditised, such as the True Wireless Stereo (TWS) product, which commonly see a downward trend in price year-on-year.

Over the years, GTRONIC has been challenged by commoditisation of sensor-based products and slower demand, which resulted in declining utilisation rate of the facilities, falling from a peak of 85% to the current c. 60~65% utilisation rate.

But things are about to change under the helm of the new Board of Directors.

In December 2023, APB Resources Berhad (KLSE: APB, 5568) acquired approximately 10.37% stake in GTRONIC from the founding members of the company. Based on various sources, we believe that there will also be significant changes in the Boardroom of GTRONIC going forward.

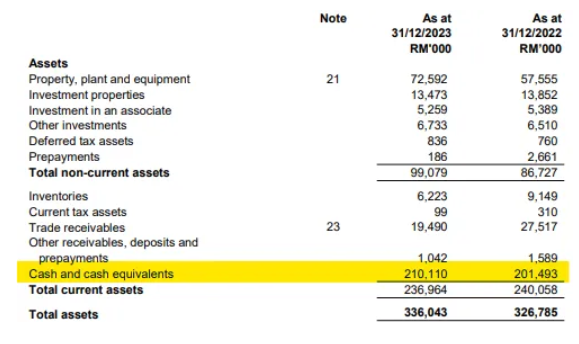

Figure 3: Balance sheet of Globetronics Technology Berhad, FY2023Q4 Quarterly Report.

GTRONIC’s current OSAT capabilities are adopting more advanced automation technologies, such as the lights out concept that result in a man-to-machine ratio of 1:20 (approximately), and the adoption of Automated Guided Vehicle (AGV) and use of Extended Reality (XR) has reduced the costs of the company.

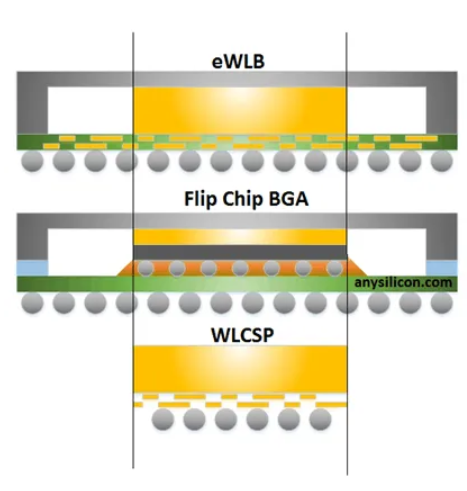

In 2024, GTRONIC is likely to work closely with a Taiwan-based partner in penetrating into advanced packaging technology for Artificial Intelligence (AI) chips (or ICs), which could be the very first in Malaysia by utilising the partner’s wafer-bumping, or perhaps Wafer-Level Chip Scale Packaging (WLCSP) technologies.

Figure 4: A snapshot of Wafer Bumping Packaging Technology, anysilicon.

We understand many would have the million dollar question in mind — WHY GTRONIC?

Over the years, GTRONIC has been involved in many prototyping processes with the end customer, and as Taiwan+1 initiative is spreading across the globe, leading technology players are seeking diversification in terms of production, especially on advanced ICs such as the AI-specific ICs.

*Taiwan+1 means to have an additional production capacity outside of the Taiwan region.

Notably, such development would draw over RM250~300 million of cash from the company as Capital Expenditure (CAPEX), where a huge chunk of the cash will be funded by internally generated funds, and the rest would be from facilities from various banks, where if we look into the facilities of GTRONIC, they have ample space to allocate for new advanced packaging machines.

All in all, GTRONIC is likely to be the first AI-specific ICs’ OSAT in Malaysia, which could significantly shift the perception of the company’s linkage to consumer electronics, to the game-changing AI technology industry.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|