PRG : THE RATIONALE BEHIND ITS HISTORICAL HIGH SHARE PRICE

BURSAMASTER BULLSEYE

Publish date: Mon, 11 Jan 2016, 01:03 PM

|

PRG (7168) |

|

|

|

1- As of 8 January 2016, PRG has been on a strong uptrend as suggested by the upward sloping 20-Day and 50-Day Moving Averages. This bullish movement has brought PRG to close on Friday at its historical high of 1.02. One important point to note, PRG has broken its most major resistance of 1.00 conclusively to close at 1.02 with good volume of 5.3 million shares traded. PRG share price has demonstrated a steady and uninterrupted climb from 0.84 on 22-Dec-2015 to its historical high of 1.02 on 8-jan-2015 unabated though the market saw 2 circuit breaker dropped of the Shanghai stock exchange last week. This morning PRG seems resilience to the negative market; closing 12.30 pm unchanged with sellings well absorbed on volume of about 2 mil shares traded mostly at 1.02 & 1.03. The trading pattern indicates that uptrend is intact and once selling at this 1.02 & 1.03 level subside; it should trend high. The highest done this moring at 1.04 is an all time record again. If ican can create a new record this afternoon, we should see my immediate TP of 1.10 & 1.20 easily met. This is a strong indicator that the price should climb higher with my immediate TP is pegged at 1.10 & 1.20.

2- Another important point to note is that its major shareholder, Dato Lua Choon Han, has been aggressively acquiring its share from the open market totaling 3.02 million or 2.08%,. This bodes well for the feel good factor to market participants.

Refer to Bursa announcement : http://www.bursamalaysia.com/market/listed-companies/company-announcements/4964633

3- PRG is holding an EGM on Tuesday 12 Jan 2016. Market talk of something good to be announced at the EGM. Let’s see what goodies to come.

Refer to Bursa announcement : http://www.bursamalaysia.com/market/listed-companies/company-announcements/4950529

Highlights :

“Picasso Residence in KL” In December 2013, the group’s wholly-owned subsidiary Premier Gesture S/B has proposed a 60:40 JV with Almaharta S/B for the development of a parcel of leasehold land along Jalan Jelatek (off Jalan Ampang), Kuala Lumpur. The JV company is named Premier De Muara S/B. The proposed residential development will comprise 2 blocks of 38-storey condominium consisting of 472 units. Now named as The Picasso Residence, the launch is expected during the first quarter of 2015. The GDV for this project is estimated at close to RM600 million, with an estimated GP margin of 32% over its 4- year development period. “Construction project in Ipoh” Meanwhile in July 2014, PRG announced that its wholly-owned subsidiary, Valencia Glade Sdn Bhd, has in July 2014 accepted a Letter of Award for the construction and completion of 4 blocks of 9-Storey Apartment Type A, 1 block of 9-Storey Apartment Type A1, a 1-storey gymnasium and swimming Pool and other common facilities in Pasir Putih, Ipoh (Treetops Residency). The contract is worth approximately RM50.2 million. This construction is now on- going and is expected to be completed in 1H/2016. As such, PRG anticipates that the group’s construction business may contribute to 25% or more of the net profits of the group.

“Formalizing diversification into Construction” Subsequently, on 9th November 2015, PRG announced the group’s formal intention to diversify into the construction business, with approval to be sought from its shareholders at the group’s next EGM scheduled to be held on this coming Tuesday, 12-Jan-2015 at 2.00pm.

This proposal is being undertaken in order to comply with Bursa Malaysia’s regulations. Pursuant to Paragraph 10.13 of Bursa’s Main Market Listing Requirements, a listed company must obtain its shareholders’ approval in a general meeting for any transaction or business arrangement which might reasonably be expected to result in a situation whereby: (a) the diversion of 25% or more of the net assets of the group to an operation which differs widely from those operations previously carried on; or (b) the contribution from such an operation of 25% or more of the net profits of the group.

With the diversification of the PRG’s principal activities to include property development as approved by the shareholders at the EGM held in April 2014, PRG had subsequently established a construction division to complement its property development activities. The construction division of the group currently operates under Premier Construction SB (“PCSB”) and is a registered Grade G7 contractor with Construction Industry Development Board of Malaysia (CIDB).

The Proposed Diversification complements the group’s existing business in property development and enables the group to undertake complementary activities in property development, construction and project management services.

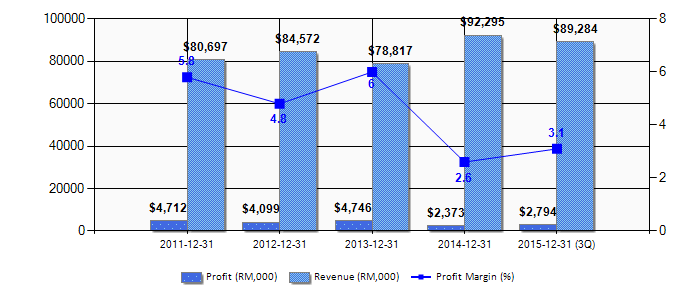

PRG 5 Years Revenue & Profit Trend |

|

|

PRG Quarter Report History

|

Date |

Financial |

No. |

Financial |

Revenue |

Profit Before |

Net Profit |

Earning |

Dividend |

NTA |

Download |

||||

|

19/11/2015 |

31/12/2015 |

3 |

30/09/2015 |

30,013 |

1,564 |

1,638 |

1.13 |

0.00 |

0.782 |

11% |

||||

|

27/08/2015 |

31/12/2015 |

2 |

30/06/2015 |

32,450 |

1,675 |

1,517 |

1.05 |

0.00 |

0.763 |

297% |

||||

|

28/05/2015 |

31/12/2015 |

1 |

31/03/2015 |

26,821 |

-480 |

-361 |

-0.25 |

0.00 |

0.748 |

20% |

||||

|

27/02/2015 |

31/12/2014 |

4 |

31/12/2014 |

30,025 |

1,928 |

2,123 |

1.47 |

0.00 |

0.748 |

100% |

||||

|

27/11/2014 |

31/12/2014 |

3 |

30/09/2014 |

22,681 |

1,373 |

1,470 |

1.38 |

0.00 |

0.722 |

12% |

||||

|

18/08/2014 |

31/12/2014 |

2 |

30/06/2014 |

20,544 |

-645 |

-769 |

-0.85 |

0.00 |

0.830 |

149% |

||||

|

29/05/2014 |

31/12/2014 |

1 |

31/03/2014 |

19,045 |

-268 |

-451 |

-0.50 |

0.00 |

0.845 |

203% |

||||

|

28/02/2014 |

31/12/2013 |

4 |

31/12/2013 |

20,887 |

1,146 |

1,060 |

1.17 |

0.00 |

0.853 |

14% |

||||

|

27/11/2013 |

31/12/2013 |

3 |

30/09/2013 |

19,603 |

1,927 |

1,679 |

1.86 |

0.00 |

0.840 |

68% |

||||

|

29/08/2013 |

31/12/2013 |

2 |

30/06/2013 |

19,145 |

2,079 |

1,567 |

1.73 |

0.00 |

0.840 |

6% |

||||

|

27/05/2013 |

31/12/2013 |

1 |

31/03/2013 |

19,182 |

740 |

440 |

0.49 |

0.00 |

0.820 |

14% |

||||

|

28/02/2013 |

31/12/2012 |

4 |

31/12/2012 |

19,087 |

1,840 |

1,235 |

1.37 |

0.00 |

0.810 |

33% |

||||

|

||||||||||||||

REFERENCE :

http://klse.i3investor.com/blogs/icon8888/73391.jsp

http://klse.i3investor.com/blogs/icon8888/88546.jsp

HAPPY TRADING & GOOD LUCK

BURSAMASTER

Disclaimer

The content published is solely for information and personal use only. It should not be construed to be, any advice, recommendation, offer or invitation to buy or sell any securities, futures contracts or any other instrument. Readers should seek independent advice from their own professional advisers (including legal, tax, financial and accounting) as to the risks and merits before entering into any transaction pursuant to or in reliance on any information here.

The content published above shall only be for your sole and personal non-professional use. No guarantee is given on the accuracy or completeness of the information published here. No warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person or group of persons acting on such information.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on BURSAMASTER BULLSEYE

Created by BURSAMASTER BULLSEYE | Jul 11, 2016

sell

EPS 1.13 annualised only 4.52 sen. Is it great result?

2016-01-13 00:21