WATCHLIST : 4TH NOVEMBER 2015

Bursamaster Kelab

Publish date: Wed, 04 Nov 2015, 12:51 AM

|

MINHO (5576) |

|||||||||||||||

|

|

|||||||||||||||

|

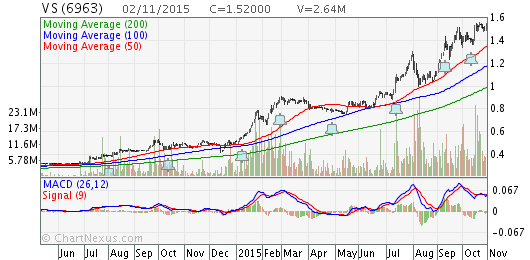

MINHO has closed today at its main resistance of 1.36 where it is expected a good fight between the bulls and the bears. For the upside to continue, the resistance needs to be broken conclusively, preferably with high volume. The indicator analysis on RSI is not exhibiting any extreme condition. The next resistance should be 1.49. Since it has been trading in a tight range of 1.28 – 1.36 during the past week with sellings well absorbed, there is a good chance the resistance of 1.36 be broken conclusively with good volume if the general market sentiments is fairly good

52-week range : 0.70 – 1.92 1-week range : 1.28 – 1.36

|