WATCHLIST : 2 – 6 NOV 2015

|

HIL (8443)

|

|

|

|

HIL has been trading above its upward sloping 20-Day Moving Average which is a good sign. However the upward movement has encountered resistance at the level of 0.815. Special attention to be placed to the price and volume behavior in order to determine whether this resistance level can be broken decisively for HIL to resume its upward movement. The RSI indicator is giving a reading in the overbought region. While this is expected given the recent upward movement, it also gives a warning that the current movement may be over-extended.

|

If the major resistance of 0.815 & 0.825 can be broken conclusively; the price could even test 0.90 in the short term. Support is at 0.79 and 0.71. Upon breach of 0.71, traders should cut loss. Traders should monitor closely the trading volume; once volume picks up, there is a good chance of it breaking the resistance of 0.825

http://klse.i3investor.com/blogs/angiegoh1932/84916.jsp

|

MITRA (9571)

|

|

|

|

MITRA has been trading on the uptrend mode and above its upward sloping 20-Day Moving Average .. The support and resistance level of MITRA are 1.19 and 1.26 respectively. The indicator analysis on RSI is not exhibiting any extreme condition. Kenanga has put a target price of 1.61 meaning another 33% upside.

http://klse.i3investor.com/servlets/ptres/32900.jsp

|

MYEG (0138)

|

|

|

|

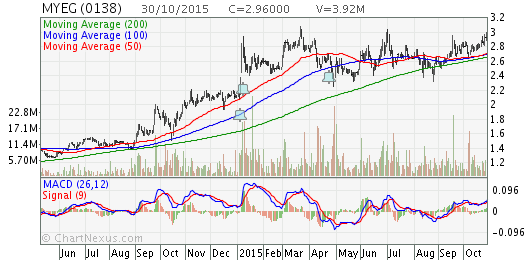

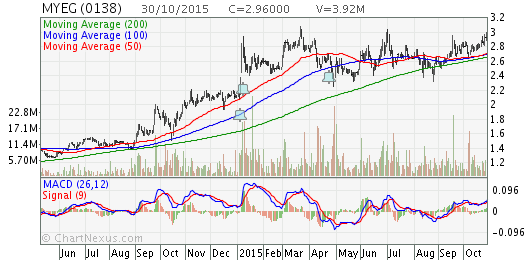

MYEG price just broke the resistance of 2.95 reinforcing the bullishness in the recent price movement. Ideally one would like to see an increase in traded volume to demonstrate the enthusiasm of the traders to push the price past this technical resistance level. However, there was a decrease in the traded volume in this breakout. Hence it is important to monitor the immediate price volume action to ascertain the validity of this breakout.

MYEG was testing the MYR3.00 resistance level in its latest session. Traders may buy if this level is breached in the near term, with a target price of MYR3.25, followed by MYR3.40.In the meantime, the stock may take a breather if the MYR3.00 level cannot be breached. Support may then be found at MYR2.67, where traders can exit upon a breach.

|

EWEIN (7249)

|

|

|

|

EWEIN has demonstrated an very volatile trading pattern on 30-Oct; the volatility gap is at 0.125 during the day, trading from a low of 0.845 to a high of 0.97. Furthermore, the next resistance level is quite far at 1.09.

Support should be seen at 0.89 & 0.87 levels, upon breach traders may exit.

However, with Friday’s performance, I believe Ewein is set to break the major resistance of 1.09 very soon.

Quote : Kenanga Research

EWEIN (Trading Buy, TP: RM1.09). EWEIN surged 4.0 sen or 4.65% to RM0.90 yesterday on strong buying volume. The share price was observed trying to break out from its resistance level of RM0.90 (R1), while staying above all its SMA trend lines to indicate the uptrend movement. The bullish outlook is further evidenced by the MACD indicator while the positive buying momentum is showcased by both RSI and Stochastic indicators. If we observe the price movement over a longer term, the share price is looking to complete its ‘Rounding Bottom’ chart pattern by trending towards its 5-month’s peak of RM1.09. As such, we are issuing a ‘Trading Buy’ call on EWEIN with a near-term Target Price at its psychological RM1.00 (R2) level, while a strict stop-loss is set at RM0.845 (S2).

Source: Kenanga Research - 29 Oct 2015

|

EDUSPEC (0107)

|

|

|

|

EDUSPEC has been on an uptrend mode since it’s lowest closing of 0.195 on 26-8-2015. Ever since it has reversed its downtrend mode and closing at 0.31 last Friday; a glimmer short of its recent intraday high of 0.315 done on 28-10-2015. In addition, there is a technical support level at 0.305 which may support any short-term retracement. Its 52-week high was recorded at 0.43

|

INARI (0166)

|

|

|

|

INARI support level of 3.54 which has been tested successfully, may provide the springboard for the trend to continue. There has been market talk of Inari listing its subsidiary in the Phillipines and the sterling quarter results to be announce in the 3rd week of Nov 2015 with some surprises. We should see the development of the price movement.

Inari has been a local & foreign funds favorite. Investors should secede to collect near its support of 3.54. Its main resistance is pegged at 3.85. Breaching this level could see a much higher pictogram.

Inari has been covered extensively by research housed and investment banks; placing a TP of between 3.50 to 4.55.

|

|

|

|

|

|

CANONE (5105)

|

|

|

|

CANONE has been trading above its upward sloping 20-Day Moving Average which is a good sign. In addition, the price just broke the resistance of 3.2 reinforcing the bullishness in the recent price movement. This breakout was accompanied by a higher than average traded volume which shows the enthusiasm of the traders to push the price higher and past this resistance hence giving a higher probability of a successful breakout.

|

http://klse.i3investor.com/blogs/benjamin/84510.jsp

HAPPY TRADING

BURSAMASTER